If it feels like it’s been a volatile few months for stocks, that’s because it has been. Consider

- Q4 2018 was the worst quarter for the S&P 500 since the Great Depression.

- Q1 2019: best Q1 in 32 years

- May 2019: worst May in 10 years and second worst since the 1960s (Nasdaq fell into a correction over trade war fears)

- June 2019: on track for the best June for the Dow since 1938, best June for S&P 500 since 1955 and best June for Nasdaq since 2000

- We’re on track for the best first half for stocks since 1997

Two factors have dominated the headlines and been the core drivers of these wild stock price swings, interest rates (tied to recession fears) and the trade war (also closely tied to recession fears).

On June 28th and June 29th (Friday and Saturday), the G20 meeting in Osaka, Japan is expected to generate the next potential major market-moving news, that is likely to dominate the first half of July. That would be the meeting between US President Trump and Chinese President Xi.

With the strong June rally pricing in a positive outcome, it’s important investors have realistic expectations about what’s most likely to happen, and how the market is likely to react.

What To Expect From the G20 Trade Meeting

A few days ago our President took to Twitter to say

“Had a very good telephone conversation with President Xi of China. We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.” – President Trump

The good news is that both he and President Xi have agreed to an “extended meeting” and talks are resuming after being completely shut down after a six week period of pure escalation and threats.

The market may have spent the last two weeks rallying on hopes that this G20 meeting would act like the last one (Buenos Ares on November 30th/December 1st, 2018) which saw a truce called in the trade war with the US postponing the 25% tariffs on $250 billion in Chinese imports (which went up on May 10th).

The alternative to some kind of “deal to make a deal while tariffs don’t go up” is that, as Trump has threatened, 25% tariffs go up on the remaining 60% of Chinese imports “immediately”. Now in reality that’s not likely to happen, since there is a 90 day comment period in which the administration must take input from companies before imposing new tariffs. Those hearings began on June 17th, which likely means that September 17th or so is when the final round of tariffs would take effect.

The US and China would have nearly three months to come to a deal before those actually hit the economies of both countries. That’s the good news. The bad news is that, while the US and China were said to be “90% of the way to a deal” back in May the final 10% is where all the major sticking points lie for both sides.

Here’s Chief economic advisor Larry Kudlow (a trade dove),

“Our position will continue to be that we want structural changes. We want structural changes on all the items … theft of IP, forced transfers of technology, cyber hacking. Of course trade barriers. We’ve got to have something that’s enforceable.”

For China, the big sticking point is the removal of all tariffs the moment a deal is signed. But the US has been holding out to keep at least some of the current tariffs in place, and only lowering them over time as a way of ensuring Beijing’s compliance.

And we can’t forget that leading the trade talks for the US is a long-time trade hawk, who shares Trump’s love of tariffs (though doesn’t think trade wars are “good and easy to win.” US Trade Rep Robert Lightheizer (who is leading the US trade talks) recently told Congress

“I don’t know if it will get them to stop cheating, tariffs alone. I think you don’t have any other option…I know one thing that won’t work and that is talking to them. Because we’ve done that for 20 years.”

A month ago Moody’s Analytics estimated the chances of a definitive G20 trade deal at 45%. That was before the Huawei blacklisting and China retaliating with a similar list against US companies (first to feel Beijing’s wrath was FedEx). So it’s fair to assume that the chances of a final trade deal, that ends all tariffs is now much smaller (I estimate about 25%).

Most likely we get a deal to make a deal later, as we got December 1st at that G20 meeting. That will mean existing tariffs (and all their economic damage) continue, but at least things don’t get worse.

So what does that likely mean for Wall Street in July? Read on to find out.

How the Market Is Likely to React

If G20 ends in failure, and the US officially announces the final tariff round is coming in September, the market is likely to recreate May’s 6.5% swoon (possibly worse since we’re starting at slightly higher valuations now).

That’s because US companies have already begun pulling way back on investment, as seen in Morgan Stanley’s proprietary Business Condition index, which plunged to a 10 year low in June. Since 2002 (when MS began tracking it) a reading above 34 indicates business expansion, and below 34 recession. 14 is a shockingly bad number that indicates some US companies are slamming on the breaks in terms of hiring and investing in future growth.

