Trilogy Metals Inc. (TMQ): Price and Financial Metrics

TMQ Price/Volume Stats

| Current price | $0.68 | 52-week high | $0.70 |

| Prev. close | $0.68 | 52-week low | $0.25 |

| Day low | $0.64 | Volume | 206,102 |

| Day high | $0.70 | Avg. volume | 258,429 |

| 50-day MA | $0.52 | Dividend yield | N/A |

| 200-day MA | $0.47 | Market Cap | 109.18M |

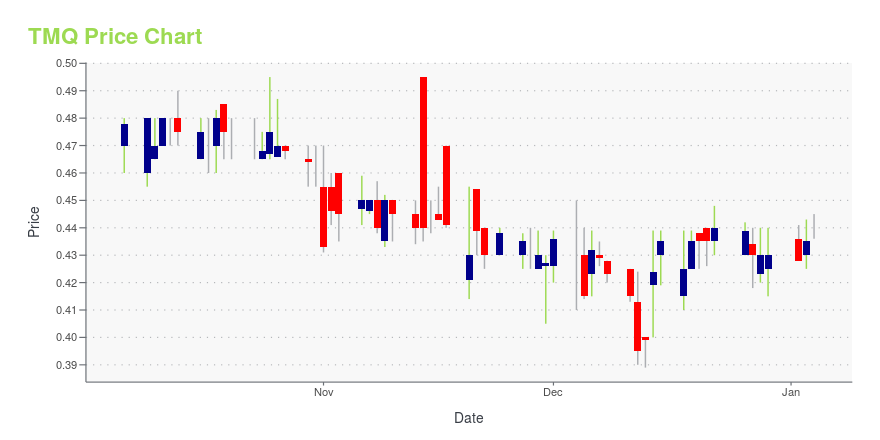

TMQ Stock Price Chart Interactive Chart >

Trilogy Metals Inc. (TMQ) Company Bio

Trilogy Metals, Inc. engages in the development and exploration of mineral properties. The firm holds interests in the Upper Kobuk mineral projects that include the Arctic, a copper-zinc-lead-gold-silver and Bornite, a carbonate-hosted copper projects, which is located in the Ambler mining district in Northwest Alaska. The company was founded on April 27, 2011 and is headquartered in Vancouver, Canada.

Latest TMQ News From Around the Web

Below are the latest news stories about TRILOGY METALS INC that investors may wish to consider to help them evaluate TMQ as an investment opportunity.

10 Best Debt Free Penny Stocks To Buy NowIn this article we present the list of 10 Best Debt Free Penny Stocks To Buy Now. Click to skip our discussion of the pros and potential cons of debt-free stocks and go straight to the 5 Best Debt Free Penny Stocks To Buy Now. Trilogy Metals Inc. (NYSE:TMQ), Forte Biosciences, Inc. (NASDAQ:FBRX), and AERWINS Technologies […] |

Companies Like Trilogy Metals (TSE:TMQ) Are In A Position To Invest In GrowthThere's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining... |

Trilogy Metals Provides an Update on the Ambler Access ProjectTrilogy Metals Inc. (TSX: TMQ) (NYSE American: TMQ) ("Trilogy" or the "Company") is pleased to provide an update on the Ambler Access Project ("AAP") – the proposed 211-mile, industrial-use-only road from the Upper Kobuk Mineral Projects ("UKMP") to the Dalton Highway that will enable the advancement of exploration and development at the Ambler Mining District, home to some of the world's richest known copper-dominant polymetallic deposits. The United States Bureau of Land Management ("BLM") has |

Trilogy Metals Reports Third Quarter Fiscal 2023 Financial ResultsTrilogy Metals Inc. (TSX: TMQ) (NYSE American: TMQ) ("Trilogy Metals", "Trilogy" or "the Company") announces its financial results for the third quarter ended August 31, 2023. Details of the Company's financial results are contained in the interim unaudited consolidated financial statements and Management's Discussion and Analysis which will be available on the Company's website at www.trilogymetals.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. All amounts are in United States |

Trilogy Metals Advances 100%-Owned Helpmejack Project in the Eastern Ambler Schist Belt, AlaskaTrilogy Metals Inc. (TSX: TMQ) (NYSE American: TMQ) ("Trilogy" or the "Company") is pleased to provide an exploration update on its 100%-owned projects in northern Alaska. Simple, low-cost fieldwork involving stream sediment and rock sampling has outlined two target areas prospective for volcanogenic massive sulphide ("VMS") and shale-hosted zinc deposits at the Helpmejack Project located in the eastern part of the Ambler Schist Belt. Zinc values more than 3,000 ppm in stream sediments are the h |

TMQ Price Returns

| 1-mo | 52.16% |

| 3-mo | 65.85% |

| 6-mo | 35.73% |

| 1-year | 26.02% |

| 3-year | -67.77% |

| 5-year | -68.81% |

| YTD | 58.14% |

| 2023 | -21.82% |

| 2022 | -66.67% |

| 2021 | -17.50% |

| 2020 | -23.08% |

| 2019 | 50.29% |

Loading social stream, please wait...