I think we can all agree that it’s been a December to remember — but for all the wrong reasons. Last week, the Dow Jones suffered its worst weekly slide in 10 years, and the Nasdaq did even worse, falling 8%. The S&P 500 is having its worst December since 1931 (the darkest days of the Great Depression) and is now officially in a bear market. Thu,s the longest bull run in US history is officially dead. Investors are blindly selling in a panic (weekly money outflows from ETFs are at record highs).

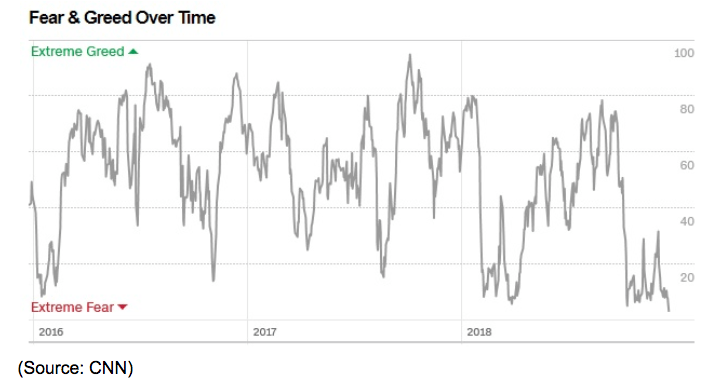

CNN’s fear and greed index, composed of seven market indicators (such as volatility, put/call ratios, and safe haven demand), is now at 2, an all-time low (it was 12 post-Lehman collapse in September 2008).

So needless to say, there is a lot of panic out there, as bears run rampant and stocks of even quality companies with rock-solid fundamentals sell off as if a recession were already here.

To know how bad things might get, we need to first identify the risks that have the market so panicked right now, and how bad things might potentially get. So here are the five biggest risks facing investors in the coming months, that will likely decide whether 2019 sees stocks improve upon 2018’s terrible returns.

The Federal Reserve Might Remain Too Hawkish

One of the big reasons that stocks sold off so strongly last week was due to the Federal Reserve taking an overly hawkish tone. The actual 0.25% rate hike (to 2.25% to 2.5% on the Fed Funds Rate) was not a surprise (bond futures had the probability at 66% the day of the hike).

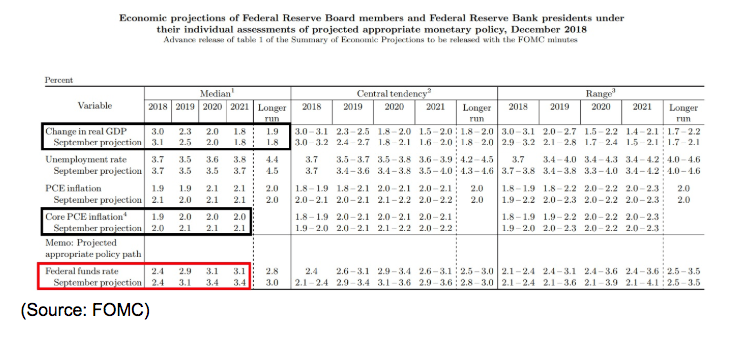

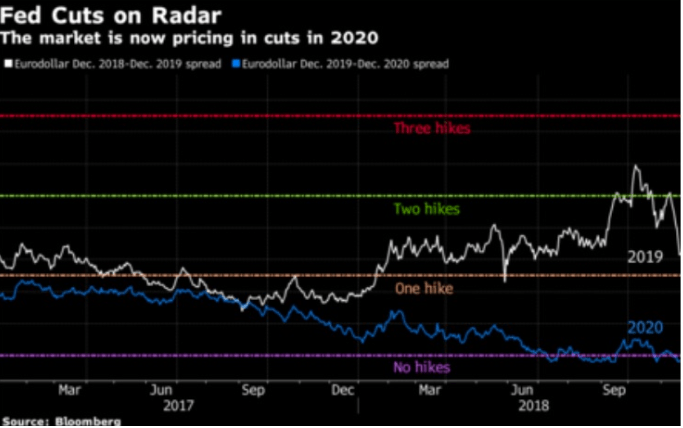

Rather it was the fact that the Fed, despite lowering its economic growth projections for 2019, as well as long-term inflation expectations, still forecast two more rate hikes next year, and three more in total. The bond market had been pricing in just one more rate hike after December, due to falling economic growth and inflation expectations.

