Stocks stumbled and fell badly at the end of 2018. But, solid fundamentals suggest they should regain their footing in 2019.

The 2018 numbers are in the books and they aren’t pretty; the nine-year win streak was broken as most major indices were down around 7% — the worst December in 11 years. It was the first year that four major asset classes, stocks, bonds, commodities, and real estate, all declined.

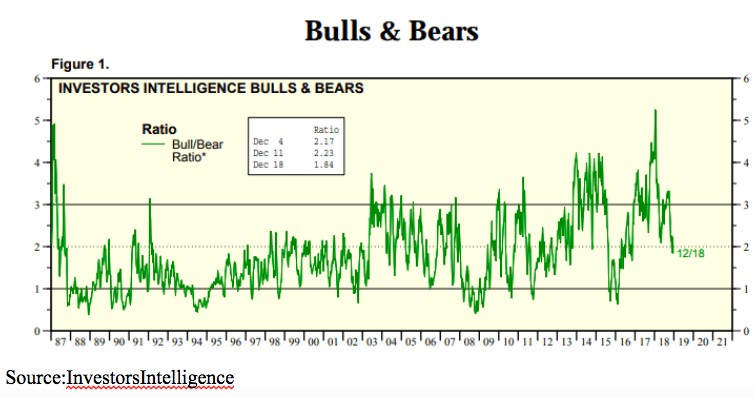

All of this has led to a sharp turn in sentiment from optimistically bullish to pessimistic and bearish.

As you can see below, the Investor bull/bear sentiment ratio has dropped to it’s lowest level since the beginning of 2016, which was also the last time the market fell by 20%.

At this point, I think the market has priced in pretty badly, some are even predicting a 2019 recession. But given the fundamental backdrop I think stocks should begin to regain their footing the next few months.

Let’s take a look at some of the blocks upon which a rally could build.

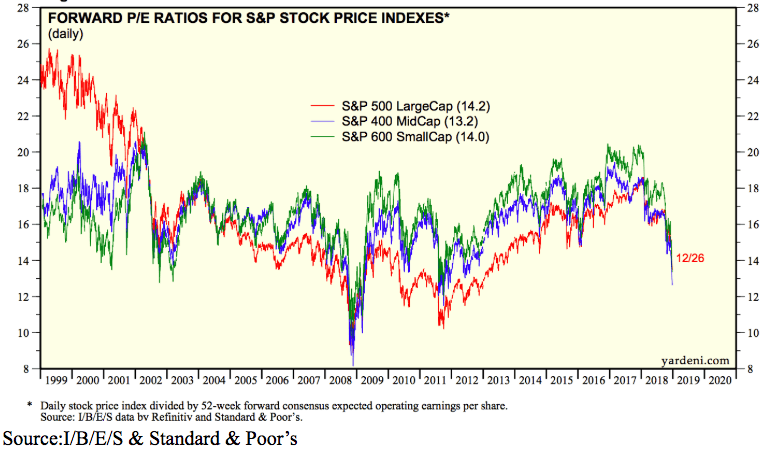

Valuation & Growth

Stock valuations have dropped dramatically as the P/E on major indices declined from around 20x forward earnings at the beginning of the year to the current 14x level.

Much of the decline has been tied to concerns that growth rates will also decline. But an important point needs to be made: Do not confuse a rate of growth decline with an actual decline or negative turn in earnings.

No one could rightfully think that the 20% earnings growth enjoyed in 2018 — largely spurred by the initial boost of tax reform — could be repeated. But corporate earnings are still expected to grow by 5% to 7% in 2019.

That growth rate is still very respectable and indicative of an expanding economy and should warrant a higher p/e multiple for stocks.

