There is a reason that Warren Buffett, CEO of Berkshire Hathaway, is so famous. Over 77 years he’s managed to achieve about 25% CAGR total returns through his various investments, partnerships and running his conglomerate.

That investing success crushes any other investor in history, and makes him a living legend who his fans dub “the Oracle of Omaha”. But while reproducing his returns is all but impossible for most people, Buffett has three tips for investors that, if you apply them, all but assures you can become rich over time and achieve financial freedom.

So let’s take a look at what they are, to help you get on track to a prosperous future, and hopefully, the retirement of your dreams.

Bears Sound Smart, Long-Term Bulls Get Rich

In Buffett’s 2018 annual letter to shareholders, he made some great points, putting his success and that of the stock market in general, in the proper historical context.

“Could anyone then have imagined what their new country would accomplish in only three 77-year lifetimes? During the two 77-year periods prior to 1942, the United States had grown from four million people — about [0.5%] of the world’s population — into the most powerful country on earth.

In that spring of 1942, though, it faced a crisis: The United States and its allies were suffering heavy losses in a war that we had entered only three months earlier. Bad news arrived daily.

Despite the alarming headlines, almost all Americans believed on March 11 that the war would be won. Nor was their optimism limited to that victory.

Leaving aside congenital pessimists, Americans believed that their children and generations beyond would live far better lives than they themselves had led. The nation’s citizens understood, of course, that the road ahead would not be a smooth ride. It never had been.” -Warren Buffet (emphasis added)

What Buffett is talking about is the fact that, while bears often sound smart in the short-term, since they claim to be warning you about risks to your wealth, ultimately long-term bulls (about the US economy and stocks) are the ones that get rich.

As Buffett points out in his letter, America’s amazing historical success hasn’t been without its major crises

- The Civil war killed 4% of the US population

- A Great Depression that put 25% of people out of work

- Two World Wars

- National Debt rising 400 fold since 1942

- 7 Republican Presidents and 7 Democratic ones (some with completely opposite policy ideas that many claimed would destroy the economy and crash the market)

- Several controversial, bloody and expensive wars

- A decade of double-digit inflation

- Interest rates as high as 21%

- A historical crash in housing prices (that caused the Financial Crisis)

- 9/11

But as Buffett wisely summarizes these events “All engendered scary headlines; all are now history.”

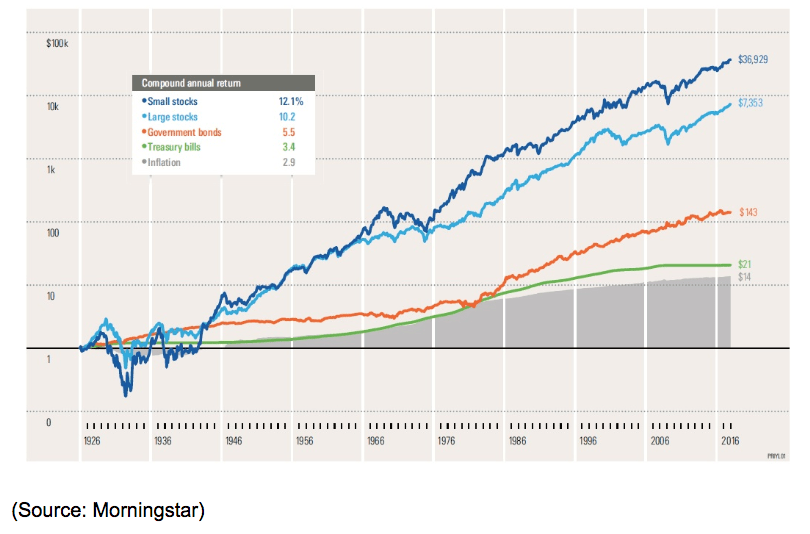

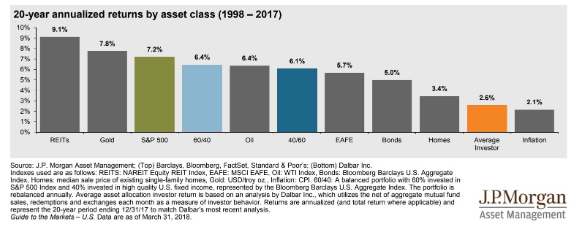

Buffett is basically saying that, given that nothing is certain about the future, all investors need to go with what’s most likely to lead to success and achieving their financial goals. In this case, stocks, ownership stakes in companies, have been the best performing asset class in history (gold, a favorite of the bears, achieved just 1% of the total returns of stocks since 1942).