In fact, the bond futures market was even forecasting a rate CUT in 2020, but the Fed’s official forecast calls for not just more than expected hikes next year, but one final hike in 2020. All 12 of the last recessions have been preceded by the Fed hiking rates too far and then not cutting them soon enough when economic fundamentals indicated that was warranted.

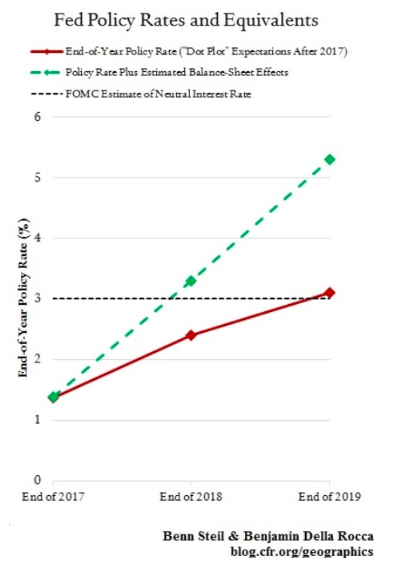

To make matters worse, Powell told reporters at the conference call that the Fed’s balance sheet roll-off (reverse QE that’s allowing $50 billion in bonds to mature each month without reinvesting them), is essentially on autopilot. The President of the New York Fed walked this back on Friday saying that the Fed was being 100% data-driven in 2019 and that any future hikes and the continued roll-off (which sucks $300 billion out of the economy each year) are all on the table.

According to Benn Steil at the Council on Foreign Relations, the combination of balance sheet roll-off (quantitative tightening) is making the effective Fed funds rate much higher than the headline figure. For example by the end of 2019, if the Fed were to hike twice more in 2019, and maintain its current QT rate of $50 billion per month, Steil estimates it would be as if the Fed had set the FFR at 5%.

These are the worries that have the market so rattled and are helping to drive stocks to their lowest valuations in four years (S&P 500’s forward PE of 14.1 is now at the lowest level since October 16th, 2014 according to FactSet Research and far below the historical average of 15.9 since 2002 when analysts began calculating it).

But don’t despair because the chances that the Fed will actually make a disastrous mistake (hiking a total of 12 times in the face of slowing growth, low inflation, and rising unemployment) are very slim. For the January 30th meeting, the bond futures market (according to CME group) is 0% and just 14.5% for March.

BUT the risk here is that the bond market, the most accurate recession predictor in history, may be ignored by the Fed who might very well hike on March 20th. That would not only likely send stocks lower, but the Fed might remain overly hawkish and insist on maintaining a forecast of at least one more rate hike. Given that the Fed has a terrible track record of “hiking until the economy breaks” Wall Street would likely react very badly to such an outcome.

The Government Shutdown Might Drag On For Weeks Or Months

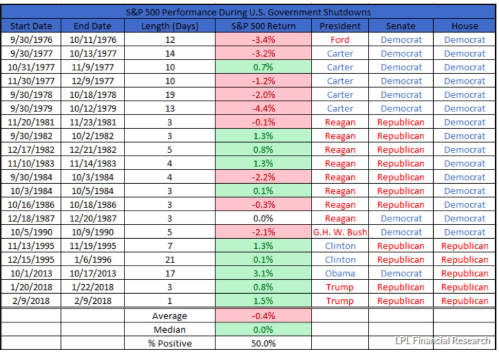

As of December 21st, the US government is in a partial government shutdown. This article explains all the important things you need to know about the third shutdown of the year.

