WeWork Inc. (WE): Price and Financial Metrics

WE Price/Volume Stats

| Current price | $1.13 | 52-week high | $130.80 |

| Prev. close | $0.84 | 52-week low | $0.82 |

| Day low | $1.13 | Volume | 133,868 |

| Day high | $1.13 | Avg. volume | 1,606,810 |

| 50-day MA | $2.94 | Dividend yield | N/A |

| 200-day MA | $19.51 | Market Cap | 60.18M |

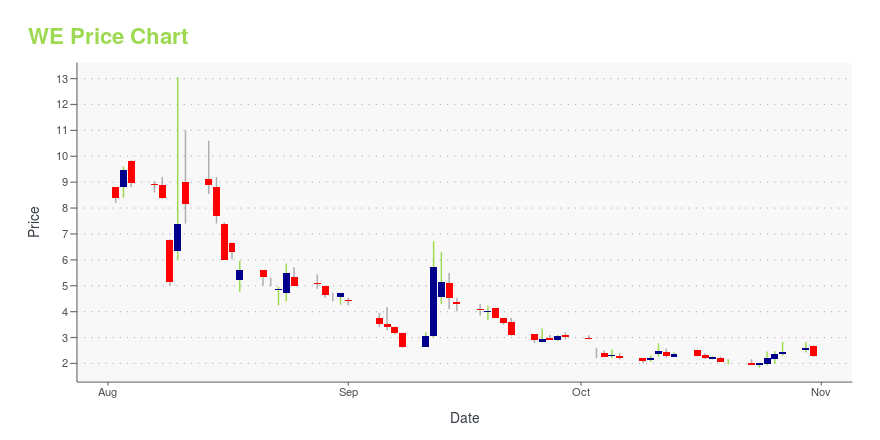

WE Stock Price Chart Interactive Chart >

WeWork Inc. (WE) Company Bio

WeWork Inc. offers flexible workspace solution to individual and enterprises worldwide. It provides open workspace, event space, dedicated desk, standard office space, office suite, and full floor office. The company was founded in 2010 and is headquartered in New York, New York.

Latest WE News From Around the Web

Below are the latest news stories about WEWORK INC that investors may wish to consider to help them evaluate WE as an investment opportunity.

WeWork poised to file for bankruptcyWeWork is reportedly planning on filing for bankruptcy as early as next week. |

WeWork Plans to File for Bankruptcy as Early as Next WeekOnce a venture capital-backed star with an astronomical valuation, the flexible-office-space provider is now preparing for chapter 11 protection, according to sources. |

WeWork stock plunges on reports of bankruptcy filing plansWeWork (WE) shares sink even lower on headlines that the company is planning to file for bankruptcy next week, according to the Wall Street Journal. Yahoo Finance anchors Julie Hyman and Josh Lipton comment on the coworking space provider's fall from grace as an original startup darling. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

UPDATE 3-WeWork plans to file for bankruptcy as early as next week - sourceWeWork plans to file for bankruptcy as early as next week, a source familiar with the matter said on Tuesday, as the SoftBank Group-backed company struggles with a massive debt pile and hefty losses. Shares of the flexible workspace provider fell 32% in extended trading after the Wall Street Journal first reported the news. New York-based WeWork is considering filing a Chapter 11 petition in New Jersey, the WSJ reported, citing people familiar with the matter. |

WeWork plans to file for bankruptcy as early as next week - sourceShares of the flexible workspace provider fell 32% in extended trading after the Wall Street Journal first reported the news. New York-based WeWork is considering filing a Chapter 11 petition in New Jersey, the WSJ reported, citing people familiar with the matter. WeWork declined to comment. |

WE Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -86.92% |

| 3-year | -99.73% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -83.37% |

| 2021 | -16.18% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...