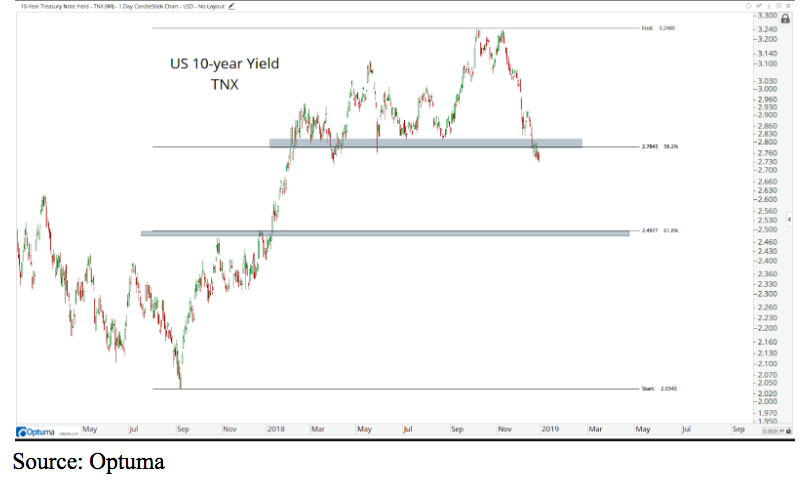

Interest Rates Still Historically Low

The higher p/e is warranted especially given the interest rates remain historically low.

The Federal Reserve seems to have pulled back from its pre-determined path of 4 more rate hikes — current consensus is 2 hikes in 2019- and yield on the 10-year is now comfortably back below the 3% level.

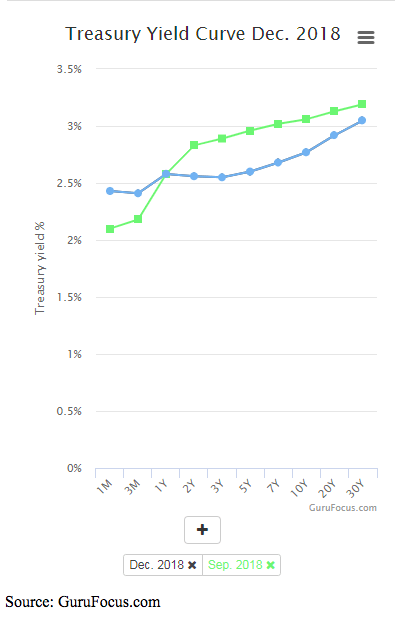

And all the concern over the yield curve inverting and therefore predicting a recession has also alleviated in recent weeks.

As you can see, the 2-10 spread went from about 10 basis point in September (green line) to about 25 basis points in December (blue line.)

Softer Dollar Good for Multinationals

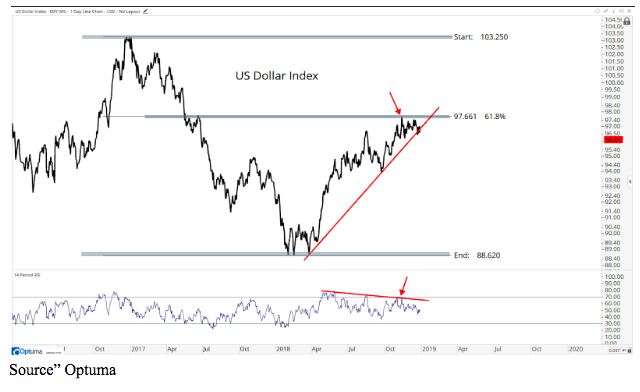

Somewhat related to the pullback in interest rates is what seems to be a rolling over in the U.S Dollar.

After surging through the first half of 2018 the Dollar index has now pulled back and with a divergence in the relative strength index it actually seems like it might break the uptrend line.

While no one wants to see a collapsing dollar, one that is less strong is beneficial to exports as it makes U.S. goods more affordable overseas markets.

So, for the multinationals, and remember nearly half revenues that compromise the S&P 500 come from selling abroad, a softening of the dollar should provide support for revenues and profits.

Technical Still Damaged

While the above fundamentals all seem constructive, I must acknowledge that the technical picture remains somewhat negative.

The charts have all been damaged and will likely run into selling at overhead resistance levels and may even need to make new lows over the next month or two.

But, if the fundamental backdrop remains sound it will be time to once again buy the dip.

The Greatest Trading Book

Ever Written

I have been working very hard to introduce you to the greatest trading book ever written. At my trading firm, the very first thing that any new trader had to do was read this book. They wouldn’t be allowed in my office if this book was not read. Now, I’ve taken this book and built an entire trading system around it. For anyone that has any interest in trading, this is a must-read. It’s about success, failure and then success again. This book is being offered today, Get Your Copy Now

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!