I think we can all agree that recessions and bear markets are no fun. With the bull market now the longest in US history and the US economic expansion set to become the longest in history in July 2019, many investors have been fearful that a recession and bear market are “overdue”.

While neither a bull market or expansion die of old age (according to a study by the San Fransisco Federal Reserve), the economic fundamentals have now deteriorated to the point that a recession does indeed look likely (75% to 90% probability) within the next nine to 16 months.

This means that a bear market is also more likely than not to begin relatively soon. And given that the Great Recession saw the S&P 500 decline by 57% (the Dow Jones Industrial Average And Nasdaq did as bad or worse) it’s understandable that investors might be very afraid that we’re set for another epic crash.

But now isn’t the time to panic, but rather look at the facts, including what’s likely to happen to both the economy and stock market over the coming 12 to 18 months. More importantly, discover what you can do with your portfolio to not just protect your hard earned wealth, but potentially profit from the coming bull market, which will follow the bear as surely as day follows night.

Why a Recession Is Now Likely in 2020

The complexity of the US economy, which is $20 trillion in size and deeply linked to the $90 trillion global economy, means that perfect recession prediction is impossible. But there are numerous models used (by governments, central banks, and financial firms) to try anyway, given the high stakes involved with economic contractions and bear markets.

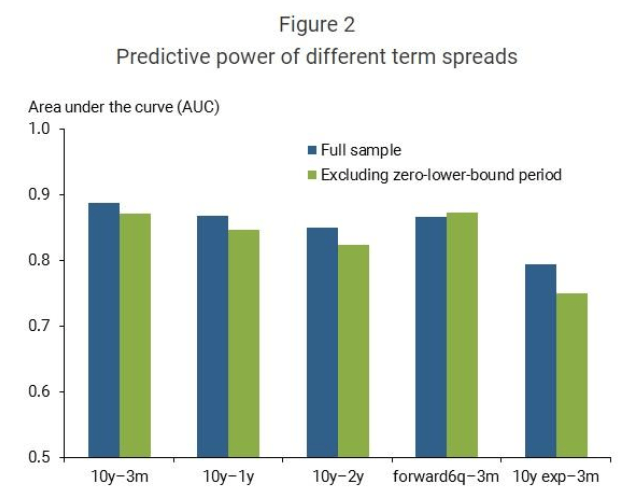

The most accurate recession predictor ever discovered is the famous yield-curve, which has accurately predicted 90% of the last 10 recessions, according to a March 2018 report by the San Francisco Federal Reserve.

More specifically, the 10y-2y curve, upon inverting, correctly forecast a recession beginning within the next six to 24 months. Just once did it give a false signal, in the mid-1960s, when we had a severe slowdown but no official recession.

So the 10y-2y curve is what we should watch right? Actually not. The same San Francisco Fed study found that the 10y-3m yield curve actually has more predictive power, making it the single best recession forecasting tool we have.

But of course, correlation isn’t causation and as impressive as the yield curve’s track record there needs to be a fundamental link between it inverting (going negative) and believing a recession is actually likely.

That link is bank lending. According to an October 2018 Dallas Fed survey of bank lending managers

“In addition, the survey included two sets of special questions inquiring about the effect of the slope of the yield curve on lending policies. Banks were first asked how their lending policies have changed in response to the flattening of the yield curve (10y-3m) since the beginning of this year. Banks generally indicated that the change in the slope of the yield curve so far this year had not affected their standards or price terms across the major loan categories. In contrast, when asked to assess their potential response to a prolonged hypothetical moderate inversion of the yield curve, banks responded that they would tighten standards or price terms across every major loan category if the yield curve were to invert, a scenario that they interpreted as a signal of a deterioration in economic conditions.” – Dallas Fed Senior Loan Officer Opinion Survey on Bank Lending Practices

Now it’s important to note three things. First, the curve banks are watching is the 10y-3m (because of its historical predictive power). Second, banks are not likely to slam the credit doors shut the second the yield curve turns negative (it closed at -1 basis point Friday, March 22nd and is -3 bp as I write this).

The survey makes clear that only a PROLONGED and moderate inversion ( much larger than we have today) would cause banks to tighten credit to people and businesses, and thus cause the very recession they think an inversion would predict.

