Telefonica Brasil S.A. ADR (VIV): Price and Financial Metrics

VIV Price/Volume Stats

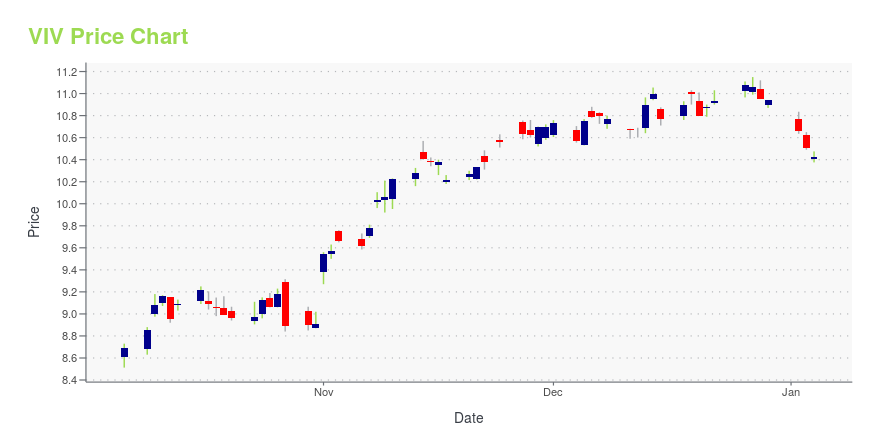

| Current price | $8.62 | 52-week high | $11.43 |

| Prev. close | $8.65 | 52-week low | $8.02 |

| Day low | $8.60 | Volume | 666,436 |

| Day high | $8.70 | Avg. volume | 874,429 |

| 50-day MA | $8.59 | Dividend yield | 3.22% |

| 200-day MA | $9.76 | Market Cap | 14.34B |

VIV Stock Price Chart Interactive Chart >

Telefonica Brasil S.A. ADR (VIV) Company Bio

Telefônica Brasil trading as Vivo, is a Brazilian telecommunications group, subsidiary of Spanish Telefónica. (Source:Wikipedia)

Latest VIV News From Around the Web

Below are the latest news stories about TELEFONICA BRASIL SA that investors may wish to consider to help them evaluate VIV as an investment opportunity.

VIV vs. NTTYY: Which Stock Is the Better Value Option?VIV vs. NTTYY: Which Stock Is the Better Value Option? |

Telefonica mulls bid for Brazil's Oi broadband fiber clients unit -sourcesTelefonica is exploring a possible offer for a unit of Brazil's Oi that provides broadband fiber services to retail and business customers, four people with knowledge of the situation said, in a bid to expand in its second-largest market. The board of Oi, which filed for bankruptcy protection earlier this year, hired advisers in October to study strategic options for its fiber broadband client base, called UPI ClientCo. The Spanish telecoms group, which operates in the country through its listed subsidiary Telefonica Brasil , has been discussing its potential move with financial advisers, said three sources, who spoke on condition of anonymity. |

Here's Why Telefonica Brasil (VIV) is a Strong Value StockThe Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage. |

Telefonica Brasil (VIV) is a Great Momentum Stock: Should You Buy?Does Telefonica Brasil (VIV) have what it takes to be a top stock pick for momentum investors? Let's find out. |

VIV or NTTYY: Which Is the Better Value Stock Right Now?VIV vs. NTTYY: Which Stock Is the Better Value Option? |

VIV Price Returns

| 1-mo | 3.32% |

| 3-mo | -7.85% |

| 6-mo | -16.20% |

| 1-year | -0.85% |

| 3-year | 22.97% |

| 5-year | N/A |

| YTD | -20.49% |

| 2023 | 61.55% |

| 2022 | -14.25% |

| 2021 | 0.03% |

| 2020 | N/A |

| 2019 | N/A |

VIV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VIV

Here are a few links from around the web to help you further your research on Telefonica Brasil Sa's stock as an investment opportunity:Telefonica Brasil Sa (VIV) Stock Price | Nasdaq

Telefonica Brasil Sa (VIV) Stock Quote, History and News - Yahoo Finance

Telefonica Brasil Sa (VIV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...