WillScot Corporation (WSC): Price and Financial Metrics

WSC Price/Volume Stats

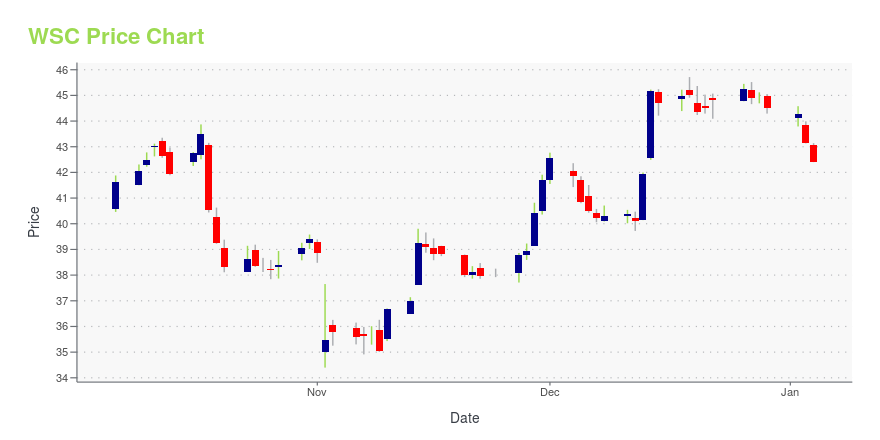

| Current price | $41.00 | 52-week high | $52.16 |

| Prev. close | $43.24 | 52-week low | $34.40 |

| Day low | $40.43 | Volume | 3,856,204 |

| Day high | $42.99 | Avg. volume | 2,018,498 |

| 50-day MA | $39.07 | Dividend yield | N/A |

| 200-day MA | $41.86 | Market Cap | 7.80B |

WSC Stock Price Chart Interactive Chart >

WillScot Corporation (WSC) Company Bio

Williams Scotsman, Inc. offers space solutions for education, construction, healthcare, government, retail, commercial, manufacturing, utilities, and energy sectors in North America. The company was founded in 1945 and is based in Baltimore, Maryland.

Latest WSC News From Around the Web

Below are the latest news stories about WILLSCOT MOBILE MINI HOLDINGS CORP that investors may wish to consider to help them evaluate WSC as an investment opportunity.

11 Stocks Under $50 To Buy NowIn this article, we will take a look at 11 stocks under $50 to buy now. To skip our analysis of the recent market activity, you can go directly to see the 5 Stocks Under $50 to Buy Now. The equity markets in United States posted another week of positive performance which marks the fourth […] |

Investing in WillScot Mobile Mini Holdings (NASDAQ:WSC) five years ago would have delivered you a 176% gainWhen you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose... |

WillScot Mobile Mini to Participate in UBS Industrials SummitPHOENIX, Nov. 15, 2023 (GLOBE NEWSWIRE) -- WillScot Mobile Mini Holdings Corp. (“WillScot Mobile Mini” or the “Company”) (Nasdaq: WSC), the North American leader in innovative temporary space solutions, today announced that Tim Boswell, President and Chief Financial Officer, and Matt Jacobsen, Senior Vice President of Finance, will host private investor meetings at the UBS Industrials Summit in Palm Beach, FL, on November 29, 2023. About WillScot Mobile Mini WillScot Mobile Mini trades on the Na |

WillScot Mobile Mini to Participate in Bank of America Leveraged Finance ConferencePHOENIX, Nov. 14, 2023 (GLOBE NEWSWIRE) -- WillScot Mobile Mini Holdings Corp. (“WillScot Mobile Mini” or the “Company”) (Nasdaq: WSC), the North American leader in innovative temporary space solutions, today announced that Tim Boswell, President and Chief Financial Officer and Matt Jacobsen, Senior Vice President of Finance, will host private investor meetings at the Bank of America Leveraged Finance Conference in Boca Raton, FL, on November 28, 2023. About WillScot Mobile Mini WillScot Mobile |

WillScot Mobile Mini Holdings Corp. (NASDAQ:WSC) Q3 2023 Earnings Call TranscriptWillScot Mobile Mini Holdings Corp. (NASDAQ:WSC) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Welcome to the Third Quarter 2023 WillScot Mobile Mini Earnings Conference Call. My name is Tanya, and I will be your operator for today’s call. At this time, all participants are in a listen-only mode. later we will conduct a […] |

WSC Price Returns

| 1-mo | 8.35% |

| 3-mo | 5.89% |

| 6-mo | -9.13% |

| 1-year | -12.37% |

| 3-year | 46.95% |

| 5-year | 163.16% |

| YTD | -7.87% |

| 2023 | -1.48% |

| 2022 | 10.60% |

| 2021 | 76.26% |

| 2020 | 25.31% |

| 2019 | 96.28% |

Continue Researching WSC

Here are a few links from around the web to help you further your research on WillScot Corp's stock as an investment opportunity:WillScot Corp (WSC) Stock Price | Nasdaq

WillScot Corp (WSC) Stock Quote, History and News - Yahoo Finance

WillScot Corp (WSC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...