But the bottom line is this. While stocks normally don’t react very negatively to shutdowns, we are not living in normal times. The typical shutdown sees stocks remain mostly flat, though dings total returns by 0.3% to 0.7% relative to had they not occurred.

This shutdown, triggered by a heated dispute over border fence funding, could last a very long time, according to our President. With the market sentiment now the lowest its been in nearly a decade, stocks are looking for any excuse to sell off, and a protracted shutdown certainly fits the bill.

According to a 2014 Congressional Research Service report each week the US government is shutdown costs the economy 0.1% of GDP growth. That’s normally not significant especially since the longest shutdown ever was just 21 days. But with Democrats now taking charge of the House (January 3rd) and neither side indicating they will budge on border fence funding, we might break that record.

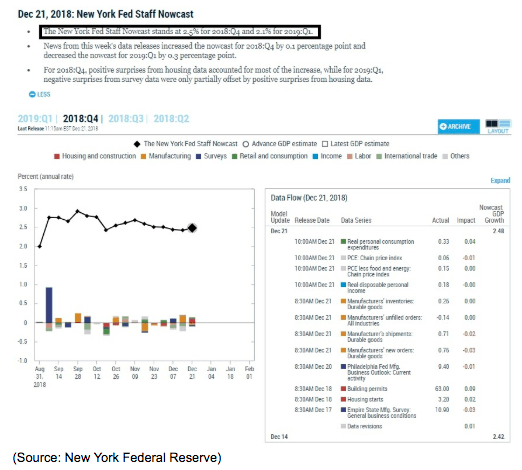

If the government shutdown lasts for a month it would knock 0.4% off Q1 GDP growth. The New York Fed is currently estimating (based on incoming economic data) that our economy will grow at 2.1% next quarter. If we break the record with a month-long shutdown that could drive growth down to 1.7% and if the shutdown were to last the entire quarter then growth might drop to 0.9%, dangerously close to contract (recession) territory.

Currently, the economic data and trends indicate an economic contraction isn’t likely for another 21 to 28 months (2020 or 2021). But if Washington messes up enough that timetable could be moved up by a full year or two. What might cause that kind of disastrous political dysfunction? That would be the third risk I’m watching, the Mueller report.

Mueller Report Might Increase Political Uncertainty Even More

In May 2017, after Trump fired FBI director, James Comey who was spearheading the investigation into potential collusion between Trump and Russia in interfering with the 2016 election, Robert Mueller was appointed special counsel and has since been investigating the matter. Since then he’s charged 33 people, including three Trump associates, and according to insiders, is expected to soon complete the investigation. NBC is reporting the final report might be delivered to the new Attorney General Bill Barr (Jeff Sessions was fired by Trump in November) by mid-February. Barr has criticized the investigation from the start so there is a lot of uncertainty about what the outcome of the report might be (depending on Mueller’s findings).

But the risk here is that bad news for the President might make him feel cornered. Impeachment isn’t likely (though that would throw DC into further chaos). But with Trump now acting in ways that have even his closest advisors and administration officials horrified (pulling out of Syria caused the Defense Secretary to resign in protest effective February 1st), scathing report findings could cause our President to begin acting even more volatility.

That ties into the two biggest risks we’re facing in the coming months.

Trade Negotiations Might Fail Or At Least Lead To A Full Year Of Extra Volatility

Previously I had optimistically believed that good progress in trade talks between the US and China might mean that a final deal that eliminates all tariffs recently put in place might be reached by February. But while those negotiations are indeed going “very well” according to our president, most economists warn that a full deal might take longer than the 90-day deadline (which ends March 1st).

This means there is good and bad news on trade. On one hand, both the US and China are VERY incentivized to strike a deal.

