Verizon Communications Inc. (VZ): Price and Financial Metrics

VZ Price/Volume Stats

| Current price | $40.09 | 52-week high | $43.42 |

| Prev. close | $39.95 | 52-week low | $30.14 |

| Day low | $39.65 | Volume | 15,911,453 |

| Day high | $40.17 | Avg. volume | 18,939,793 |

| 50-day MA | $40.57 | Dividend yield | 6.84% |

| 200-day MA | $39.08 | Market Cap | 168.75B |

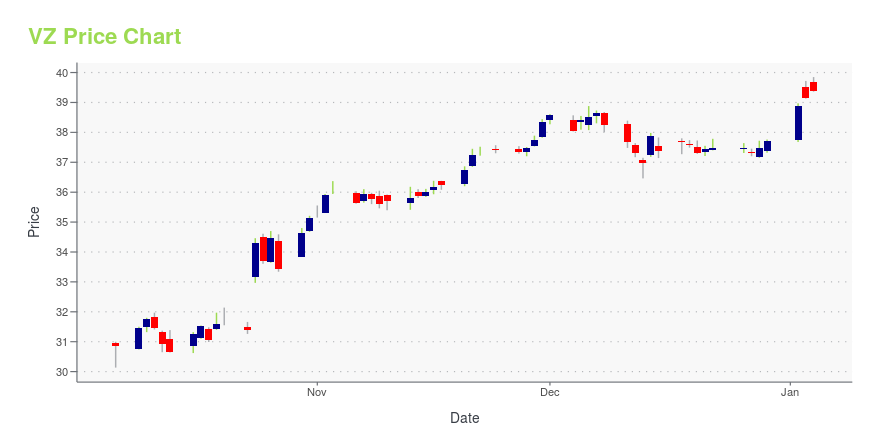

VZ Stock Price Chart Interactive Chart >

Verizon Communications Inc. (VZ) Company Bio

Verizon Communications Inc is a provider of communications, information and entertainment products and services to consumers, businesses, and governmental agencies. It offers voice, data and video services and solutions to wireless and wireline networks. The company was founded on June 30th, 2000 and is currently headquartered in New York City. In 2015, Verizon partnered with Ericsson, Qualcomm, Intel and Samsung to create the 5G Technology Forum (5GTF). By 2019, the company utilized the 5GTF to launch 5G mobile service to limited areas in the U.S., including Los Angeles, Sacramento, Houston, Chicago, Minneapolis, and Indianapolis. Verizon’s current Chief Executive Officer is Hans Vestberg and the company has operations in over 150 countries, employing 130,000 employees worldwide.

Latest VZ News From Around the Web

Below are the latest news stories about VERIZON COMMUNICATIONS INC that investors may wish to consider to help them evaluate VZ as an investment opportunity.

Financial Freedom: 7 Exceptional High-Yield Stocks for Lasting Passive GainsThe pursuit of financial freedom often conjures up images of dynamic markets, strategic maneuvers, and the allure of high-yield stocks. |

Apple’s Market Maneuvers: Is AAPL Stock a Smart Buy at $193?A ban on the Apple Watch could hit AAPL stock hard as the wearable is the tech stock's second biggest money-maker. |

The 5G Future: 3 Stocks Leading the Next Communication RevolutionCommunications is one of the most dynamic industries out there, get ahead of its advancements with these communication stocks. |

How To Earn $500 A Month From Verizon StockVerizon Communications Inc. (NYSE: VZ) shares closed slightly lower on Wednesday, despite an overall increase in the stock market. The company is launching a unique streaming bundle partnership with Netflix, Inc (NASDAQ: NFLX) and Warner Bros. Discovery, Inc (NASDAQ: WBD) Max, offering ad-supported services from these entertainment giants together for the first time. Verizon is expected to report fourth-quarter 2023 earnings before the opening bell on Jan. 23, 2024. Oppenheimer analyst Timothy H |

Verizon Communications Inc. (VZ) Is a Trending Stock: Facts to Know Before Betting on ItRecently, Zacks.com users have been paying close attention to Verizon (VZ). This makes it worthwhile to examine what the stock has in store. |

VZ Price Returns

| 1-mo | -0.67% |

| 3-mo | 2.69% |

| 6-mo | -2.34% |

| 1-year | 28.18% |

| 3-year | -14.18% |

| 5-year | -7.95% |

| YTD | 11.68% |

| 2023 | 2.71% |

| 2022 | -20.02% |

| 2021 | -7.55% |

| 2020 | -0.13% |

| 2019 | 13.84% |

VZ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VZ

Want to see what other sources are saying about Verizon Communications Inc's financials and stock price? Try the links below:Verizon Communications Inc (VZ) Stock Price | Nasdaq

Verizon Communications Inc (VZ) Stock Quote, History and News - Yahoo Finance

Verizon Communications Inc (VZ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...