Wynn Resorts Ltd. (WYNN): Price and Financial Metrics

WYNN Price/Volume Stats

| Current price | $81.61 | 52-week high | $111.09 |

| Prev. close | $80.52 | 52-week low | $80.02 |

| Day low | $80.02 | Volume | 1,925,544 |

| Day high | $81.67 | Avg. volume | 1,805,631 |

| 50-day MA | $89.43 | Dividend yield | 1.2% |

| 200-day MA | $93.73 | Market Cap | 9.15B |

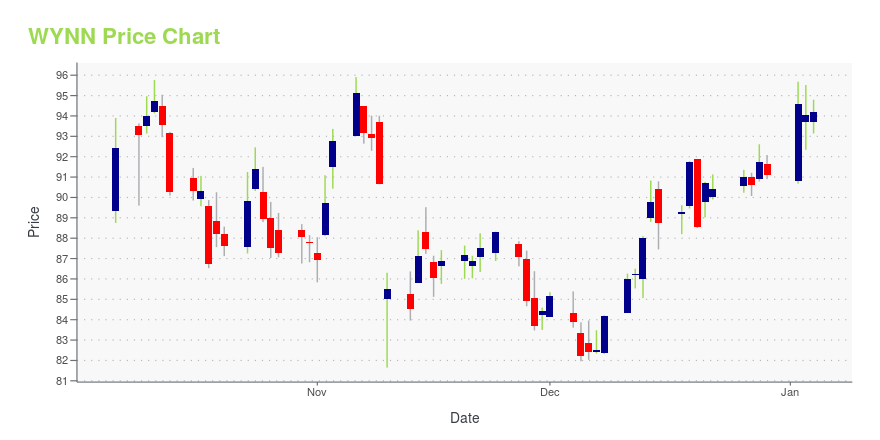

WYNN Stock Price Chart Interactive Chart >

Wynn Resorts Ltd. (WYNN) Company Bio

Wynn Resorts Ltd. is a casino resorts operator with over 25,000 employees. The company integrates hotel accommodations and a range of amenities, including fine dining outlets, premium retail offerings, distinctive entertainment theaters and large meeting complexes. Wynn operates properties in Las Vegas, Boston, and Macau Special Administrative Region of the People’s Republic of China. Casino operations constitute the largest portion of Wynn's revenue; in 2020, casino operations revenue exceeded $1.24 billion USD.

Latest WYNN News From Around the Web

Below are the latest news stories about WYNN RESORTS LTD that investors may wish to consider to help them evaluate WYNN as an investment opportunity.

Best Performing Stocks In January Over The Last Two Decades (75%+ Win Rate)January is generally one of the weakest months of the year for the stock market, but the following stocks have excelled in January over the last 15 years or more. |

The 3 Most Attractively Priced Growth Stocks to Buy Before JanuaryLeft-behind growth stocks offer compelling risk-reward profiles heading into 2024. |

Here's Why You Should Retain Wynn Resorts (WYNN) Stock NowWynn Resorts (WYNN) focuses on concession-related capital endeavors to drive growth. However, a volatile macroeconomic environment is a concern. |

12 Best Sin Stocks To Invest in 2024In this article, we discuss the 12 best sin stocks to invest in 2024. To skip the detailed analysis of the sin stocks, go directly to the 5 Best Sin Stocks To Invest in 2024. Publicly listed companies whose revenues are generated by things usually considered unethical are called “sin stocks”. They are the stocks […] |

RCL, MGM, WYNN: Which Leisure Stock Has the Most Upside?The broader basket of leisure stocks has been a rather turbulent ride in the years following the worst of the COVID-19 pandemic. Going into 2024, numerous Wall Street pros still expect strong gains from some of the industry’s stronger plays — like RCL, MGM, and WYNN — as they look to continue meeting much of the pent-up demand built during the early days of lockdown. Therefore, let’s check out TipRanks’ Comparison Tool to see how the following leisure plays stack up in the face of turbulent econ |

WYNN Price Returns

| 1-mo | -7.40% |

| 3-mo | -14.66% |

| 6-mo | -15.21% |

| 1-year | -23.74% |

| 3-year | -17.62% |

| 5-year | -39.14% |

| YTD | -9.98% |

| 2023 | 11.34% |

| 2022 | -3.02% |

| 2021 | -24.63% |

| 2020 | -18.07% |

| 2019 | 44.99% |

WYNN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WYNN

Here are a few links from around the web to help you further your research on Wynn Resorts Ltd's stock as an investment opportunity:Wynn Resorts Ltd (WYNN) Stock Price | Nasdaq

Wynn Resorts Ltd (WYNN) Stock Quote, History and News - Yahoo Finance

Wynn Resorts Ltd (WYNN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...