U.S. Century Bank (USCB): Price and Financial Metrics

USCB Price/Volume Stats

| Current price | $15.43 | 52-week high | $16.63 |

| Prev. close | $15.79 | 52-week low | $10.04 |

| Day low | $14.89 | Volume | 23,900 |

| Day high | $16.63 | Avg. volume | 26,698 |

| 50-day MA | $12.75 | Dividend yield | 1.31% |

| 200-day MA | $11.77 | Market Cap | 303.20M |

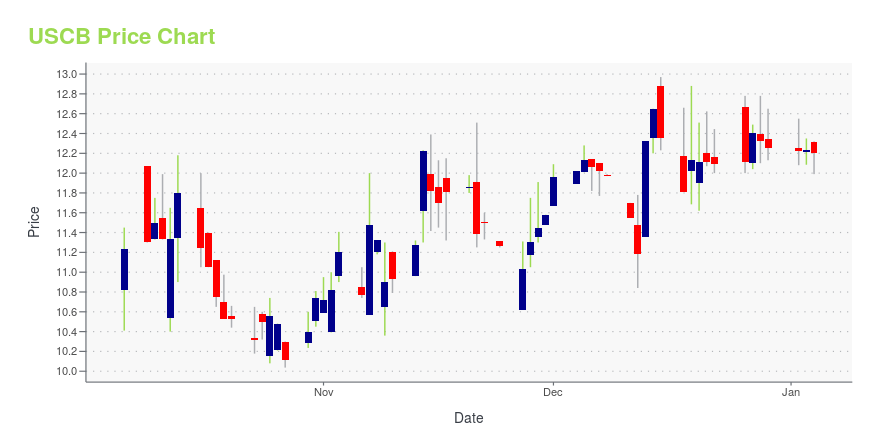

USCB Stock Price Chart Interactive Chart >

U.S. Century Bank (USCB) Company Bio

U.S. Century Bank is a community bank in Miami-Dade County, Florida, with headquarters in the city of Doral. U.S. Century Bank is a Minority Depository Institution (MDI) that provides banking services throughout South Florida. It has approximately $1.6 billion in total assets, $170 million in equity capital, and a branch network that includes 11 locations in Miami-Dade and Broward counties.

Latest USCB News From Around the Web

Below are the latest news stories about USCB FINANCIAL HOLDINGS INC that investors may wish to consider to help them evaluate USCB as an investment opportunity.

Positive Signs As Multiple Insiders Buy USCB Financial Holdings StockIt is usually uneventful when a single insider buys stock. However, When quite a few insiders buy shares, as it... |

USCB Financial Holdings Executive VP & CFO Acquires 35% More StockPotential USCB Financial Holdings, Inc. ( NASDAQ:USCB ) shareholders may wish to note that the Executive VP & CFO... |

Executive VP and CFO Robert Anderson Buys 8,750 Shares of USCB Financial Holdings IncUSCB Financial Holdings Inc (NASDAQ:USCB) has recently witnessed a significant insider transaction that has caught the attention of investors and market analysts. |

U.S. Century Bank Names William Turner New Executive Vice President and Chief Credit OfficerWilliam Turner, Executive Vice President and Chief Credit Officer William Turner named U.S. Century Bank's new Chief Credit Officer MIAMI, Dec. 07, 2023 (GLOBE NEWSWIRE) -- USCB Financial Holdings, Inc. (the “Company”) (NASDAQ: USCB), the holding company for U.S. Century Bank (the “Bank”), announced today that William “Bill” Turner, a bank executive with more than 35 years of credit experience, has been named the Bank’s new executive vice president and chief credit officer. Turner succeeds Benig |

USCB Financial Holdings, Inc. Announces Retirement of Chief Credit Officer, Benigno Pazos; Announces the Departure of Jay Shehadeh, General Counsel; Promotes Maricarmen Logroño to Chief Risk OfficerMaricarmen Logroño U.S. Century Bank promotes Maricarmen Logroño to Chief Risk Officer. MIAMI, Nov. 02, 2023 (GLOBE NEWSWIRE) -- USCB Financial Holdings, Inc. (the “Company”) (NASDAQ: USCB), the holding company for U.S. Century Bank (the “Bank”), announced today key transitions and promotion of new chief risk and compliance officer. Benigno “Ben” Pazos, CPA, Executive Vice President and Chief Credit Officer, will be retiring effective December 31, 2023. Pazos joined the Bank in 2015 and has been |

USCB Price Returns

| 1-mo | 26.68% |

| 3-mo | 44.40% |

| 6-mo | 28.10% |

| 1-year | 28.74% |

| 3-year | 46.83% |

| 5-year | N/A |

| YTD | 27.06% |

| 2023 | 0.41% |

| 2022 | -12.89% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

USCB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...