Ur-Energy Inc. (URG): Price and Financial Metrics

URG Price/Volume Stats

| Current price | $1.18 | 52-week high | $2.01 |

| Prev. close | $1.30 | 52-week low | $0.98 |

| Day low | $1.07 | Volume | 18,183,200 |

| Day high | $1.18 | Avg. volume | 3,532,792 |

| 50-day MA | $1.52 | Dividend yield | N/A |

| 200-day MA | $1.61 | Market Cap | 342.73M |

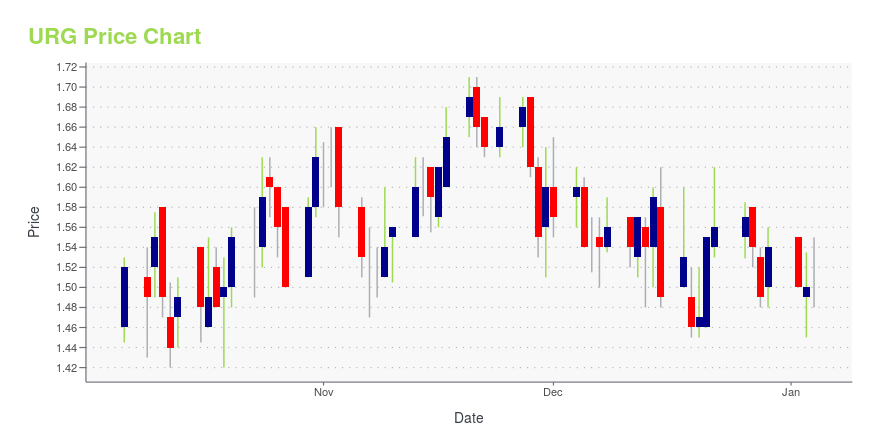

URG Stock Price Chart Interactive Chart >

Ur-Energy Inc. (URG) Company Bio

Ur-Energy, Inc. explores for uranium. The Company operates in Nunavut in Canada and Wyoming in the United States.

Latest URG News From Around the Web

Below are the latest news stories about UR-ENERGY INC that investors may wish to consider to help them evaluate URG as an investment opportunity.

11 Best Uranium Stocks To BuyIn this piece, we will take a look at the 11 best uranium stocks to buy. If you want to skip our overview of the uranium industry, and an analysis of the recent trends, then read 5 Best Uranium Stocks To Buy. Advances in manufacturing and technology have enabled humanity to manipulate materials in transformational […] |

Insider Sell: CFO Roger Smith Sells 74,067 Shares of Ur-Energy IncOn November 1, 2023, Roger Smith, the Chief Financial Officer of Ur-Energy Inc (URG), sold 74,067 shares of the company. |

Ur-Energy Inc (URG) Reports Q3 2023 Earnings: Cash and Cash Equivalents Increase by $21.6 MillionUranium miner Ur-Energy Inc (URG) sees a significant increase in cash and cash equivalents in Q3 2023, amidst an improving uranium market |

Nuclear Power Is the Future — and These Stocks Are Leading the ChargeThe world runs on energy; just think about how much of your life depends on the little outlets in the walls. For now, the bulk of our power generation capacity is supported by fossil fuels, mostly coal and natural gas, that are pulled out of the ground. Long-term, however, the social and political pressures on fossil fuels are reducing their use, and will reduce it further. Despite huge subsidies, wind and solar power simply cannot replace the lost capacity, and we will have to find it somewhere |

The Ur-Energy Inc (URG) Company: A Short SWOT AnalysisUnearthing the Strengths, Weaknesses, Opportunities, and Threats of a Leading Uranium Mining Company |

URG Price Returns

| 1-mo | -16.31% |

| 3-mo | -30.18% |

| 6-mo | -32.57% |

| 1-year | 18.00% |

| 3-year | 3.51% |

| 5-year | 96.86% |

| YTD | -23.38% |

| 2023 | 33.91% |

| 2022 | -5.74% |

| 2021 | 52.27% |

| 2020 | 36.14% |

| 2019 | -9.46% |

Continue Researching URG

Want to see what other sources are saying about Ur-Energy Inc's financials and stock price? Try the links below:Ur-Energy Inc (URG) Stock Price | Nasdaq

Ur-Energy Inc (URG) Stock Quote, History and News - Yahoo Finance

Ur-Energy Inc (URG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...