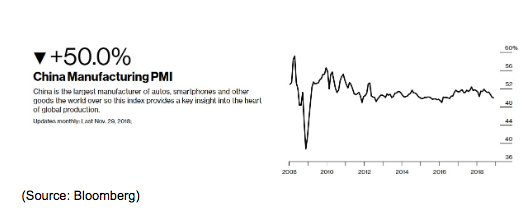

China’s economy continues to slow, with its manufacturing sector now on the verge of a contraction. While slowing growth is not purely trade related, the trade war is certainly not helping Beijing’s efforts to prop up its economy.

And on the US side slowing economic growth in recent months (hard data) continues despite still near record high small business and consumer confidence. Our President, for good or ill, thinks of the stock market as the most accurate barometer of economic health.

With the longest bull market in history now officially over Trump is being sent into a frenzy over trying to get stocks to stop falling. But while that’s a good thing (he’s listening to someone other than “his gut”) the bad news is that the administration’s efforts to stop the stock slide can themselves backfire.

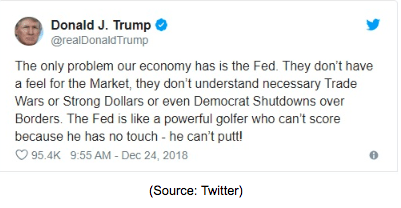

For example on Monday, December 24th, Trump helped drive the worst Christmas Eve trading session for stocks ever with another tweet attacking Fed Chairman Jerome Powell. Last week the President tweeted that the Fed should not raise interest rates but listen to the stock market, which was already on the verge of a bear market. I personally agree that the Fed should have paused in rate hikes (but listen to the bond market, not the stock market, since it’s the most accurate recession predictor ever discovered).

When the Fed’s overly hawkish stance was announced, and stocks started sliding, rumors that Trump was considering firing Powell have surfaced. Now it’s debatable about whether the President has the authority to actually do such a thing (Fed Presidents can be removed “for cause” but the Chairman for merely hiking rates doesn’t qualify).

But out of fear that these rumors might set off even greater fear in the financial markets Secretary Mnuchin then called the six CEOs of America’s largest banks to make sure that each had sufficient liquidity to avoid a short-term financial crisis. The Treasury then made the following statement Monday morning. “The banks all confirmed ample liquidity is available for lending to consumer and business markets.”

The trouble was that before Mnuchin’s call to the big banks, which many analysts described as “baffling” no one was seriously worried about America’s financial system. Trump’s tweet war with the Fed was merely one factor among many that were spooking the stock market, not the credit markets. Now it appears as the if Treasury might know something that the rest of the markets don’t, that might imply something is horribly wrong that might potentially justify stocks melting down. The good news is that the actual economic data (including the St. Louis Fed’s financial stress indicator) likely makes these fears overblown. But the point is that the administration, in an attempt to calm the market (either the President’s frequent tweets or Mnuchin’s bungled bank call) has a way of only stoking more fear that drives more panic selling.

Which brings us back to the trade negotiations. Most economists agree that China and the US appear to be looking to make good progress to justify extending talks beyond March 1st. The bad news is twofold, however. First existing tariffs will remain in place, slowing economic and earnings growth while negotiations to end the trade war are ongoing.

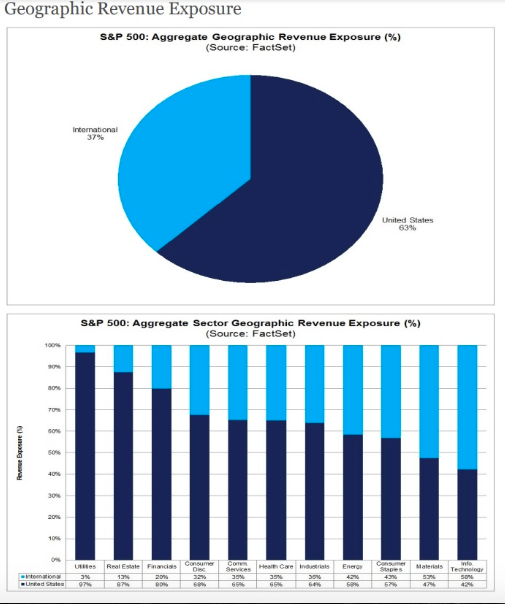

(Source: Factset Research)

With 47% of sales for the S&P 500 coming from overseas the trade war is going to continue to weigh on stocks, especially technology, which makes up about 22% of the S&P 500 market cap.