That’s due to what Buffett calls the American tailwind, which he continues to believe will lead to a brighter, and far more prosperous tomorrow. Here’s what he said in a three hour CNBC interview in early March.

“That isn’t a tailwind. It’s more like a hurricane. American business has done incredibly well, and America’s done incredibly well…America is exceptional in this respect…We’ve got something that works…It wasn’t that we were working harder. Wasn’t that we were smarter. But we had a framework that unleashed human potential.”

In essence, Buffett is saying what makes America’s economy and stock market worth investing in is the inherent framework of our system, one that’s generally based on free-market capitalism, strong property rights, and respect for intellectual property.

Yes, that system has come under attack plenty of times over the centuries, but ultimately the American dream endures, which is why entrepreneurs from around the world continue to flock here to pursue their dreams of a better and more prosperous life.

Buffett’s reminder to focus on the big picture is especially important in today’s media dominated by smart sounding but hyper-bearish “experts”. Those who offer countless reasons for why America’s economy is doomed and why the market is likely to fall as much as 70% in the coming months or years.

But having the proper mindset, that of a long-term optimist is hardly enough to make you rich over time. There are two other critical things all investors must do to get rich and achieve their financial dreams.

Focus on What You Can Control, Don’t Obsess Over What You Can’t

Buffett began investing back in 1942, at the age of 11. His first ever investment was buying 3 shares of Cities Service preferred stock for $114.75. At the time Buffett knew virtually nothing about investing, or how to analyze or value a company. In other words, he was moving outside his circle of competence and would have been far better off investing in the entire market, which is effectively a bet on the entire US economy.

“Let’s put numbers to that claim: If my $114.75 had been invested in a no-fee S&P 500 index fund, and all dividends had been reinvested, my stake would have grown to be worth (pre-taxes) $606,811 on Jan. 31, 2019 (the latest data available before the printing of this letter). That is a gain of 5,288 for 1.

Meanwhile, a $1 million investment by a tax-free institution of that time — say, a pension fund or college endowment — would have grown to about $5.3 billion.” – Warren Buffett (emphasis added)

Now I’m a passionate stock picker, but that’s because I’ve been investing for 23 years and a professional analyst/writer for five. I analyze over 250 companies per year in-depth and have spent years building out watchlists and spreadsheets analyzing fundamentals and valuations in various ways.

Buffett is saying that, if you have the time, interest, and skill to try your hand at portfolio management, great. BUT to get rich doesn’t require being a Wall Street wizard. As Buffett told CNBC investors doing well over the decades didn’t have to do anything special, or be experts at anything.

“You didn’t have to know accounting, you just had to believe in America. And you didn’t have to pick the right stock, you just picked America.”

Buffett is famous for being a fan of low-cost index funds, such as those that track the S&P 500, which accounts for 80% of American companies’ $30 trillion in market cap.

In fact, not just does Buffett love index funds, but he’s told his lawyers that when he dies his estate should invest all its remaining assets in a low-cost S&P 500 index fund. That’s because costs are crucial to achieving good returns over time, as he points out in a powerful example

“Let me add one additional calculation that I believe will shock you: If that hypothetical institution had paid only 1% of assets annually to various “helpers,” such as investment managers and consultants, its gain would have been cut in half, to $2.65 billion. That’s what happens over 77 years when the 11.8% annual return actually achieved by the S&P 500 is recalculated at a 10.8% rate.” – Warren Buffett (emphasis added)

That quote from Buffett’s annual letter highlights two important things investors always need to keep in mind (which I’ll also address in the third tip). Costs are something you can control, not just in investment vehicles like mutual funds, ETFs, and commissions, but also in life.

And as the 1942 to 2019 total return example shows, even a slight lowering of costs can result in massive differences in outcome, thanks to the power of exponential compounding over time.

I want to also highlight one other important way that cost control can help investors get rich, and that’s to do with your personal finances.

Morgan Housel, formerly of The Motley Fool (where I started as an investment analyst/writer) had a great article a few months back pointing out that the person with a frugal lifestyle is far more likely to retire comfortably than the one with an expensive lifestyle but much higher income.

