TimkenSteel Corp. (TMST): Price and Financial Metrics

TMST Price/Volume Stats

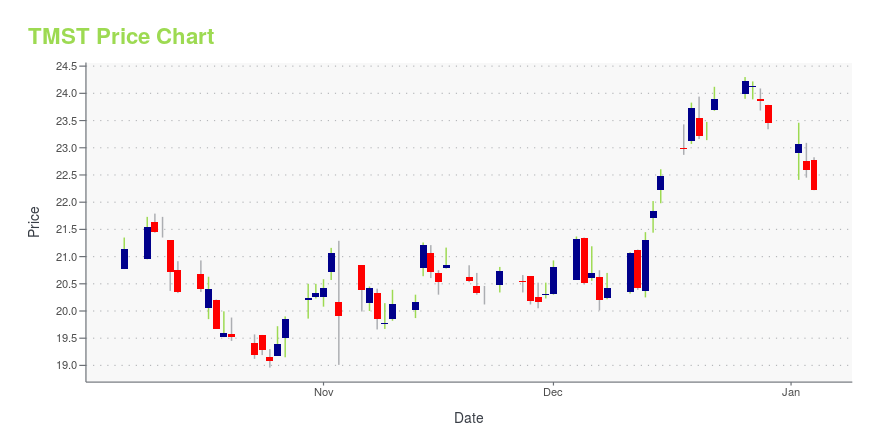

| Current price | $20.40 | 52-week high | $24.30 |

| Prev. close | $20.19 | 52-week low | $15.59 |

| Day low | $20.01 | Volume | 352,900 |

| Day high | $20.53 | Avg. volume | 192,050 |

| 50-day MA | $21.35 | Dividend yield | N/A |

| 200-day MA | $20.76 | Market Cap | 880.36M |

TMST Stock Price Chart Interactive Chart >

TimkenSteel Corp. (TMST) Company Bio

TimkenSteel Corporation manufactures and sells alloy steel, and carbon and micro-alloy steel products. It operates in two segments, Industrial & Mobile, and Energy & Distribution. The company was established in 2014 and is based in Canton, Ohio.

Latest TMST News From Around the Web

Below are the latest news stories about TIMKENSTEEL CORP that investors may wish to consider to help them evaluate TMST as an investment opportunity.

EVP, CFO Kristopher Westbrooks Sells 15,949 Shares of TimkenSteel CorpOn December 27, 2023, Kristopher Westbrooks, Executive Vice President and Chief Financial Officer of TimkenSteel Corp (NYSE:TMST), sold 15,949 shares of the company's stock, according to a SEC Filing. |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

TimkenSteel Corporation (NYSE:TMST) is favoured by institutional owners who hold 79% of the companyKey Insights Institutions' substantial holdings in TimkenSteel implies that they have significant influence over the... |

Insider Sell: EVP, CFO Kristopher Westbrooks Sells Shares of TimkenSteel Corp (TMST)TimkenSteel Corp (NYSE:TMST) has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. |

Is TimkenSteel Corporation's (NYSE:TMST) Recent Stock Performance Influenced By Its Financials In Any Way?TimkenSteel's (NYSE:TMST) stock is up by 4.3% over the past month. As most would know, long-term fundamentals have a... |

TMST Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -1.16% |

| 1-year | -10.09% |

| 3-year | 56.92% |

| 5-year | 194.80% |

| YTD | -13.01% |

| 2023 | 29.06% |

| 2022 | 10.12% |

| 2021 | 253.32% |

| 2020 | -40.59% |

| 2019 | -10.07% |

Continue Researching TMST

Here are a few links from around the web to help you further your research on TimkenSteel Corp's stock as an investment opportunity:TimkenSteel Corp (TMST) Stock Price | Nasdaq

TimkenSteel Corp (TMST) Stock Quote, History and News - Yahoo Finance

TimkenSteel Corp (TMST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...