The second potential risk is that the negotiations are likely to last six to 12 months, but potentially far longer (NAFTA negotiations lasted 15 months between three close allies). Along the way, we’re likely to see more contradictory statements from various administration officials about progress on that final deal, potentially including threats to impose 25% tariffs on all Chinese imports (as Peter Navarro made last week, yet again).

And if all these short-term risks weren’t bad enough the biggest risk of all, including one that could actually cause a global financial meltdown, is also returning next year.

Debt Ceiling Is Coming Back In March

As part of the Bipartisan Budget Act of 2018, the debt ceiling was suspended on Feb 9th, 2018 but is set to be reinstated on March 1st, 2019.

Here’s what Goldman Sachs recently warned of in one of its research notes.

“The confusion and disorder surrounding this week’s spending debate suggest fiscal deadlines in 2019 — including the debt limit deadline, which we expect to fall between August to October — could be more disruptive than they have been since the 2011-2013 period.”

The good news is that while the debt ceiling is returning in March, the actual limit isn’t likely to be breached until much later in the year. That’s because the new debt ceiling is set at $22 trillion and the Treasury Department has various means of moving money around to head off a default on our debt for several months.

The bad news? That this means that next year’s biggest risk of all (a US default on its debt would shatter the world’s bond markets which are built around US Treasuries being “risk-free”) is potentially going to serve as a year-round sword of Damocles that looms over the already petrified stock market.

While an actual default is not likely, in recent years Republicans have attempted to force spending concessions from Democrats in order to pass a higher debt ceiling. Now not just will a split Congress make such a deal harder, but what’s more any spending cuts, even if they make sense for the long-term, would represent fiscal austerity that will further slow economic growth.

Bottom Line: It Could Be A Nerve-Wracking Few Months But Stay Calm And Remember That Worst Case Scenarios Rarely Play Out

The purpose of this article isn’t to panic investors but merely point out the reality of the risks that could make for an unpleasant 2019. The good news is that most of these risks are not likely to actually occur, so it’s important for investors to not give in to the temptation to assume the sky is falling and sell in a blind panic.

Ultimately non-recessionary bear markets (which we now in) typically take seven months for stocks to decline 25.4% according to Ned Davis Research. With the risks we’re facing now, especially political risks created by our walking, talking, and tweeting black swan of a President, we might very well hit those historical levels. The good news is that solid fundamentals combined with already low valuations mean that the faster stocks fall the faster they are likely to bottom.

That’s because the current earnings and macroeconomic fundamentals are far stronger than the market meltdown would imply. The time to sell has passed, and now you need to trust your asset allocation and the quality of your portfolio to ride out what might be a painful few weeks or months. America’s economy is amazingly resilient. We’ve survived far worse and we’ll pull through these five risks as well.

So hunker down and stop checking your portfolio. The news isn’t going to be good for the next few weeks or months but remember that as long as your mix of cash/bonds/stocks is right for your risk profile, and the quality of your stock portfolio is good, these mounting paper losses are not likely to destroy your long-term financial dreams.

The Greatest Trading Book Ever Written

Adam Mesh been working very hard to introduce you to the greatest trading book ever written. At his trading firm, the very first thing that any new trader had to do was read this book. They wouldn’t be allowed in his office if this book was not read. Now, he’s taken this book and built an entire trading system around it. For anyone that has any interest in trading, this is a must-read. It’s about success, failure and then success again. This book is being offered today, Get Your Copy Now

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!