Tilly's, Inc. (TLYS): Price and Financial Metrics

TLYS Price/Volume Stats

| Current price | $5.49 | 52-week high | $9.50 |

| Prev. close | $5.62 | 52-week low | $4.85 |

| Day low | $5.39 | Volume | 87,900 |

| Day high | $5.68 | Avg. volume | 97,033 |

| 50-day MA | $5.58 | Dividend yield | N/A |

| 200-day MA | $6.88 | Market Cap | 165.15M |

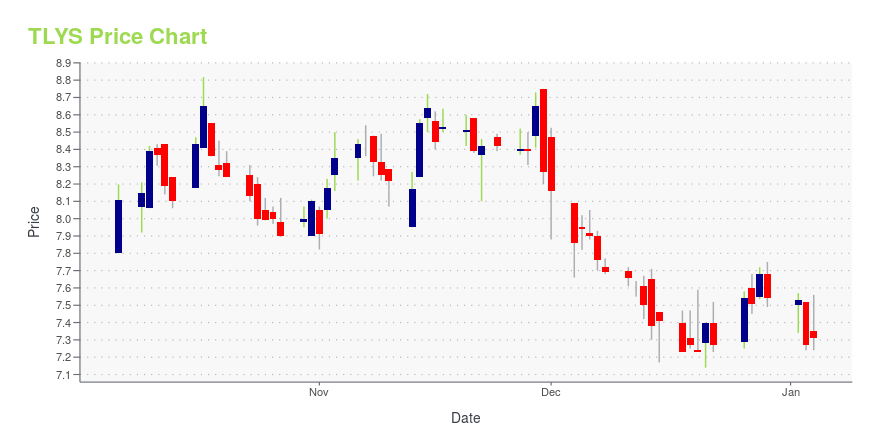

TLYS Stock Price Chart Interactive Chart >

Tilly's, Inc. (TLYS) Company Bio

Tillys, Inc. retails casual clothing, footwear, and accessories for teens and young adults in the United States. The company was founded in 1982 and is headquartered in Irvine, California.

Latest TLYS News From Around the Web

Below are the latest news stories about TILLY'S INC that investors may wish to consider to help them evaluate TLYS as an investment opportunity.

Tilly’s, Inc. Announces Participation in ICR Conference 2024IRVINE, Calif., December 22, 2023--Tilly’s, Inc. (NYSE: TLYS) today announced that Ed Thomas, President and Chief Executive Officer, and Mike Henry, Executive Vice President, Chief Financial Officer, will participate in a fireside chat at the ICR Conference 2024 held at the Grand Lakes Orlando, in Orlando, Florida on January 9, 2024 at 10:30 a.m. Eastern Time. |

Tilly’s, Inc. and Tilly’s Life Center Partner On Round-Up-4-Change Campaign to Continue Helping TeensIRVINE, Calif., December 18, 2023--Tilly's Inc. and Tilly's Life Center are partnering together again this holiday season with a campaign contributing towards teen mental health. |

Tilly’s, Inc. (NYSE:TLYS) Q3 2023 Earnings Call TranscriptTilly’s, Inc. (NYSE:TLYS) Q3 2023 Earnings Call Transcript November 30, 2023 Tilly’s, Inc. beats earnings expectations. Reported EPS is $-0.03, expectations were $-0.07. Operator: Good day, and welcome to Tilly’s Third Quarter 2023 Results Conference Call [Operator Instructions]. Please also note this event is being recorded. And I’d now like to turn the conference over […] |

Tilly's (TLYS) Q3 2023 Earnings Call TranscriptEd Thomas, president and CEO; and Michael Henry, EVP and CFO, will discuss the company's results and then host a Q&A session. And that was -- the content, actually, we have is good; we just didn't have enough. |

Tilly's Inc (TLYS) Reports Decreased Sales and Net Loss in Q3 Fiscal 2023Net Loss Narrows, Beating Previous Expectations Amid Economic Challenges |

TLYS Price Returns

| 1-mo | 12.04% |

| 3-mo | -8.65% |

| 6-mo | -26.80% |

| 1-year | -33.05% |

| 3-year | -63.20% |

| 5-year | -33.62% |

| YTD | -27.19% |

| 2023 | -16.69% |

| 2022 | -43.82% |

| 2021 | 97.43% |

| 2020 | -33.39% |

| 2019 | 12.80% |

Continue Researching TLYS

Want to do more research on Tilly'S Inc's stock and its price? Try the links below:Tilly'S Inc (TLYS) Stock Price | Nasdaq

Tilly'S Inc (TLYS) Stock Quote, History and News - Yahoo Finance

Tilly'S Inc (TLYS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...