This means that should economic data improve a bit, and the curve un-invert, the recession clock would be turned off. This means the inversion is NOT a time to panic and “sell everything and run for the hills!” as some might have you believe.

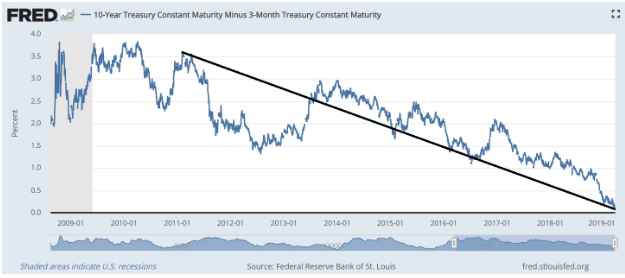

But the 10y-3m yield curve has been falling for eight years now meaning that the long-term trend, combined with rapidly falling US economic growth means a rosy scenario is now far less likely.

(Source: St. Louis Federal Reserve)

Ok, so a recession now appears likely, but when will it actually start, how bad will it be, and most importantly for investors, what kind of carnage can we expect for our portfolios?

When the Next Downturn Is Likely To Start & How Much Stocks Will Probably Fall

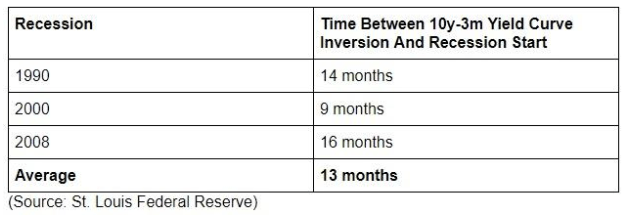

The thing about using any macroeconomic model, including the yield curve, is that it can only provide a rough guide to when an economic downturn will begin. Using the last three recessions we can see that a recession now appears 75% to 90% likely to begin (the 10y-2y curve remains positive for now) in nine to 16 months. That means December 2019 to July 2020, with April 2020 being the start using the average lead time.

But just because a recession is likely doesn’t mean that we’re in for a horrific repeat of the Financial Crisis.

The Great Recession was the worst since the Great Depression and a result of a near collapse of the global financial system. New regulations and much better-capitalized banks mean that such a crisis isn’t likely to repeat. And don’t just take my word for it. Here’s what Warren Buffett said in a 2013 interview about the chances of another financial crisis.

“The banks will not get this country in trouble, I guarantee it. The capital ratios are huge, the excesses on the asset side have been largely cleared out. Our banking system is in the best shape in recent memory.” – Warren Buffett

If we exclude the Great Recession, then since WWII the average recession has lasted 12 months and seen GDP decline by 1.7% or about three times less than the Great Recession.

Ok, so maybe the next recession will be much milder than the last one, but what about the stock market? That’s what investors care most about. After all, the 2001 recession was also very mild yet the S&P 500 was cut in half and the Nasdaq fell 80% at its peak.

