For better or worse, cybersecurity is one of the few industries that’s likely to see organic high double-digit revenue growth over the next five years.

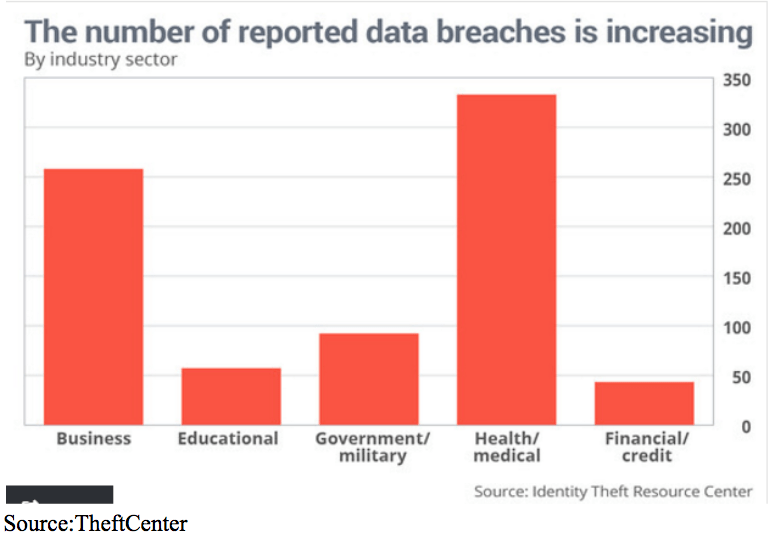

As cyber hacks continue to mount, so will the spending from private, public and government increases in an effort to combat intrusions to sensitive data and financial theft.

From election interference to health records to credit card theft, the number of cyber hacks hits new highs every year with millions of people being impacted.

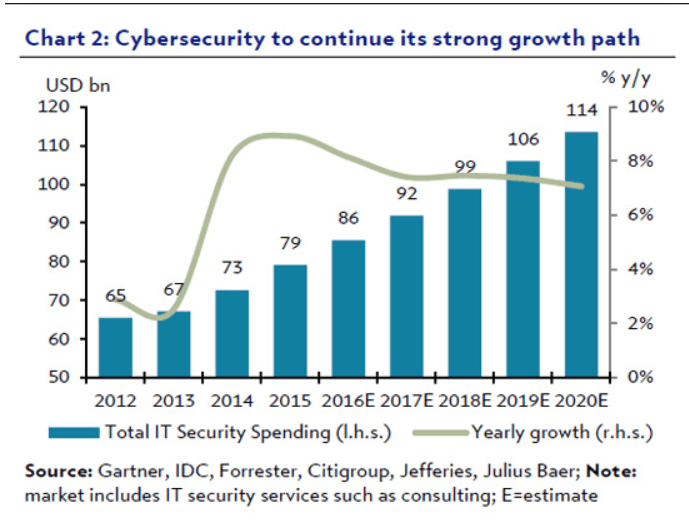

Companies are expected to increase annual spending on overall information technology by 10% annually — with nearly 25% of that budget going to cybersecurity.

In his new 2020 budget proposal, President Trump has $9.6 billion to defend defense networks and the nation from cyber attacks, conducting offensive operations through U.S. Cyber Command. That number is more than $1 billion, or a 12% increase from 2019 levels.

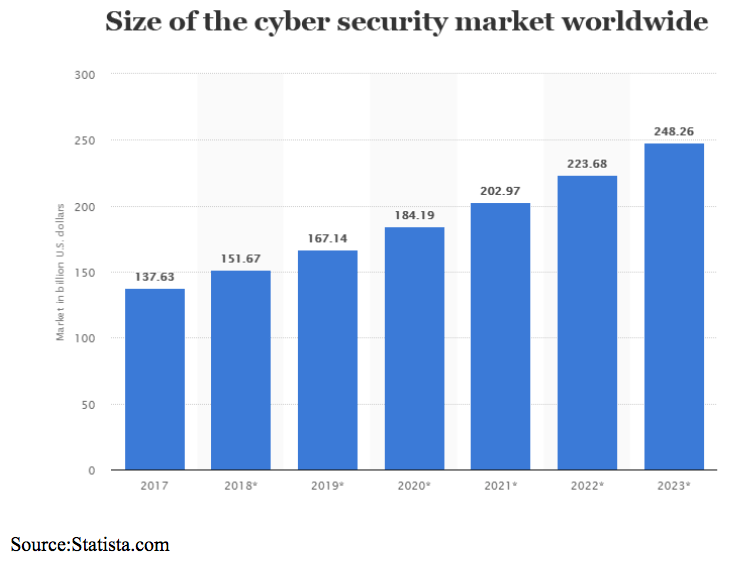

Overall global spending on cybersecurity is expected to hit $250 billion with the next 5 years, a 65% increase from 2018 levels.

Palo Alto Networks (PANW) the company best positioned to take advantage of this trend. The company provides worldwide security platform solutions. The company provides firewalls and software; the systems are available as both physical appliances on site or as extensions to a virtual system.

It also offers subscription services that cover areas of threat prevention; it is estimated that security sold as SAAS will represent over 50% of all spending by 2020.

Last month — when PANW reported earnings — it showed revenue growth of 30% year-over-year to $711.2 million. More impressive, were the improving margins as gross margins jumped 30 basis points to a fat 76.3%.

Palo Alto has installed ex-Google employees in key positions and they are following the search giants playbook by making key acquisitions, offering free market share services network scaling, and a focus on bundling services by leveraging cloud applications.

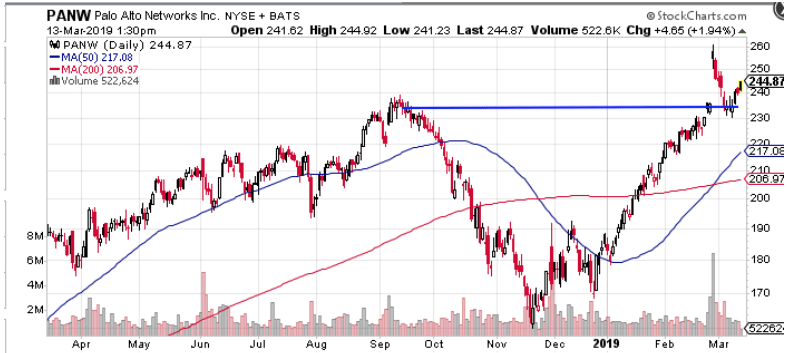

From a technical standpoint, the stock had a huge pop following the blow out earnings report. But then pulled back to support at the $235 level.

Even though the stock is up some 45% from its December low, this recent pullback is a great buying opportunity. I expect the shares to not only to make a new high but go on a multi-year bull run thanks to the tailwinds of the cybersecurity sector.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!