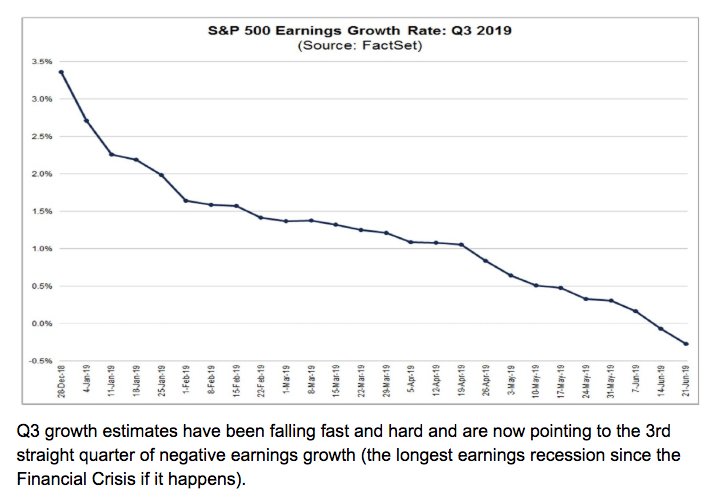

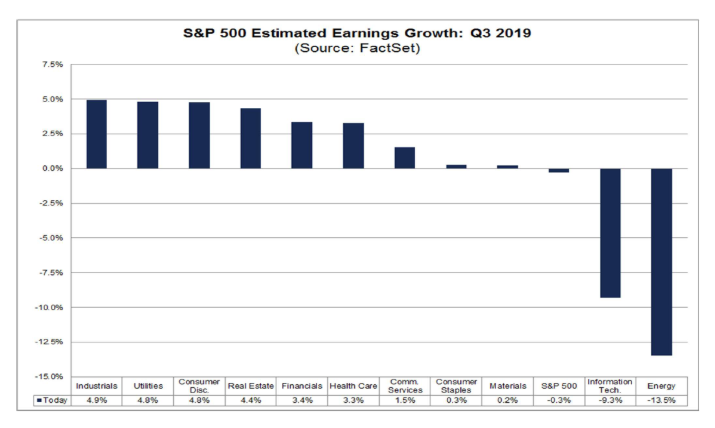

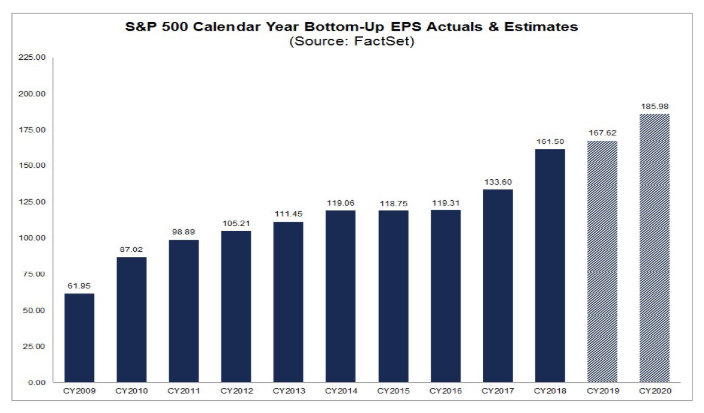

Meanwhile, according to FactSet Research’s weekly survey of Wall Street analyst EPS growth expectations, things look pretty bleak on the earnings front.

Leading the charge towards negative growth is energy and tech. Technology companies in the S&P 500 get 57% of revenues from overseas and are thus the most trade sensitive sector (more on this in a moment).

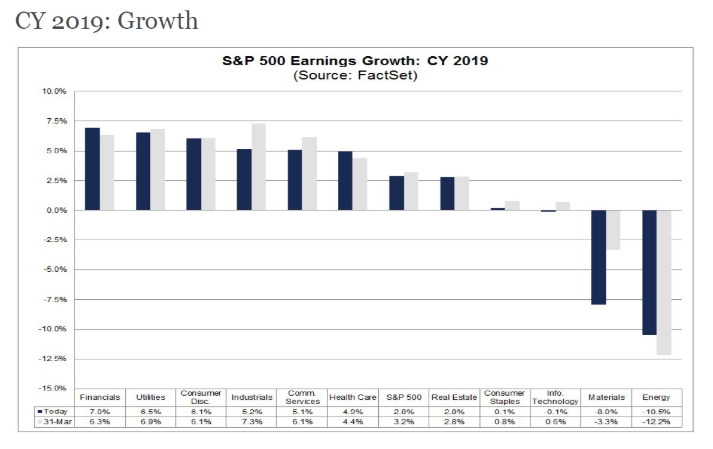

For the full 2019 analysts now expect a rather unimpressive 2.8% growth from the S&P 500 (down from nearly 10% at the start of the year). And that assumes nearly 7% EPS growth in Q4, which is likely impossible without a trade deal that eliminates existing tariffs. Tech, normally a source of double-digit growth for the market, is expected to deliver no growth at all this year, entirely due to the trade war.