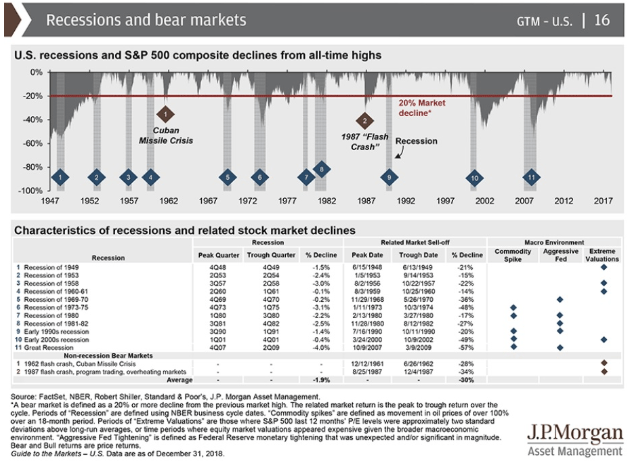

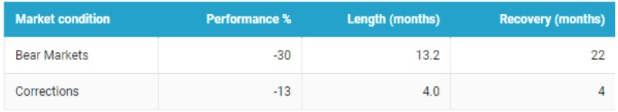

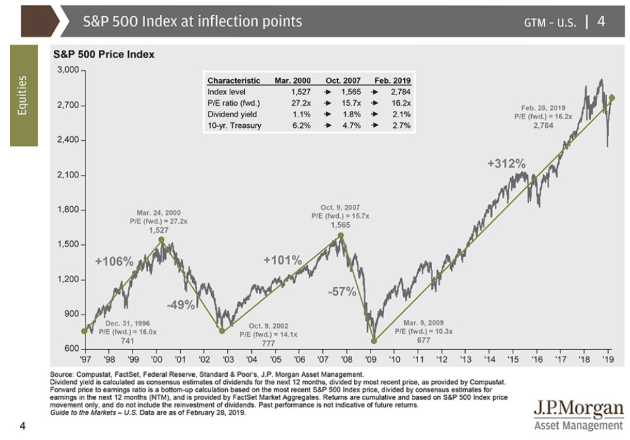

Since 1926 the average bear market, including the giant crashes in 2000, 2008, 1973 and the Great Depression (peak decline of 90% which is still the record) has seen stocks fall for 13 months, an average peak decline of 30%.

But of course, averages can be misleading because every bear market is unique and the range on decline durations and severity is large.

(Source: Moon Capital Management)

The median decline has been 15 months but as you can see stocks have fallen from as short as three months to as long as three years. What ultimately determines how long and strong stocks fall is the fundamentals of the economy and the valuations stocks reach.

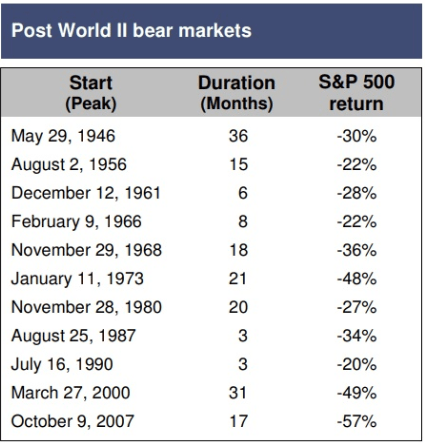

As of Friday, March 22nd, the forward PE on the S&P 500 was 16.6, which is only slightly above the 25 year average of 16.2

At the peak of the tech bubble, the last time stocks fell 50% during a mild recession, the forward PE reached 27.2, or 64% higher than it is now. This means that we’re not likely to see a 50+% crash but rather a historically normal bear market decline of 20% to 30%.

The 30% end of that range is due to the historical average BUT remember that includes the great crashes of the Depression, 1973, 2000 and the Great Recession.

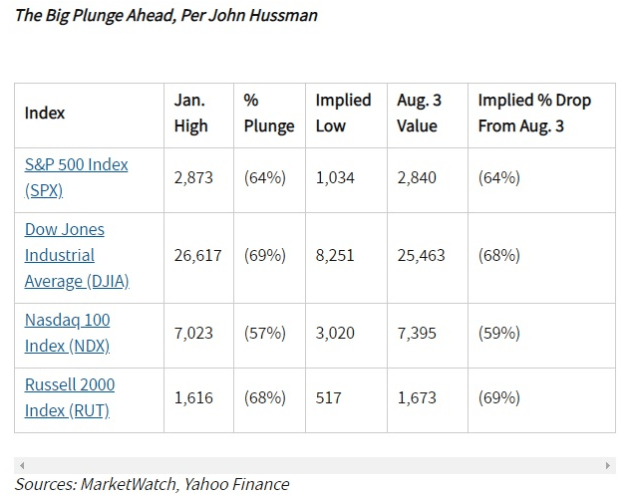

I personally expect this bear market (which appears to have begun September 20th, 2018) to see stocks bottom 20% to 25% from all-time highs. Why am I so much more optimistic than hyper bears like hedge fund manager John Hussman, who back in mid-2018 predicted a 70% crash was coming for the Dow?

