Uranium Royalty Corp. (UROY): Price and Financial Metrics

UROY Price/Volume Stats

| Current price | $2.31 | 52-week high | $3.76 |

| Prev. close | $2.25 | 52-week low | $2.02 |

| Day low | $2.26 | Volume | 1,018,418 |

| Day high | $2.32 | Avg. volume | 1,434,080 |

| 50-day MA | $2.46 | Dividend yield | N/A |

| 200-day MA | $2.67 | Market Cap | 278.71M |

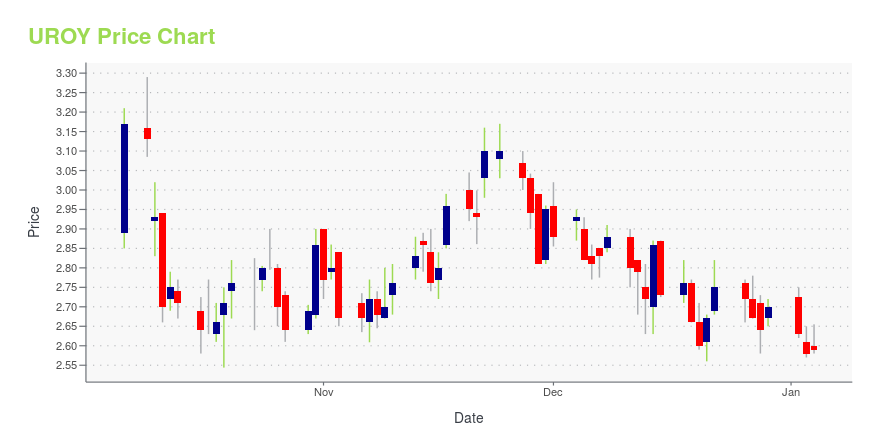

UROY Stock Price Chart Interactive Chart >

Uranium Royalty Corp. (UROY) Company Bio

Uranium Royalty Corp. operates as a pure-play uranium royalty company. It acquires, accumulates, and manages a portfolio of geographically diversified uranium interests. The company has royalty interests in the Diabase project located in Saskatchewan, Canada; the Anderson project, the Slick Rock project, and the Workman Creek project; and the Langer Heinrich uranium project in Namibia. It also holds royalty interests in the Church Rock, Dewey-Burdock, Lance, Roca Honda, Reno Creek, Roughrider, and Michelin Projects. The company was incorporated in 2017 and is headquartered in Vancouver, Canada.

Latest UROY News From Around the Web

Below are the latest news stories about URANIUM ROYALTY CORP that investors may wish to consider to help them evaluate UROY as an investment opportunity.

UROY Stock Earnings: Uranium Royalty Reported Results for Q2 2024Uranium Royalty just reported results for the second quarter of 2024. |

Returns On Capital Are Showing Encouraging Signs At Uranium Royalty (TSE:URC)What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly... |

Uranium Royalty Corp. Endorses Net-Zero Nuclear Industry Pledge at COP 28Uranium Royalty Corp. (NASDAQ: UROY) (TSX: URC) ("URC" or the "Company") is pleased to report President and Chief Executive Officer, Scott Melbye, presented his views at the COP 28 Net-Zero Nuclear Pavilion in a panel discussion addressing the sustainability of the uranium sector. The panel was part of the United Nations Conference on Climate Change in Dubai, United Arab Emirates and hosted by the World Nuclear Association and Emirates Nuclear Energy Corporation. While at COP 28, URC demonstrate |

Uranium Royalty Corp. Releases Inaugural Sustainability ReportUranium Royalty Corp. (NASDAQ: UROY) (TSX: URC) ("URC" or the "Company") is pleased to announce the publication of its inaugural 2023 Sustainability Report. This report presents the Company's approach and performance on sustainability initiatives and outlines sustainability strategy and goals for the future. |

Uranium Royalty Corp. Provides Update on Physical Uranium PurchasesUranium Royalty Corp. (NASDAQ: UROY) (TSX: URC) ("URC" or the "Company") is pleased to announce that it has secured additional fixed-price uranium purchase commitments totaling 1 million pounds U3O8 in the current quarter. Deliveries will occur at Cameco Corporation's Blind River facility in Ontario, Canada during the fourth quarter of 2023. The weighted average purchase price for such commitments is US$70.44 per pound (TradeTech spot price is US$73.50 per pound as at October 26, 2023), which is |

UROY Price Returns

| 1-mo | 2.21% |

| 3-mo | -1.70% |

| 6-mo | -30.42% |

| 1-year | 12.14% |

| 3-year | -19.79% |

| 5-year | N/A |

| YTD | -14.44% |

| 2023 | 13.92% |

| 2022 | -35.07% |

| 2021 | 218.39% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...