VEON Ltd. (VEON): Price and Financial Metrics

VEON Price/Volume Stats

| Current price | $27.00 | 52-week high | $27.90 |

| Prev. close | $27.08 | 52-week low | $14.50 |

| Day low | $26.79 | Volume | 23,713 |

| Day high | $27.20 | Avg. volume | 31,331 |

| 50-day MA | $26.17 | Dividend yield | N/A |

| 200-day MA | $22.44 | Market Cap | 2.00B |

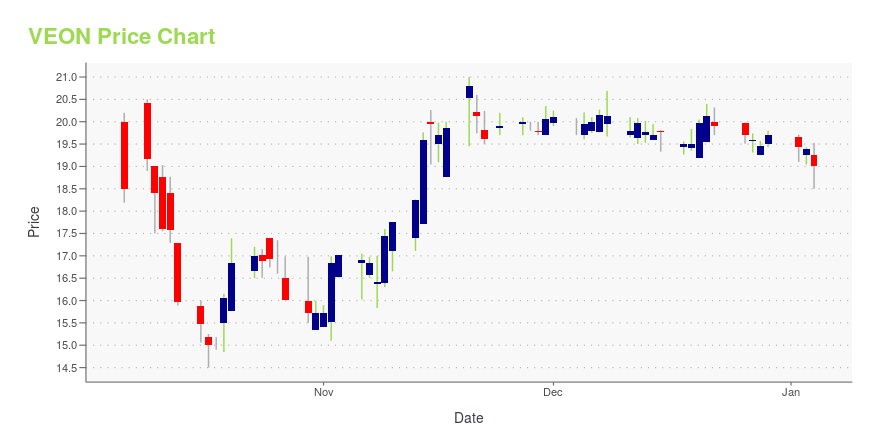

VEON Stock Price Chart Interactive Chart >

VEON Ltd. (VEON) Company Bio

VEON Ltd., formerly known as VimpelCom, offers voice and data services through a range of traditional and broadband mobile and fixed line technologies in Italy, Russia, Ukraine, Kazakhstan, Uzbekistan, Tajikistan, Armenia, Georgia, Kyrgyzstan, Laos, Algeria, Bangladesh, and Pakistan. The company was founded in 1992 and is based in Amsterdam, the Netherlands.

Latest VEON News From Around the Web

Below are the latest news stories about VEON LTD that investors may wish to consider to help them evaluate VEON as an investment opportunity.

VEON Presents Digital Operator Success Story at NSR/BCG Investor Conference in New YorkNew York, 20 December 2023: VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, recently participated in an investor conference organized by New Street Research and Boston Consulting Group in New York, highlighting the achievements of its digital operator strategy. “VEON has a tailored digital operator approach in each of its markets, going beyond traditional telecommunications and providing digital experiences t |

Kyivstar restores services in all categories, brings 99% of mobile network back on airAmsterdam, 19 December 2023 – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, today announces that Kyivstar has now restored services in all categories of its communication services, with mobile voice and internet, fixed connectivity, SMS and MyKyivstar self-care application active and available across Ukraine. As of today, 99% of Kyivstar’s base stations in the territory controlled by the Ukrainian governmen |

Kyivstar restores mobile internet across Ukraine, reactivates international roamingAmsterdam, 15 December 2023 – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, today announces that its Ukrainian subsidiary Kyivstar has restored mobile internet services across the country following Tuesday’s widespread cyber-attack. The restoration of mobile internet covers all communication standards including 4G. In addition to reactivation of mobile internet, international roaming services have also been |

Kyivstar restores voice services across Ukraine, starts the reactivation of mobile data servicesAmsterdam, 14 December 2023 – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, today announces that, following Tuesday’s widespread cyber-attack and the subsequent service outage, its Ukrainian subsidiary Kyivstar is restoring connectivity on its networks. According to the latest updates from Kyivstar, in the territory controlled by Ukraine: More than 90% of mobile base stations are now operationalVoice servic |

Kyivstar starts restoring voice services on its network following widespread cyber-attackAmsterdam, 13 December 2023 – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global digital operator that provides converged connectivity and online services, announces that its Ukrainian subsidiary Kyivstar has started restoring voice services on its mobile network as of 18.00 Kyiv time, following the widespread cyber-attack of 12 December 2023. The restoration will continue to progress gradually and in stages; and setbacks during the process are possible. Kyivstar technical teams are al |

VEON Price Returns

| 1-mo | 4.29% |

| 3-mo | 15.24% |

| 6-mo | 39.53% |

| 1-year | 50.84% |

| 3-year | -35.71% |

| 5-year | -62.02% |

| YTD | 37.06% |

| 2023 | 60.82% |

| 2022 | -71.35% |

| 2021 | 13.25% |

| 2020 | -37.09% |

| 2019 | 18.91% |

Continue Researching VEON

Here are a few links from around the web to help you further your research on VEON Ltd's stock as an investment opportunity:VEON Ltd (VEON) Stock Price | Nasdaq

VEON Ltd (VEON) Stock Quote, History and News - Yahoo Finance

VEON Ltd (VEON) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...