VeriSign Inc. (VRSN): Price and Financial Metrics

VRSN Price/Volume Stats

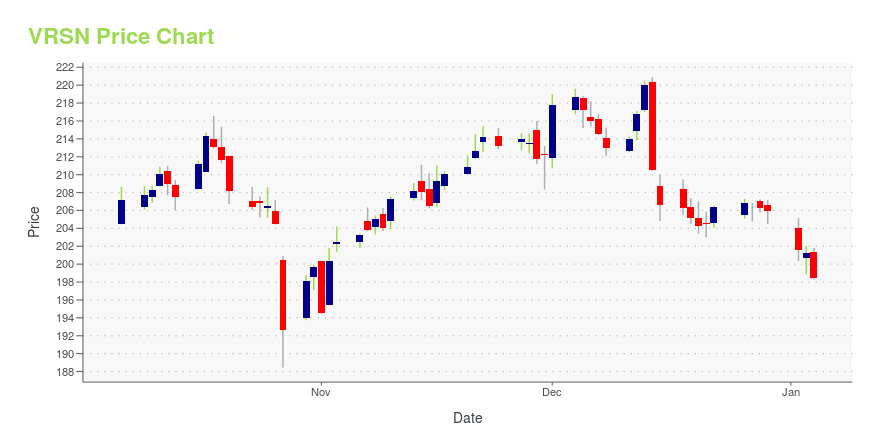

| Current price | $184.10 | 52-week high | $220.91 |

| Prev. close | $176.74 | 52-week low | $167.04 |

| Day low | $174.60 | Volume | 1,328,546 |

| Day high | $184.22 | Avg. volume | 671,413 |

| 50-day MA | $176.66 | Dividend yield | N/A |

| 200-day MA | $192.32 | Market Cap | 18.34B |

VRSN Stock Price Chart Interactive Chart >

VeriSign Inc. (VRSN) Company Bio

Verisign Inc. is an American company based in Reston, Virginia, United States that operates a diverse array of network infrastructure, including two of the Internet's thirteen root nameservers, the authoritative registry for the .com, .net, and .name generic top-level domains and the .cc and .tv country-code top-level domains, and the back-end systems for the .jobs, .gov, and .edu Sponsored top-level domains. Verisign also offers a range of security services, including managed DNS, distributed denial-of-service (DDoS) attack mitigation and cyber-threat reporting. (Source:Wikipedia)

Latest VRSN News From Around the Web

Below are the latest news stories about VERISIGN INC that investors may wish to consider to help them evaluate VRSN as an investment opportunity.

Internet stocks will continue to do well in 2024: Citi analystThe Magnificent Seven and Big Tech stocks dominated the markets this year. But what's in store for 2024? Citi Director of Internet Equity Research Ygal Arounian joins Yahoo Finance Live to discuss his outlook for internet stocks next year. Arounian expects another strong year for internet stocks for several reasons, including strong fundamentals, potential Federal Reserve rate cuts, and a recovery in consumer spending. Arounian expects the generative AI hype to continue into 2024, saying he thinks that next year, investors will see more "actual real implementation of AI across different end businesses that will start to drive more meaningful change." When it comes to stocks Arounian likes for 2024, he is picking The Trade Desk (TTD), Wayfair (W), and VeriSign (VRSN). Click here to watch... |

The Zacks Analyst Blog Highlights VeriSign, Block, Royal Caribbean Cruises, W.R. Berkley and Eldorado GoldVeriSign, Block, Royal Caribbean Cruises, W.R. Berkley and Eldorado Gold are part of the Zacks top Analyst Blog. |

7 Cybersecurity Stocks to Exit ASAPCybersecurity is a fast-growing business, but not everyone can be a winner in this competitive space. |

VeriSign Inc's Exec. Chairman & CEO D Bidzos Sells 6,000 SharesOn December 21, 2023, D Bidzos, the Exec. Chairman & CEO of VeriSign Inc (NASDAQ:VRSN), sold 6,000 shares of the company. |

VeriSign (VRSN) Advances But Underperforms Market: Key FactsVeriSign (VRSN) closed at $204.46 in the latest trading session, marking a +0.09% move from the prior day. |

VRSN Price Returns

| 1-mo | 2.79% |

| 3-mo | 4.91% |

| 6-mo | -9.36% |

| 1-year | -12.10% |

| 3-year | -16.00% |

| 5-year | -15.00% |

| YTD | -10.61% |

| 2023 | 0.25% |

| 2022 | -19.06% |

| 2021 | 17.29% |

| 2020 | 12.31% |

| 2019 | 29.93% |

Continue Researching VRSN

Want to see what other sources are saying about Verisign Inc's financials and stock price? Try the links below:Verisign Inc (VRSN) Stock Price | Nasdaq

Verisign Inc (VRSN) Stock Quote, History and News - Yahoo Finance

Verisign Inc (VRSN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...