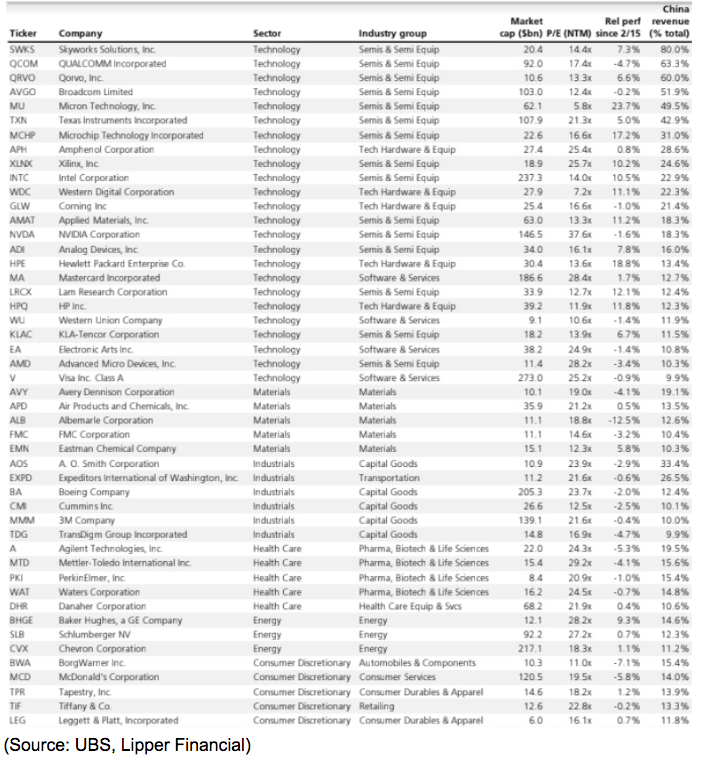

Of the 50 most trade sensitive US companies 24 of them are tech companies, 15 of those being chip makers like Skyworks, Broadcom, and Texas Instruments. Industrials, energy, and basic materials, all economically sensitive sectors as well, are also well represented on the list (thus explaining those sector’s weak 2019 results in recent months).

So with the risks of a G20 trade talk failure potentially leading to short-term earnings devastation for those trade-sensitive sectors and names, that means it a good time to sell them right? Actually no.

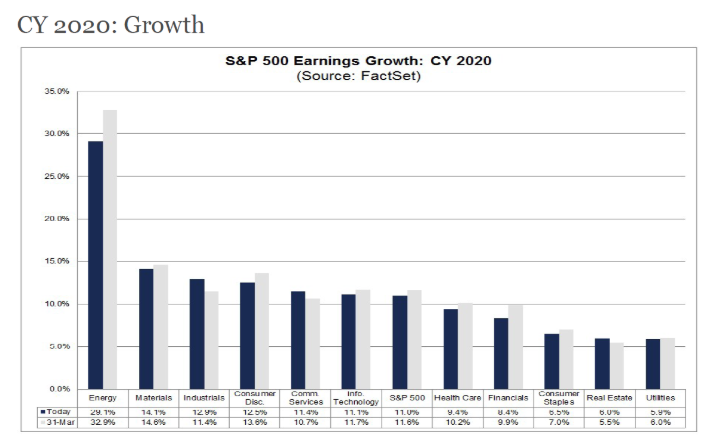

That’s because the trade war, no matter how bad it gets, is going to end eventually (the worse it is the shorter it will last). Thus no matter how scared Wall Street gets about these trade sensitive companies, we mustn’t forget that “this too shall pass.” Take a look at the consensus for 2020’s EPS growth.

While it’s true that Wall Street’s long-term estimates are educated guesstimates at best (and typically 3% to 4% inflated this far out) the point is that 2020 is expected to show a nice return to growth for the S&P 500. Note that Energy, Materials, Industrial and Tech are some of the best growth sectors of next year, precisely because an end to the trade war would send their bottom lines soaring (off comps).

This is why I recently bought Skyworks Solutions and Broadcom for my retirement portfolio (where I keep 100% of my life savings, about $270,000 right now). I paid about 11 times cash flow for both (and roughly 1.0 PEG), meaning March 2009 style valuations for two quality tech companies whose multiples are going to expand significantly when a trade deal eventually arrives.

When that happens doesn’t matters isn’t important to me, because I can buy more of each should a G20 failure cause them to crater like they did in May.

And even if you aren’t interested in taking a contrarian view on the eventual trade war’s end (by buying the most at risk companies who will fly the highest and fastest when it’s over) don’t forget that the stock market goes up in 74% of years since 1926.

