Telus Corporation Ordinary Shares (TU): Price and Financial Metrics

TU Price/Volume Stats

| Current price | $15.88 | 52-week high | $19.14 |

| Prev. close | $15.83 | 52-week low | $14.63 |

| Day low | $15.80 | Volume | 2,611,053 |

| Day high | $15.95 | Avg. volume | 2,292,594 |

| 50-day MA | $15.88 | Dividend yield | 7.27% |

| 200-day MA | $16.85 | Market Cap | 23.44B |

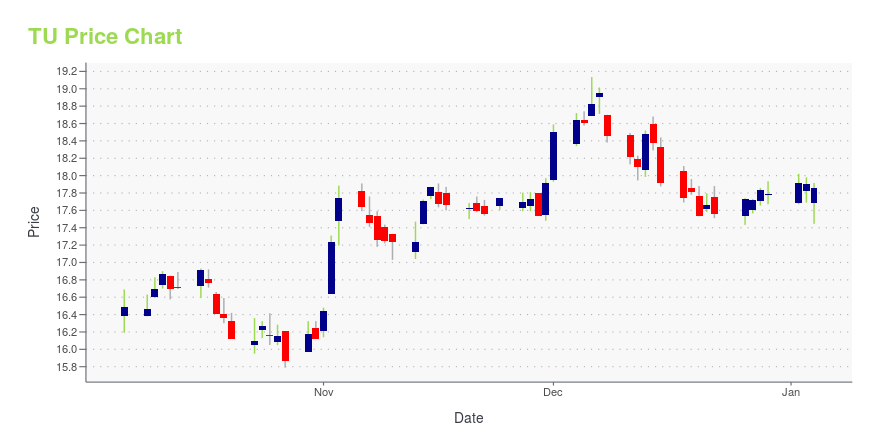

TU Stock Price Chart Interactive Chart >

Telus Corporation Ordinary Shares (TU) Company Bio

TELUS Corporation provides a range of telecommunications services and products, including wireless and wireline voice and data in Canada. The company was founded in 1993 and is based in Vancouver, Canada.

Latest TU News From Around the Web

Below are the latest news stories about TELUS CORP that investors may wish to consider to help them evaluate TU as an investment opportunity.

TELUS (TSE:T) shareholders have endured a 7.7% loss from investing in the stock a year agoIt's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly... |

Rogers Communication (RCI) to Deploy Satellite Tech in 2024Rogers Communication (RCI) plans to introduce satellite-to-mobile phone technology in 2024, aiming to establish connectivity in remote areas. |

DTEGY vs. TU: Which Stock Is the Better Value Option?DTEGY vs. TU: Which Stock Is the Better Value Option? |

TELUS' (TSE:T) Shareholders Will Receive A Bigger Dividend Than Last YearThe board of TELUS Corporation ( TSE:T ) has announced that it will be paying its dividend of CA$0.3761 on the 2nd of... |

TELUS expands its lineup of French-language entertainment with content from Club illicoAs Quebecers increasingly turn to on-demand subscription services for their favourite TV content, TELUS is the first company to redistribute content from Club illico. Customers who sign up for the service between December 7 and 31 will enjoy their first month at $0. MONTREAL, Dec. 06, 2023 (GLOBE NEWSWIRE) -- TELUS announces that it will begin offering OPTIK TV customers the option to subscribe to Club illico, for just $10 a month, saving $5 on a standalone subscription, beginning December 7, 20 |

TU Price Returns

| 1-mo | 4.54% |

| 3-mo | 0.55% |

| 6-mo | -9.41% |

| 1-year | -6.12% |

| 3-year | -15.73% |

| 5-year | 9.99% |

| YTD | -7.73% |

| 2023 | -2.40% |

| 2022 | -14.30% |

| 2021 | 21.66% |

| 2020 | 6.60% |

| 2019 | 22.32% |

TU Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TU

Want to do more research on Telus Corp's stock and its price? Try the links below:Telus Corp (TU) Stock Price | Nasdaq

Telus Corp (TU) Stock Quote, History and News - Yahoo Finance

Telus Corp (TU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...