Triumph Bancorp, Inc. (TBK): Price and Financial Metrics

TBK Price/Volume Stats

| Current price | $58.74 | 52-week high | $136.01 |

| Prev. close | $59.76 | 52-week low | $46.03 |

| Day low | $57.82 | Volume | 275,800 |

| Day high | $59.93 | Avg. volume | 204,984 |

| 50-day MA | $55.31 | Dividend yield | N/A |

| 200-day MA | $69.69 | Market Cap | 1.44B |

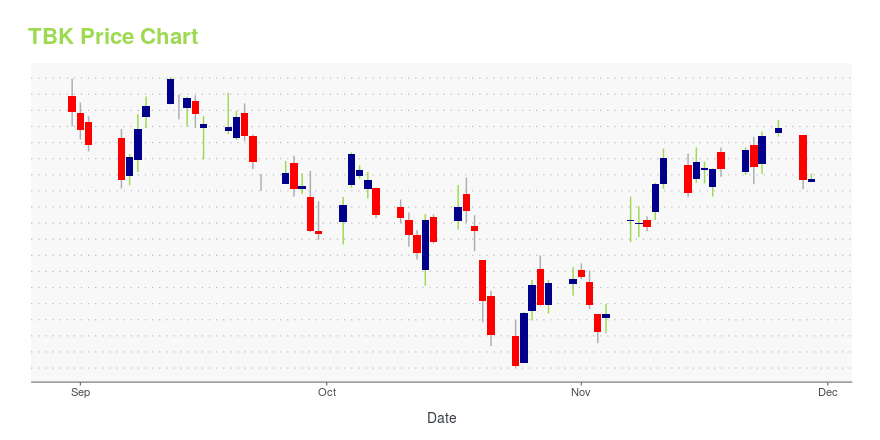

TBK Stock Price Chart Interactive Chart >

Triumph Bancorp, Inc. (TBK) Company Bio

Triumph Bancorp provides banking and commercial finance products to businesses in Iowa, Illinois, and Texas. The company was founded in 2010 and is based in Dallas, Texas.

Latest TBK News From Around the Web

Below are the latest news stories about TRIUMPH BANCORP INC that investors may wish to consider to help them evaluate TBK as an investment opportunity.

Triumph Financial, Inc. Announces Preliminary Results of Tender OfferDALLAS, Dec. 07, 2022 (GLOBE NEWSWIRE) -- Triumph Financial, Inc. (f/k/a Triumph Bancorp, Inc.) (Nasdaq: TFIN) (“Triumph” or the “Company”) announced today the preliminary results of its modified “Dutch auction” tender offer to purchase up to $100 million of its common stock for cash at a price per share not less than $51.00 and not greater than $58.00, which expired at 12:00 midnight, New York City time, at the end of the day on December 6, 2022. Based on the preliminary count by Equiniti Trust |

Triumph Bancorp Rebrands to Triumph FinancialTriumph Business Capital, Triumph Insurance Group and Triumph Commercial Finance consolidate to form new brand – TriumphDALLAS, Dec. 01, 2022 (GLOBE NEWSWIRE) -- Triumph Bancorp, Inc. today announced the completion of an extensive rebranding effort, including a change of the company name to Triumph Financial, Inc. (the “Company” or “Triumph Financial”). Prior to the market open on Dec. 2, 2022, the Company’s common stock will begin trading on NASDAQ under the ticker symbol “TFIN.” This will repl |

Triumph Bancorp Announces Dividend for 7.125% Series C Fixed-Rate Non-Cumulative Perpetual Preferred StockDALLAS, Nov. 30, 2022 (GLOBE NEWSWIRE) -- November 30, 2022 (GLOBE NEWSWIRE) – Triumph Bancorp, Inc. (the “Company”) (Nasdaq: TBK) today announced the Company’s Board of Directors declared a quarterly cash dividend of $17.81 per share on its 7.125% Series C Fixed-Rate Non-Cumulative Perpetual Preferred Stock, represented by depositary shares (NASDAQ: TBKCP), each representing a 1/40th interest in a share of preferred stock. Holders of depositary shares will receive $0.44525 per depositary share. |

Schneider Expands TriumphPay Relationship to Include Invoice Processing and Joins Payments NetworkSchneider becomes 76th broker added to TriumphPay's open payments network since launching in JanuaryDALLAS, Nov. 29, 2022 (GLOBE NEWSWIRE) -- TriumphPay today announced the addition of Schneider (NYSE: SNDR) to its rapidly growing open payments network. TriumphPay has continued expanding the reach of its open payments network since it launched earlier this year, providing brokers, factors, shippers and carriers a single solution to manage payments and mitigate fraud and risk. "We're thrilled tha |

Hopeful week for insiders who might be regretting buying US$1.1m of Triumph Bancorp, Inc. (NASDAQ:TBK) stock earlier this yearSome of the losses seen by insiders who purchased US$1.1m worth of Triumph Bancorp, Inc. ( NASDAQ:TBK ) shares over the... |

TBK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -21.07% |

| 5-year | 82.59% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 145.27% |

| 2020 | 27.70% |

| 2019 | 28.01% |

Continue Researching TBK

Want to do more research on Triumph Bancorp Inc's stock and its price? Try the links below:Triumph Bancorp Inc (TBK) Stock Price | Nasdaq

Triumph Bancorp Inc (TBK) Stock Quote, History and News - Yahoo Finance

Triumph Bancorp Inc (TBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...