TrueBlue, Inc. (TBI): Price and Financial Metrics

TBI Price/Volume Stats

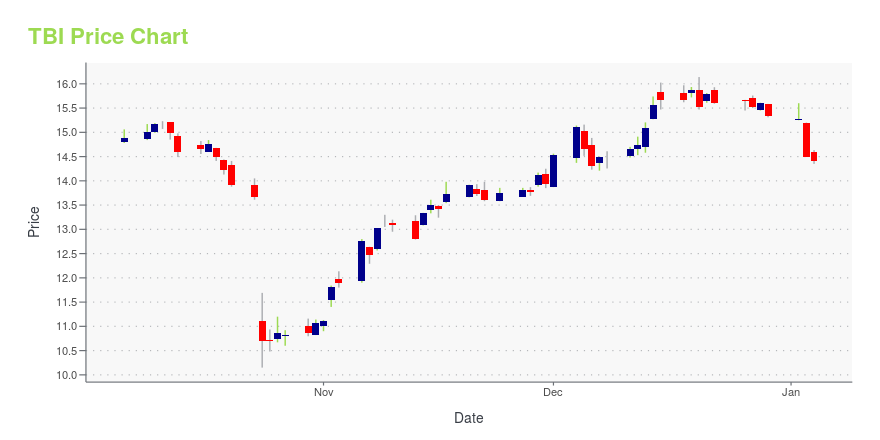

| Current price | $11.89 | 52-week high | $16.14 |

| Prev. close | $11.74 | 52-week low | $9.12 |

| Day low | $11.74 | Volume | 143,415 |

| Day high | $12.07 | Avg. volume | 366,166 |

| 50-day MA | $10.67 | Dividend yield | N/A |

| 200-day MA | $12.32 | Market Cap | 363.48M |

TBI Stock Price Chart Interactive Chart >

TrueBlue, Inc. (TBI) Company Bio

TrueBlue Inc. is a provider of specialized workforce solutions, helping clients improve growth and performance by providing staffing, recruitment process outsourcing and managed service provider solutions. The company was founded in 1985 and is based in Tacoma, Washington.

Latest TBI News From Around the Web

Below are the latest news stories about TRUEBLUE INC that investors may wish to consider to help them evaluate TBI as an investment opportunity.

TrueBlue Recognized for Women in LeadershipTrueBlue (NYSE: TBI), a leading provider of specialized workforce solutions, is pleased to announce that TrueBlue President and CEO Taryn Owen and PeopleReady President Kristy Willis have been recognized for their impactful leadership in the staffing industry. |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

TrueBlue's PeopleReady Earns Dual Awards for Innovative JobStack AppTrueBlue, a leading provider of specialized workforce solutions, today announced that PeopleReady, a TrueBlue company (NYSE: TBI), has been recognized with two awards from the International Awards Associate (IAA) for its groundbreaking JobStack app. |

TrueBlue to Participate in the Sidoti Virtual Investor ConferenceTACOMA, Wash., November 30, 2023--TrueBlue (NYSE: TBI), a leading provider of specialized workforce solutions, today announced that Chief Executive Officer Taryn Owen and Chief Financial Officer Carl Schweihs will participate in a fireside chat at the Sidoti Virtual Investor Conference on Thursday, December 7, 2023 at 4:00 PM Eastern Time. A live webcast and replay will be available through TrueBlue’s Investor Relations website at investor.trueblue.com and here. Management will also host virtual |

TrueBlue (NYSE:TBI) shareholders have endured a 44% loss from investing in the stock five years agoIn order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market... |

TBI Price Returns

| 1-mo | 16.00% |

| 3-mo | 13.13% |

| 6-mo | -17.26% |

| 1-year | -21.05% |

| 3-year | -56.29% |

| 5-year | -47.51% |

| YTD | -22.49% |

| 2023 | -21.65% |

| 2022 | -29.24% |

| 2021 | 48.05% |

| 2020 | -22.32% |

| 2019 | 8.13% |

Continue Researching TBI

Want to do more research on TrueBlue Inc's stock and its price? Try the links below:TrueBlue Inc (TBI) Stock Price | Nasdaq

TrueBlue Inc (TBI) Stock Quote, History and News - Yahoo Finance

TrueBlue Inc (TBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...