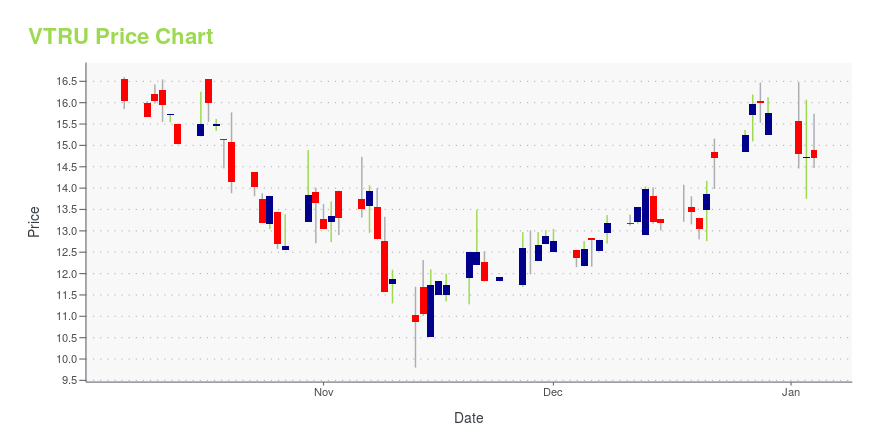

Vitru Limited (VTRU): Price and Financial Metrics

VTRU Price/Volume Stats

| Current price | $9.07 | 52-week high | $18.05 |

| Prev. close | $8.85 | 52-week low | $8.44 |

| Day low | $9.01 | Volume | 4,200 |

| Day high | $9.27 | Avg. volume | 25,578 |

| 50-day MA | $12.00 | Dividend yield | N/A |

| 200-day MA | $13.85 | Market Cap | 304.24M |

VTRU Stock Price Chart Interactive Chart >

Vitru Limited (VTRU) Company Bio

Vitru Limited provides distance learning education services. The Company offers access to education through a digital ecosystem. Vitru serves students in Brazil.

Latest VTRU News From Around the Web

Below are the latest news stories about VITRU LTD that investors may wish to consider to help them evaluate VTRU as an investment opportunity.

Vitru Limited (NASDAQ:VTRU) Q3 2023 Earnings Call TranscriptVitru Limited (NASDAQ:VTRU) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good evening, everyone and thank you for waiting. Welcome to [Vistra Luxembourg S.à.r.l] Third Quarter 2023 Financial Results Conference Call. All participations will be in a listen only mode during the company’s presentation. After the company’s remarks there will be question-and-answer session. [Operator […] |

Q3 2023 Vitru Ltd Earnings CallQ3 2023 Vitru Ltd Earnings Call |

Vitru Announces Change to Release Date of Third Quarter 2023 Financial Results to November 14, 2023FLORIANÓPOLIS, Brazil, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Vitru Limited ("Vitru") announces that the release of its third quarter 2023 financial results will be postponed to November 14, 2023 - before the market opens - due to the preparation of certain documents related to the migration to B3, as announced in September, 2023. A webcast hosted by Vitru will accompany this announcement at 8:30 a.m. Eastern time on the same day. 3Q23 Results Presentation(Live webcast in English click here)November |

Vitru Limited to Report Third Quarter 2023 Financial Results on November 09, 2023FLORIANÓPOLIS, Brazil, Oct. 11, 2023 (GLOBE NEWSWIRE) -- Vitru Limited, or Vitru (Nasdaq: VTRU), today announced that it will report its third quarter 2023 financial results after the market closes on Thursday, November 09, 2023. Vitru will host a corresponding webcast at 04:30 p.m. Eastern time on that day. 3Q23 Results Presentation(Live webcast in English via Zoom click here)November 09, 202304:30 p.m. EST The event will be webcast live, and the audio and associated slides will be available on |

Vitru Announces Proposed Group Restructuring and Migration of ListingVitru Group simplified structure prior to the Proposed Transaction Vitru Group simplified structure prior to the Proposed Transaction Vitru Group simplified structure after the Proposed Transaction Vitru Group simplified structure after the Proposed Transaction FLORIANÓPOLIS, Brazil, Sept. 05, 2023 (GLOBE NEWSWIRE) -- Vitru Limited (Nasdaq: VTRU) (“Vitru”) today announced that on September 4, 2023, its board of directors has approved a corporate restructuring proposal, subject to the approval of |

VTRU Price Returns

| 1-mo | N/A |

| 3-mo | -30.23% |

| 6-mo | -36.75% |

| 1-year | -45.36% |

| 3-year | -47.87% |

| 5-year | N/A |

| YTD | -42.45% |

| 2023 | -29.96% |

| 2022 | N/A |

| 2021 | 0.00% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...