ZK International Group Co., Ltd. (ZKIN): Price and Financial Metrics

ZKIN Price/Volume Stats

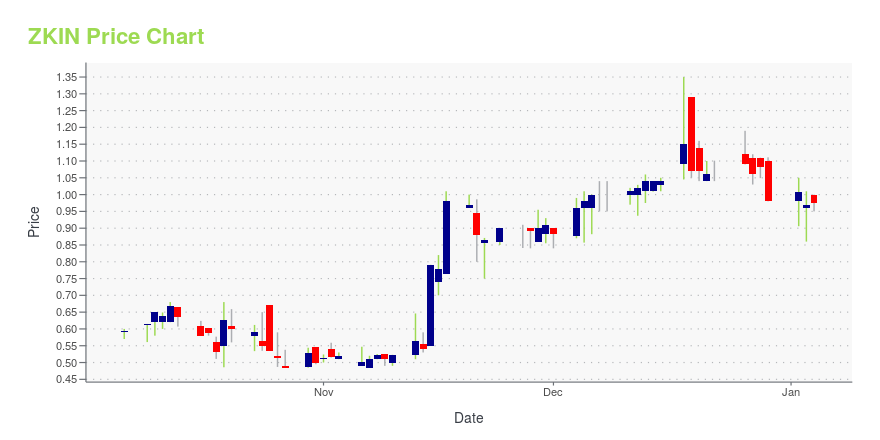

| Current price | $0.59 | 52-week high | $1.35 |

| Prev. close | $0.61 | 52-week low | $0.41 |

| Day low | $0.58 | Volume | 18,923 |

| Day high | $0.64 | Avg. volume | 67,717 |

| 50-day MA | $0.57 | Dividend yield | N/A |

| 200-day MA | $0.69 | Market Cap | 17.93M |

ZKIN Stock Price Chart Interactive Chart >

ZK International Group Co., Ltd. (ZKIN) Company Bio

ZK International Group Co., Ltd. operates as a holding company. The Company, through its subsidiaries, designs, produces, and manufactures stainless and carbon steel pipes, single-press tubes, pipe connections, fittings, components, and other parts. ZK International Group serves customers worldwide.

Latest ZKIN News From Around the Web

Below are the latest news stories about ZK INTERNATIONAL GROUP CO LTD that investors may wish to consider to help them evaluate ZKIN as an investment opportunity.

ZK International Group Co., Ltd. Accelerates Growth with Corporate Update: Website Launch, Rebranding, Successful $8 Million Bid, $5 Million Financing, and Nasdaq ComplianceZK International Group Co., Ltd. (Nasdaq: ZKIN) ("ZKIN", "ZK International" or the "Company"), a pioneer in stainless-steel innovation and technology, is pleased to share a corporate update highlighting recent developments and the launch of its new website. |

ZK International Group Co., Ltd. Resolves Nasdaq Bid Price Deficiency and Remains in Compliance with Nasdaq Listing StandardsZK International Group Co., Ltd. (Nasdaq: ZKIN) ("ZKIN", "ZK International" or the "Company"), a pioneer in innovation and technology, and a global leader in the design and production of stainless steel products, is pleased to announce that the bid price deficiency concern raised by Nasdaq has been successfully resolved. |

ZK International Group Ltd. Strengthens Competitive Position In Western China Gas Market ($ZKIN)ZK International (NASDAQ: ZKIN) shares have been surging, evidenced by a triple-digit percentage price increase 139% since the start of November. But investors didn't miss the chance entirely. Some profit-taking into the holiday weekend keeps the opportunity in play. In fact, the value proposition strengthened on the heels of another major deal signed. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the most recent news for Tuesday morning! |

ZK International Group Co., Ltd., Wins $8 Million Bid with Chongqing Gas Group to Supply the Municipal Gas Infrastructure Project, thus Strengthening its Competitive Edge in the Western China Gas MarketZK International Group Co., Ltd. (Nasdaq: ZKIN) ("ZKIN", "ZK International" or the "Company"), a leading designer, engineer, manufacturer, and supplier of patented high-performance stainless steel and carbon steel pipe products for sophisticated water or gas pipeline systems, proudly announces a new marketing and sales achievement. The Company has successfully secured an $8 million bid in collaboration with Chongqing Gas Group, bolstering its new position as a key player in the Western China gas |

ZKIN Price Returns

| 1-mo | 11.74% |

| 3-mo | -5.48% |

| 6-mo | -26.24% |

| 1-year | -4.05% |

| 3-year | -81.03% |

| 5-year | -54.62% |

| YTD | -39.80% |

| 2023 | 140.49% |

| 2022 | -70.68% |

| 2021 | -46.33% |

| 2020 | 100.78% |

| 2019 | -9.15% |

Continue Researching ZKIN

Want to see what other sources are saying about ZK International Group Co Ltd's financials and stock price? Try the links below:ZK International Group Co Ltd (ZKIN) Stock Price | Nasdaq

ZK International Group Co Ltd (ZKIN) Stock Quote, History and News - Yahoo Finance

ZK International Group Co Ltd (ZKIN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...