That’s because, while corporate earnings don’t always go up (like 2014 to 2016) the overall trend of the last 20 years is of 6.1% CAGR growth which is likely to continue in the 2020s (due to advanced AI’s productivity-boosting effects, spurred on by 5G and the Internet of Things).

So I’m saying don’t sell anything, buy trade sensitive stocks right? Not necessarily. It depends on your personal situation and asset allocation. If the strong June rally has caused your equity exposure to get too large and put you at risk of emotional and costly mistakes in a potentially rough July swoon then now would be a good time to rebalance by selling some stocks and buying more bonds (which are likely to go up in a short-term market panic).

I myself just did my annual rebalancing, selling one overweight stock and using the proceeds to lower my cost basis and increase my holdings into three undervalued high-yield blue-chips (safe yields ranging from 7.5% to 8.5%).

That allowed me to lock in some gains (about 10% on that sold position, which I reduced by about 40% but still own for the long-term), improve my diversification (by both sector and holdings), and boost my portfolio’s annual income by about $200 per year.

I not just increased my portfolio’s yield on cost to 5.3%, but I slightly improved the long-term dividend growth outlook (to 6.9% per Morningstar’s conservative estimates). That means that even ignoring the fact that my portfolio is 19% undervalued (per Morningstar’ conservative DCF models) I’m likely to see about 12.2% CAGR total returns over the coming five years.

And if my portfolio reverts to fair value over that time? Then my total returns are likely to be closer to 17% CAGR, which is fantastic given that I’m 100% in low-risk, blue-chip dividend stocks.

Mind you most investors shouldn’t even consider a 100% stock portfolio (60% stocks/40% bonds is the rule of thumb the famous 4% retirement rule is based on). My asset allocation is based on my unique situation that includes a VA pension that covers my monthly expenses 170%, 35 sources of total income (including my stocks, pension, and 5 sites I write for) and my ability to save and invest $8,000 to $10,000 per month, money that I won’t need for at least five years.

But the point is that if you’ve built your portfolio correctly, and have the right asset allocation for you, then selling ahead of a potential market downturn is a horrible idea.

No less than Peter Lynch, second greatest investor in history (29% CAGR total returns from 1977 to 1990) said

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”

Bottom Line: The G20 Trade Meeting Could Dominate the First Half of July, But Don’t Let That Change Your Long-Term Investing Plans

Obviously, no one can know for sure what the outcome of the G20 trade meeting between Trump and Xi will bring. What seems most likely, and what Wall Street is pricing in, is a “deal to make a deal in the future.” Specifically, an agreement to hold off on the third round of Chinese tariffs (which would apply to 60% of imports and hammer America’s industrial sector into a recession) is likely to be postponed as China and the US talks continue.

The good news is that this should avoid making the situation worse. The bad news is that some of the latest economic data is pointing to a major slowdown in industrial spending that is almost entirely trade war-related.

Should Trump attempt to make good on his threats to impose 25% tariffs on those $300 billion in Chinese imports “immediately” it will likely take three months for the comment period (which started on June 17th) to elapse and mean the final tariff round doesn’t hit until September 17th or later.

However, the effects on the economy and stock market would likely be far more immediate and possibly force the Fed to deliver on the 25 or even 50 basis point rate cut some bond analysts are now expecting at the end of next month.

The bad news about that is that a significant decrease in business investment, over trade war uncertainty, would likely slow GDP growth to 1% or possibly lower in the following quarters. The good news, as far as short-term stock prices go, is that the market’s crazy low rate euphoria rally might then resume, meaning a painful July swoon might be followed by another just as strong August rally.

So how can investors prepare themselves for whatever might happen at the G20 and in July and beyond? Simple. Remember that, despite what the media might say, both the trade war and Fed rate policy are ultimately short-term events, that won’t likely destroy the market’s long-term trend of rising higher due to corporate earnings, cash flow and dividend growth (the fundamentals that ultimately determine 100% of share prices).

Rebalance your portfolio at market highs (if you need to), as I just did, but NEVER try to time the market by selling all your stocks in fear of a correction, and with plans to buy back in after a significant decline.

Such market timing is great…in theory, but almost never in reality. Because as Jack Bogle, founder of Vanguard once said,

“Sure, it’d be great to get out of stocks at the high and jump back in at the low, but in 55 years in the business, I not only have never met anybody who knew how to do it, I’ve never met anybody who had met anybody who knew how to do it.”

Instead, trust in your portfolio’s risk management and asset allocation to protect your nest egg from short-term market chaos, because following your long-term investing plan is far more likely to get you to your financial goals than reacting emotionally to every wild swing in the stock market.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!