Because the next recession is likely to be mild, meaning that corporate earnings contraction should also be relatively small. Remember that outside of extreme conditions, like the Financial Crisis, were stocks bottomed at a forward PE of 10.3, the lowest stocks tend to decline to is about 13 to 15 forward earnings. The 2002 low was 14.1 and I expect roughly the same to occur when stocks bottom this time (since the economic fundamentals are likely to be similar).

That means a roughly 16% decline from today’s levels which would put us right at that 20% official bear market threshold (and about December 2018 lows). Back on December 24th, the forward PE bottomed at 13.7.

Another thing to consider is that the Fed, who normally cuts the Fed Funds rate about 5% during recessions, now only has 2.5% to cut before hitting zero. That likely means more QE (bond buying) will be coming this time as well, which should put a higher floor under stocks.

Why is it important to have some idea where stocks are likely to bottom (and when)? That’s so that you can make the most informed decision when it comes to protecting your wealth over the coming year, but also in taking part in the next bull market, which is likely to begin late 2019 or early 2020.

What You Can Do To Protect Yourself And Profit From The Coming Bull Market

The second worst thing you can do, according to decades of market studies (and the best investors in history) is panic sell all your stocks now. The single worst thing you can do is pray that “this time is different” and ignore the yield curve’s warnings, and then panic sell all your stocks near the bottom of the next bear market.

This is where asset allocation comes in, the most time tested and effective way to protect your wealth.

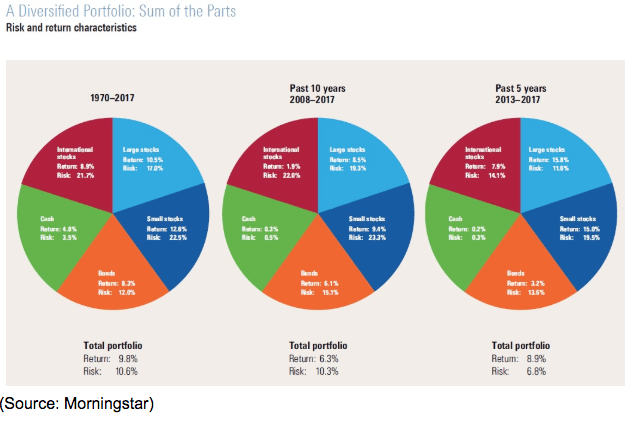

Asset allocation is just the fancy way of describing your asset mix and portfolio construction. For example, this model portfolio from Morningstar represents a well-diversified mix of ETFs including cash equivalents (T-bills), bonds, US large cap stocks, US small caps, and international companies.

It’s designed to not just generate good returns, but with lower volatility over time (better risk-adjusted returns). Most importantly for our current discussion, is the fact that the cash and bonds give you something to sell in the case you need the money (like retirees paying the bills with the 4% rule) without selling stocks that have crashed to historically low levels.

Cash is what you sell first since it’s role is to remain stable in value and the yield is just high enough to offset inflation.

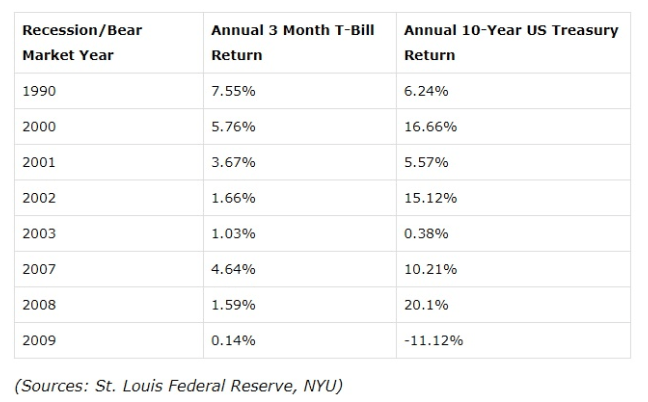

Bonds, especially long-term US Treasuries, are what appreciates in value the most during recessions. That’s both due to a flight to safety (out of stocks and into risk-free assets) and because long-term interest rates are declining (due to falling inflation expectations created by negative economic growth).

If the Fed is buying bonds (QE) it’s also typically buying long-term ones, which means that the longer the duration of bonds the more they will appreciate during a recession/bear market. Not just will that act as a buffer for your portfolio, but it will also give you something to sell when stocks finally bottom.

