Vale S.A. ADR (VALE): Price and Financial Metrics

VALE Price/Volume Stats

| Current price | $10.86 | 52-week high | $16.08 |

| Prev. close | $10.70 | 52-week low | $10.64 |

| Day low | $10.75 | Volume | 25,627,100 |

| Day high | $10.93 | Avg. volume | 25,935,631 |

| 50-day MA | $11.57 | Dividend yield | 10.98% |

| 200-day MA | $13.10 | Market Cap | 48.69B |

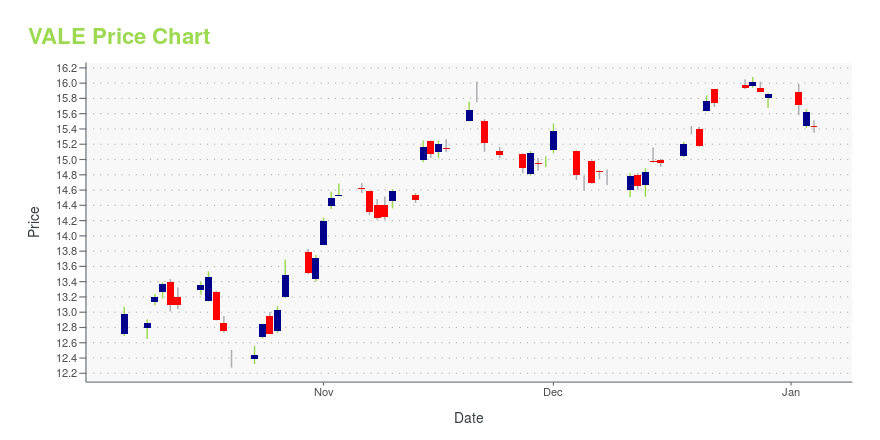

VALE Stock Price Chart Interactive Chart >

Vale S.A. ADR (VALE) Company Bio

Vale S.A engages in the research, production, and sale of iron ore and pellets, nickel, fertilizer, copper, coal, manganese, ferroalloys, cobalt, platinum group metals, and precious metals in Brazil and internationally. The company was founded in 1942 and is based in Rio de Janeiro, Brazil.

Latest VALE News From Around the Web

Below are the latest news stories about VALE SA that investors may wish to consider to help them evaluate VALE as an investment opportunity.

Financial Freedom: 7 Exceptional High-Yield Stocks for Lasting Passive GainsThe pursuit of financial freedom often conjures up images of dynamic markets, strategic maneuvers, and the allure of high-yield stocks. |

Got $20? 3 Blue-Chip Stocks to Buy for High Total ReturnsBlue-chip stocks are like the foundation blocks of a portfolio. |

3 Blue-Chip Stocks Set for a 50% Surge in the Coming YearThese are the attractively valued blue-chip stocks to buy as they represent companies with a positive outlook for 2024. |

11 Best Nickel Stocks to Buy NowIn this article, we discuss the 11 best nickel stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Nickel Stocks to Buy Now. Nickel has become an important source of revenue for mining and processing companies as the demand for the metal increases. Nickel […] |

13 Best Mining Stocks To Buy NowIn this piece, we will take a look at the 13 best mining stocks to buy now. If you want to skip our analysis of the mining industry and want to jump to the top five stocks in this list, head on over to 5 Best Mining Stocks To Buy Now. The global supply of […] |

VALE Price Returns

| 1-mo | -2.69% |

| 3-mo | -11.56% |

| 6-mo | -18.97% |

| 1-year | -16.72% |

| 3-year | -37.70% |

| 5-year | 20.15% |

| YTD | -28.52% |

| 2023 | -0.07% |

| 2022 | 29.63% |

| 2021 | -1.97% |

| 2020 | 29.89% |

| 2019 | 2.31% |

VALE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VALE

Here are a few links from around the web to help you further your research on Vale SA's stock as an investment opportunity:Vale SA (VALE) Stock Price | Nasdaq

Vale SA (VALE) Stock Quote, History and News - Yahoo Finance

Vale SA (VALE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...