Wheaton Precious Metals Corp (WPM): Price and Financial Metrics

WPM Price/Volume Stats

| Current price | $58.30 | 52-week high | $63.06 |

| Prev. close | $58.74 | 52-week low | $38.37 |

| Day low | $58.19 | Volume | 1,431,860 |

| Day high | $59.38 | Avg. volume | 1,860,904 |

| 50-day MA | $55.94 | Dividend yield | 1.03% |

| 200-day MA | $49.21 | Market Cap | 26.44B |

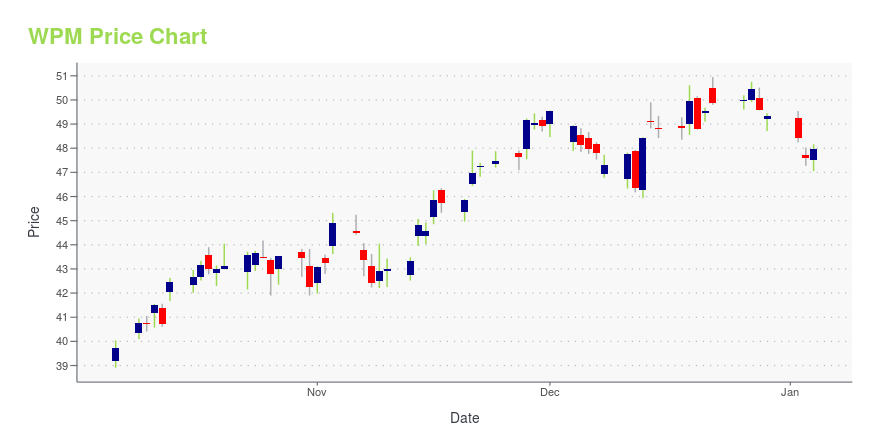

WPM Stock Price Chart Interactive Chart >

Wheaton Precious Metals Corp (WPM) Company Bio

Wheaton Precious Metals Corp. is a Canadian multinational precious metals streaming company. It produces over 26 million ounces and sells over 29 million ounces of silver mined by other companies (including Barrick Gold and Goldcorp) as a by-product of their main operations. (Source:Wikipedia)

Latest WPM News From Around the Web

Below are the latest news stories about WHEATON PRECIOUS METALS CORP that investors may wish to consider to help them evaluate WPM as an investment opportunity.

Wheaton Precious Metals (TSE:WPM) Is Experiencing Growth In Returns On CapitalIf we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll... |

13 Best Mining Stocks To Buy NowIn this piece, we will take a look at the 13 best mining stocks to buy now. If you want to skip our analysis of the mining industry and want to jump to the top five stocks in this list, head on over to 5 Best Mining Stocks To Buy Now. The global supply of […] |

Is This Unique Gold Investment the Perfect Inflation Hedge?Investors often see hard assets as a way to hedge against inflation. These precious metals stocks could be a nearly perfect option. |

LYSDY or WPM: Which Is the Better Value Stock Right Now?LYSDY vs. WPM: Which Stock Is the Better Value Option? |

13 Most Promising Gold Stocks According to AnalystsIn this article, we discuss the 13 most promising gold stocks according to analysts. To skip the detailed analysis of the industry, go directly to the 5 Most Promising Gold Stocks According to Analysts. Gold has started to make noise in the stock and commodity markets again as it recently jumped to a record high. […] |

WPM Price Returns

| 1-mo | 10.31% |

| 3-mo | 8.26% |

| 6-mo | 25.40% |

| 1-year | 34.86% |

| 3-year | 36.83% |

| 5-year | 128.48% |

| YTD | 18.86% |

| 2023 | 27.91% |

| 2022 | -7.53% |

| 2021 | 3.56% |

| 2020 | 41.82% |

| 2019 | 54.62% |

WPM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WPM

Want to see what other sources are saying about Wheaton Precious Metals Corp's financials and stock price? Try the links below:Wheaton Precious Metals Corp (WPM) Stock Price | Nasdaq

Wheaton Precious Metals Corp (WPM) Stock Quote, History and News - Yahoo Finance

Wheaton Precious Metals Corp (WPM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...