USD Partners LP (USDP): Price and Financial Metrics

USDP Price/Volume Stats

| Current price | $0.01 | 52-week high | $0.10 |

| Prev. close | $0.01 | 52-week low | $0.00 |

| Day low | $0.01 | Volume | 29,900 |

| Day high | $0.01 | Avg. volume | 37,918 |

| 50-day MA | $0.01 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 300.59K |

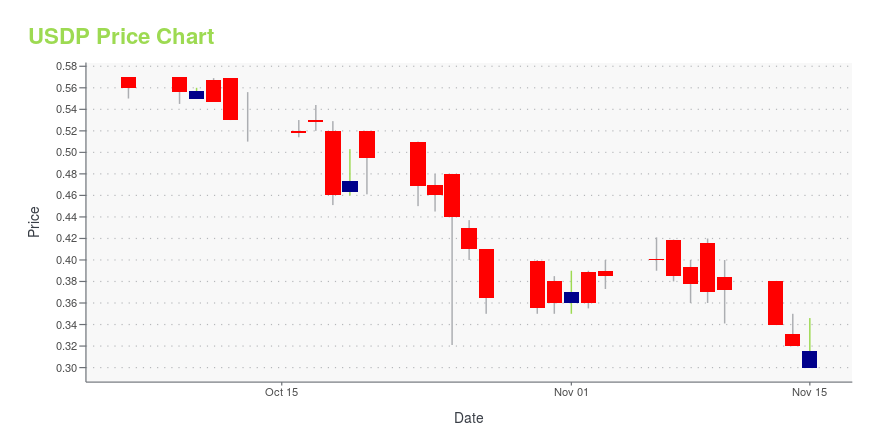

USDP Stock Price Chart Interactive Chart >

USD Partners LP (USDP) Company Bio

USD Partners LP acquires, develops, and operates energy-related rail terminals and other midstream infrastructure assets and businesses in the United States and Canada. The company is based in Houston, Texas.

USDP Price Returns

| 1-mo | 33.33% |

| 3-mo | N/A |

| 6-mo | -70.59% |

| 1-year | -78.26% |

| 3-year | -99.80% |

| 5-year | -99.57% |

| YTD | -69.88% |

| 2024 | -74.87% |

| 2023 | -95.70% |

| 2022 | -34.97% |

| 2021 | 67.37% |

| 2020 | -60.27% |

Loading social stream, please wait...