ZTO Express (Cayman) Inc. ADR (ZTO): Price and Financial Metrics

ZTO Price/Volume Stats

| Current price | $19.17 | 52-week high | $28.04 |

| Prev. close | $18.66 | 52-week low | $15.90 |

| Day low | $18.81 | Volume | 2,270,389 |

| Day high | $19.37 | Avg. volume | 3,839,966 |

| 50-day MA | $21.86 | Dividend yield | 3.15% |

| 200-day MA | $21.05 | Market Cap | 11.63B |

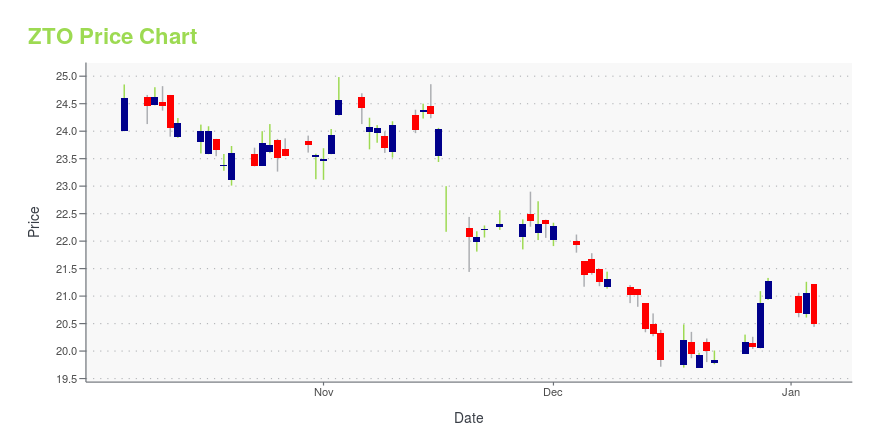

ZTO Stock Price Chart Interactive Chart >

ZTO Express (Cayman) Inc. ADR (ZTO) Company Bio

ZTO Express is a express delivery company in China and one of the largest express delivery companies globally, in terms of total parcel volume in 2015, according to the iResearch Report. ZTO provides express delivery service as well as other value-added logistics services through its extensive and reliable nationwide network in China covering over 96% of China’s cities and counties as of June 30, 2016. ZTO is both a key enabler and a direct beneficiary of China’s fast-growing e-commerce market, and has established itself as one of the largest express delivery service providers for millions of online merchants and consumers transacting on leading Chinese e-commerce platforms, such as Alibaba and JD.com. Globally, ZTO provides delivery services in key overseas markets through its business partners as it expands coverage of international express delivery by collaborating with international industry players. (Source:Verify.Wiki)

Latest ZTO News From Around the Web

Below are the latest news stories about ZTO EXPRESS (CAYMAN) INC that investors may wish to consider to help them evaluate ZTO as an investment opportunity.

7 Undervalued Gems That Wall Street Missed Out On in 2023Under a frenzied environment, it’s normal to overpay for certain hot investments – but this framework also drives the case home for undervalued stocks Wall Street overlooked. |

10 Stocks with 50% Upside Potential According to AnalystsIn this article, we will take a look at 10 stocks with 50% upside potential according to analysts. To skip our analysis of the recent market activity, you can go directly to see the 5 Stocks with 50% Upside Potential According to Analysts. This year turned out to be one of the strongest rallies in […] |

Ryder (R) Touches 52-Week High: What's Driving the Stock?Ryder (R) expects full-year adjusted earnings per share between $12.60 and $12.85 (prior view: $12.20 and $12.70). |

5 Reasons Why Investors Should Buy SkyWest (SKYW) Stock NowSkyWest (SKYW) is scheduled to operate a total of 258 E175 aircraft by 2026-end. |

6 Reasons Why You Should Add Wabtec (WAB) to Your PortfolioWabtec (WAB) raises its 2023 sales view in the range of $9.50-$9.70 billion (prior view: $9.25-$9.50 billion). |

ZTO Price Returns

| 1-mo | -9.15% |

| 3-mo | -11.29% |

| 6-mo | 16.39% |

| 1-year | -25.66% |

| 3-year | -24.03% |

| 5-year | 0.26% |

| YTD | -7.19% |

| 2023 | -20.80% |

| 2022 | -4.78% |

| 2021 | -3.22% |

| 2020 | 24.88% |

| 2019 | 47.50% |

ZTO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ZTO

Want to see what other sources are saying about ZTO Express (Cayman) Inc's financials and stock price? Try the links below:ZTO Express (Cayman) Inc (ZTO) Stock Price | Nasdaq

ZTO Express (Cayman) Inc (ZTO) Stock Quote, History and News - Yahoo Finance

ZTO Express (Cayman) Inc (ZTO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...