Team, Inc. (TISI): Price and Financial Metrics

TISI Price/Volume Stats

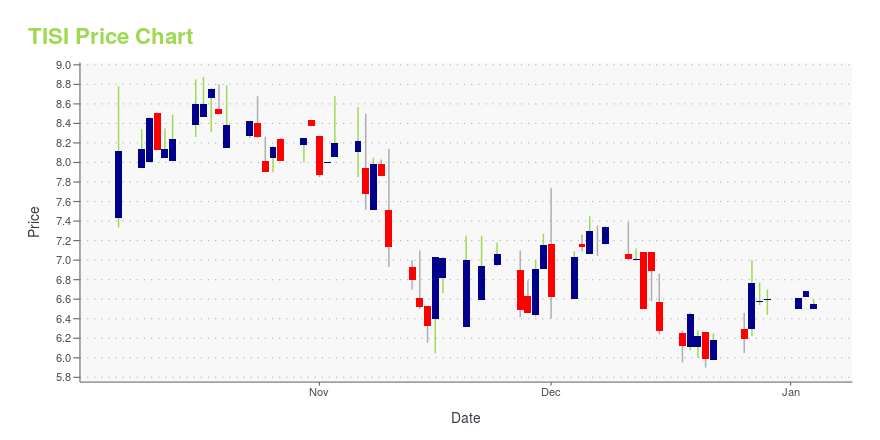

| Current price | $9.91 | 52-week high | $11.25 |

| Prev. close | $10.22 | 52-week low | $5.05 |

| Day low | $9.68 | Volume | 38,300 |

| Day high | $10.47 | Avg. volume | 12,311 |

| 50-day MA | $8.46 | Dividend yield | N/A |

| 200-day MA | $7.32 | Market Cap | 43.75M |

TISI Stock Price Chart Interactive Chart >

Team, Inc. (TISI) Company Bio

Team, Inc. is a provider of specialty industrial services, including inspection and assessment, required in maintaining and installing high-temperature and high-pressure piping systems and vessels that are utilized extensively in the refining, petrochemical, power, pipeline and other heavy industries. The company was founded in 1973 and is based in Sugar Land, Texas.

Latest TISI News From Around the Web

Below are the latest news stories about TEAM INC that investors may wish to consider to help them evaluate TISI as an investment opportunity.

Team, Inc. Reports Third Quarter 2023 ResultsSUGAR LAND, Texas, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”), a global, leading provider of specialty industrial services offering clients access to a full suite of conventional, specialized, and proprietary mechanical, heat-treating, and inspection services, today reported its financial results for the third quarter ended September 30, 2023. Third Quarter 2023 Highlights1: Reported total revenues of $206.7 million.Grew gross margin to 25.5% of revenue o |

Team Inc. Names Michael Caliel as Executive ChairmanAs executive chairman, Caliel will focus on Team Inc.’s long-term corporate strategy, growth opportunities, profit improvement, enhancing enterprise and advising the management team. |

Team, Inc. Reports Second Quarter 2023 ResultsSecond Quarter 2023 Revenue Increased $18.0 million or 8.1% Over Second Quarter 2022 Gross Margin Improved by 190 basis points Over Second Quarter 2022 SUGAR LAND, Texas, Aug. 10, 2023 (GLOBE NEWSWIRE) -- Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”), a global, leading provider of specialty industrial services offering clients access to a full suite of conventional, specialized, and proprietary mechanical, heat-treating, and inspection services, today reported its financial results for the s |

Team, Inc. Announces Successful Closing of Refinancing TransactionsSimplifies Capital Structure and Extends Maturities SUGAR LAND, Texas, June 20, 2023 (GLOBE NEWSWIRE) -- Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”), a global, leading provider of specialty industrial services offering clients access to a full suite of conventional, specialized, and proprietary mechanical, heat-treating, and inspection services, today announced the successful closing of a series of previously announced refinancing transactions (the “Transactions”) that raised $87.4 million |

Team, Inc. Regains Compliance With NYSE Continued Listing StandardsSUGAR LAND, Texas, May 30, 2023 (GLOBE NEWSWIRE) -- Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”), a global, leading provider of specialty industrial services offering clients access to a full suite of conventional, specialized, and proprietary mechanical, heat-treating, and inspection services, today announced that it has received formal notice from the New York Stock Exchange (“NYSE”) that the Company has regained compliance with the NYSE’s quantitative continued listing standards. On June |

TISI Price Returns

| 1-mo | 17.98% |

| 3-mo | 50.84% |

| 6-mo | 45.52% |

| 1-year | 19.83% |

| 3-year | -83.09% |

| 5-year | -93.82% |

| YTD | 50.15% |

| 2023 | 25.71% |

| 2022 | -51.83% |

| 2021 | -90.00% |

| 2020 | -31.75% |

| 2019 | 9.01% |

Continue Researching TISI

Want to do more research on Team Inc's stock and its price? Try the links below:Team Inc (TISI) Stock Price | Nasdaq

Team Inc (TISI) Stock Quote, History and News - Yahoo Finance

Team Inc (TISI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...