Superior Industries International Inc. (SUP): Price and Financial Metrics

SUP Price/Volume Stats

| Current price | $3.30 | 52-week high | $4.57 |

| Prev. close | $3.30 | 52-week low | $2.49 |

| Day low | $3.26 | Volume | 76,621 |

| Day high | $3.40 | Avg. volume | 68,867 |

| 50-day MA | $3.42 | Dividend yield | N/A |

| 200-day MA | $3.22 | Market Cap | 94.38M |

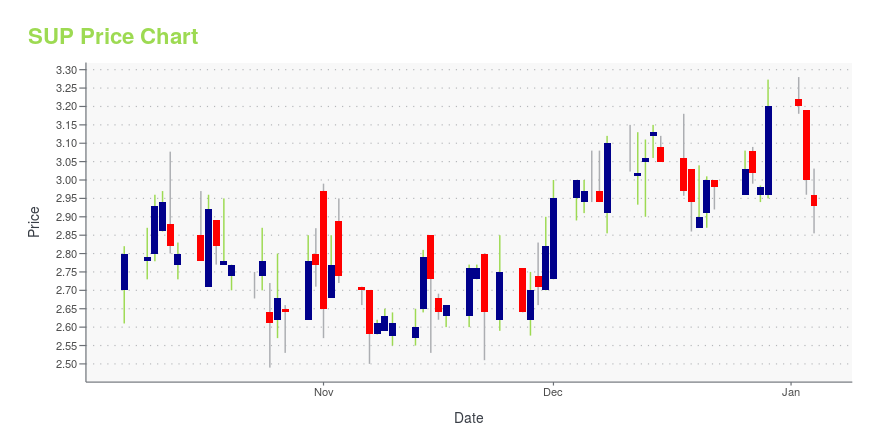

SUP Stock Price Chart Interactive Chart >

Superior Industries International Inc. (SUP) Company Bio

Superior Industries International designs, manufactures, and sells aluminum road wheels to the original equipment manufacturers in North America. The company was founded in 1957 and is based in Southfield, Michigan.

Latest SUP News From Around the Web

Below are the latest news stories about SUPERIOR INDUSTRIES INTERNATIONAL INC that investors may wish to consider to help them evaluate SUP as an investment opportunity.

Superior Industries International, Inc. (NYSE:SUP) Q3 2023 Earnings Call TranscriptSuperior Industries International, Inc. (NYSE:SUP) Q3 2023 Earnings Call Transcript November 1, 2023 Superior Industries International, Inc. misses on earnings expectations. Reported EPS is $-1.1 EPS, expectations were $-0.28. Operator: Welcome to Superior Industries Third Quarter 2023 Earnings Call. [Operator Instructions] We are joined this morning by Majdi Abulaban, President and CEO; Tim Trenary, Executive […] |

Superior Industries International Inc (SUP) Reports Q3 2023 Financial ResultsNet Sales Decrease by 20% YoY, Adjusted EBITDA Margin Increases by 160 bps YoY |

Superior Reports Third Quarter 2023 Financial ResultsSOUTHFIELD, Mich., November 01, 2023--Superior Reports Third Quarter 2023 Financial Results; Solid Growth in Adjusted EBITDA, Margin and Content per Wheel |

Superior Industries to Release Third Quarter 2023 Financial Results and Host Conference CallSOUTHFIELD, Mich., October 18, 2023--Superior Industries to Release Third Quarter 2023 Financial Results and Host Conference Call |

Superior Announces Strategic Action in German Production Facility to Further Enhance CompetitivenessSOUTHFIELD, Mich., August 31, 2023--Superior Announces Strategic Action in German Production Facility to Further Enhance Competitiveness |

SUP Price Returns

| 1-mo | -4.07% |

| 3-mo | -17.91% |

| 6-mo | -1.20% |

| 1-year | -10.57% |

| 3-year | -59.36% |

| 5-year | 20.88% |

| YTD | 3.12% |

| 2023 | -24.17% |

| 2022 | -5.80% |

| 2021 | 9.54% |

| 2020 | 10.84% |

| 2019 | -18.60% |

Continue Researching SUP

Want to do more research on Superior Industries International Inc's stock and its price? Try the links below:Superior Industries International Inc (SUP) Stock Price | Nasdaq

Superior Industries International Inc (SUP) Stock Quote, History and News - Yahoo Finance

Superior Industries International Inc (SUP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...