Vasta Platform Ltd. Cl A (VSTA): Price and Financial Metrics

VSTA Price/Volume Stats

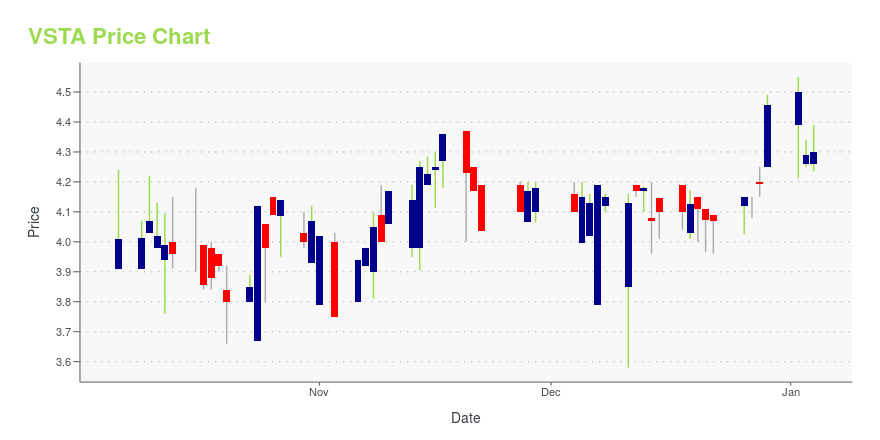

| Current price | $3.05 | 52-week high | $4.55 |

| Prev. close | $3.07 | 52-week low | $2.87 |

| Day low | $2.96 | Volume | 6,347 |

| Day high | $3.08 | Avg. volume | 46,256 |

| 50-day MA | $3.22 | Dividend yield | N/A |

| 200-day MA | $3.81 | Market Cap | 247.06M |

VSTA Stock Price Chart Interactive Chart >

Vasta Platform Ltd. Cl A (VSTA) Company Bio

Vasta Platform Ltd. provides technical education and digital solutions that cater to all needs of private schools operating in the K-12 educational segment. The company operates through two segments: Content & EdTech Platform segment which derives its results from core and complementary educational content solutions through digital and printed content, including textbooks, learning systems and other complimentary educational services. Digital Platform segment which aims to unify the school administrative ecosystem, enabling private schools to aggregate multiple learning strategies and help them to focus on education, by using physical and the Livro Fácil digital e-commerce platform and other digital services. The company was founded on October 19, 2019 and is headquartered in Sao Paulo, Brazil.

Latest VSTA News From Around the Web

Below are the latest news stories about VASTA PLATFORM LTD that investors may wish to consider to help them evaluate VSTA as an investment opportunity.

Vasta Platform Third Quarter 2023 Financial ResultsSÃO PAULO, November 08, 2023--Vasta Platform's third quarter 2023 results |

Vasta Platform Limited to Report Third Quarter 2023 Financial Results on November 8, 2023SÃO PAULO, October 27, 2023--Vasta Platform Limited to Report Third Quarter 2023 Financial Results on November 8, 2023 |

Vasta Platform (NASDAQ:VSTA) Will Want To Turn Around Its Return TrendsWhat are the early trends we should look for to identify a stock that could multiply in value over the long term... |

Vasta Announces Share Repurchase ProgramSÃO PAULO, September 14, 2023--Vasta Announces Share Repurchase Program |

Vasta Platform Limited (NASDAQ:VSTA) Has Found A Path To ProfitabilityWith the business potentially at an important milestone, we thought we'd take a closer look at Vasta Platform Limited's... |

VSTA Price Returns

| 1-mo | 0.00% |

| 3-mo | -19.74% |

| 6-mo | -28.40% |

| 1-year | -10.16% |

| 3-year | -56.43% |

| 5-year | N/A |

| YTD | -31.54% |

| 2023 | 11.38% |

| 2022 | -5.44% |

| 2021 | -70.83% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...