That can either pay the bills (for retirees) or be used for buying stocks at their best valuations in a decade or more. This second reason is why the Vanguard Long-Term Treasury ETF (VGLT) is now 9% of my portfolio and where I plan to put all weekly savings/dividends for as long as the yield curve is inverted AND stocks haven’t yet hit -20% from all-time highs.

When the bear market is official, then I’ll put my watchlists to work, scooping up top quality companies at fire-sale prices. Now, what if the market does happen to fall more than 30%? Well, I’ll be monitoring the economic fundamentals closely each week, including the St. Louis Fed’s financial stress index.

If things are worse than I’m currently expecting then I’ll adjust my staged buying of stocks (how fast I sell bonds to buy my watchlist companies). But my goal isn’t to perfectly time the bottom, which is impossible.

Rather I’m merely looking to make a great long-term call, based on company fundamentals and historical valuations. My entire investing approach is about using what’s most likely to work overtime (based on the most proven high probability strategies) and apply that to a diversified portfolio of companies.

As long as I’m right 70+% of the time, I’ll end up achieving great returns, AND maximizing my long-term income, which is ultimately how I plan to fund my retirement.

Bottom Line: Stay Calm, Stick To A Smart Strategy And The Right Asset Allocation, And You Can Not Just Survive The Coming Bear Market But Actually Profit From It

The biggest mistake investors can make is to panic and make rash investing decisions. History is very clear that proper asset allocation, based on your personal risk profile and long-term goals, is the best way to protect your wealth during inevitable recessions and bear markets.

While a recession is now likely to begin in 2019, and a bear market might already be underway, that doesn’t mean it’s too late to take steps to protect your hard earned wealth. That’s because the stock market is still up 12% YTD and thus it’s not too late to shift more of your money into defensive, risk-free assets such as cash equivalents (like MINT) or long-term US Treasuries (like VGLT). I’ve spent the last few months recommending readers recession-proof their portfolios to focus on asset allocation in order to get more defensive, and indeed just finished recession-proofing my own retirement portfolio.

That doesn’t necessarily mean selling all your stocks and going 100% into bonds (or cash) but merely making sure your savings are positioned in such a way as to avoid becoming a forced seller (via either leverage or financial necessity) during a period when even the highest-quality blue–chips might end up selling at firesale prices.

If you still have the ability to add money to your portfolio (are not retired) then the coming months might prove to be a terrific time to add quality dividend stocks at ever better valuations (and lock in much higher yields). Personally, I’m planning to put all my weekly savings/dividends into VGLT (long bonds) so that my growing position in this appreciating asset class will provide me with plenty of dry powder to go bargain shopping as soon as the S&P 500 hits -20% from its September 20th all-time high.

It’s important to remember that all macroeconomic/market analysis is purely probabilistic. History is a useful but rough guide to what is likely to happen, not a crystal ball that allows for pinpoint accurate timing.

Thus don’t obsess over making the “perfect” decision but rather just a good one, based on what’s most likely to occur in the coming year or so, and always with a focus on what best meets your personal risk-profile and long-term goals.

While a bear market is likely underway today, and a recession is probably coming by early 2020, the good news is that we’re probably not going to repeat 2007-2009. The economy is likely to spend about 12 months shrinking, with a peak decline of just 1% to 2%.

Stocks themselves are likely to decline 20% to 30% from their all-time highs (about 16% to 26% lower than today), but the Fed’s probably next round of QE could put a relatively high floor under equities. In other words, the doomsday predictions some permabears have been making (like a 70% market crash) are extremely unlikely to occur based on the actual fundamentals of the global financial markets.

What’s more, I recommend putting any dry powder to work via staged buying starting at -20% and not necessarily waiting for a 30% or larger decline. Never forget that every bear market is unique and thus historical averages (like a 13-month average decline of 30%) is far from a prediction of where this bear market will bottom or how long it will last.

As long as your asset allocation is correct, and your watchlists of companies to buy during a bear market are ready, (like my weekly dividend watchlist series) then you’ll not just sleep well at night during the likely current bear market, but potentially profit immensely when the next bull market begins in late 2019/early 2020.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!