It’s Friday again, can you believe it? Seemed this week just flew by. And now here we are needing to decide whether to point you at a juicy article, try to wrestle a story out of a rather normal-looking chart, or call in sick like Federal employees should probably do.

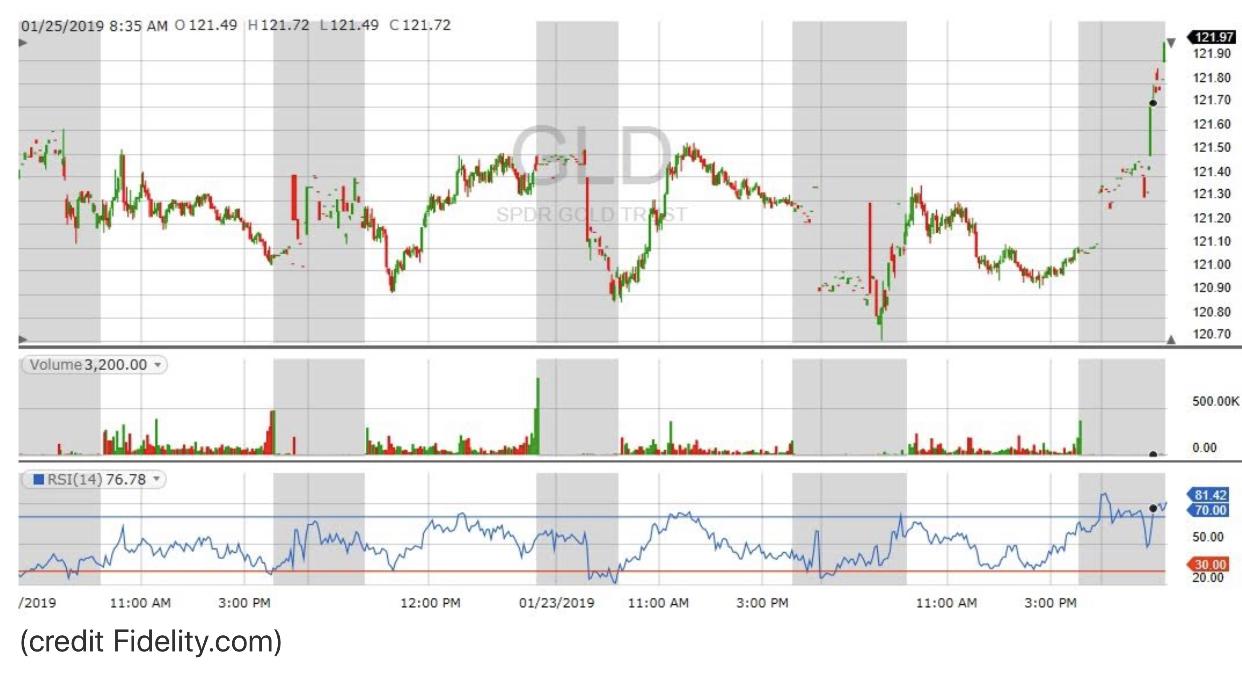

Well the chart of GLD is looking rather interesting this morning, sort of. Things were just kind of going sideways up until a half-hour ago, which coincided with your sleepy Gold Enthusiast making some tea and toast.

He thinks there’s more to it than that of course. The tea is exquisite, coming from a co-op in India and all, but the marmelade is just garden-variety stuff. So why did gold just jump up?

Looking at the headlines there isn’t much that says “this should push gold higher.” But maybe in this day of instant news, and valuable news being delayed while “somebody” mulls it over, we haven’t seen the right bit of news yet. (And by the way, mulls is ancient Greek for delaying while figuring out how to profit. heh heh)

Or it could be just a fat-finger trade. Some poor junior trader accidentally multiplied a buy order by 10, or 100… that’s happened before with market-moving consequences.

Or maybe people are starting realize countries all over the world are stockpiling gold at an increasing rate. “Don’t believe what they say, believe what they do” seems to be the operative principle here.

And of course, after all these weeks, some news wonk finally figured out that Congress members still get paid during government shutdowns. Despite the fact that they are the ones who didn’t do their job by reaching an agreement before funding ran out. You know what they say – those in power rig the game for themselves. And they continue to do it to this day. It will be interesting to see whether any of the new members of Congress – so hyped as being visionaries for our future – will actually propose any bills which make a lick of difference.

Or whether they’ll simply get sucked into the Washington power game and keep saying one thing while doing another.

There, that seems to have satisfied your Gold Enthusiast’s need to make some comment on the week. Really it’s just been another “continuing” week, while earnings come out and we see the economy has some hot spots and some cold spots. Which is always the case.

Enjoy your weekend and we’ll be back at it next week!

Signed, The Gold Enthusiast

DISCLAIMER: The author holds no positions in any mentioned securities. He is long the gold mining sector with small, non-market-moving positions in NUGT, JNUG, a few junior mining stocks, and some GDXJ call options.

About the Author: Mike Hammer

For 30-plus years, Mike Hammer has been an ardent follower, and often-times trader, of gold and silver. With his own money, he began trading in ‘86 and has seen the market at its highest highs and lowest lows, which includes the Black Monday Crash in ‘87, the Crash of ‘08, and the Flash Crash of 2010. Throughout all of this, he’s been on the great side of winning, and sometimes, the hard side of losing. For the past eight years, he’s mentored others about the fine art of trading stocks and ETFs at the Adam Mesh Trading Group More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!