That’s because the frugal person can support a decent retirement on a much smaller portfolio, that requires say 8% long-term total returns, while the “richer” person, despite being able to save and invest more, might need 10% to 12% returns to achieve a large enough nest egg.

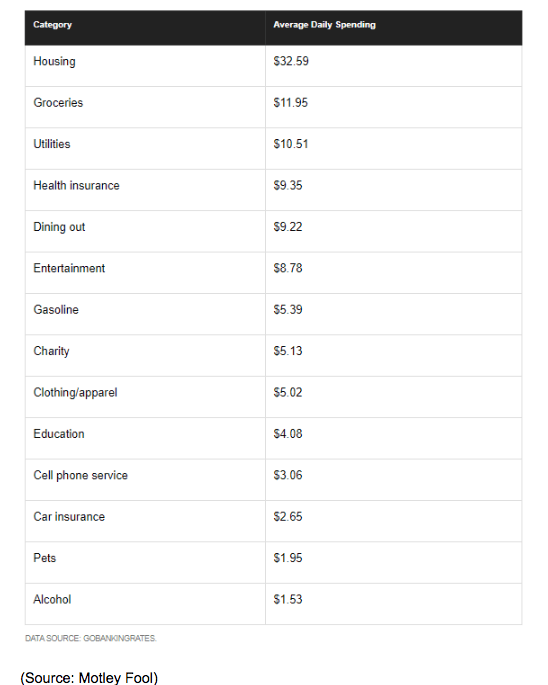

According to a March 2019 gobankingrates.com survey, the average American spends $164.55 per day (about $60K per year). While some of that is non-discretionary (such as housing and utilities) there is a lot of fat that most people can cut out of their budget.

If you can increase your savings rate by just 10% to 20%, then based on that survey data, that translates into $6,000 to $12,000 per year in additional saved income that can be invested.

Then if you take Buffett’s advice and put that in a low-cost index fund that earns just 7% inflation-adjusted returns over time (historical norm) those savings alone translate into significant wealth later on

- After 5 years: $36,919 to $73,839

- After 10 years: $88,701 to $177,403

- After 20 years: $263,191 to $526,382

- After 30 years: $606,438 to $1,212,876

Keep in mind that’s merely the future, inflation-adjusted value of the savings the typical American can realistically achieve. Any current savings you have now would add to those totals.

Don’t get me wrong, I love movies and eating out. Every Sunday (my single day off each week) I feast on Subway and Dairy Queen shakes, while binge-watching Netflix. So I’m not advocating living a life of poverty, but merely prioritizing your luxury spending.

In fact, I wrote an entire article about my approach to personal finance, including how the Buffett budget rule can help ensure a prosperous retirement.

The point is that investing is always done in the future, and so not just should you use the strategy that’s most likely to achieve your goals, but you need to focus on controlling costs, because returns in any given year are completely unpredictable.

Which brings us to the final Buffett tip for getting rich.

You Don’t Have To Be Smarter Than The Rest Of Wall Street, Just More Disciplined

My favorite Buffett quote of all time is “we don’t have to be smarter than the rest, just more disciplined”.

While Buffett’s early success was based on deep value investing in relatively little known companies (his “cigar butt” partnership days), his biggest gains over the years came from Berkshire investing infamous blue-chips but at opportunistic and deeply undervalued levels.

The simplest truth of good investing is “buy low, sell high”. However, it’s far easier said than done, because deeply ingrained human psychology (both on the fear and greed side of the equation), makes market timing seem incredibly attractive.

I’ll admit that right now I’m watching the market’s steady rise with amazement and trepidation, as weakening economic and earnings growth fundamentals don’t support the kind of low-volatility, steady climb higher we’re seeing.

Am I tempted to sell? Part of me is because the current economic data and trends point to a recession coming in 2020 or 2021, and so a bear market seems highly likely within the next year or two.

Selling now and then buying back in after a 30% (average bear market low since 1926) decline seems like such a smart thing to do! But if market timing were easy, then the fortune that Wall Street has spent on computerized trading would have allowed some financial firms to own half the planet by now.

That’s why I remain 100% invested, with no plans to sell, even if my economic models say a recession (and bear market) is right around the corner. After all, history is merely a useful guide to the future, not a crystal ball.

All forecasts, no matter how good the model, are probabilistic in nature, and my primary investing goal is to maximize safe and growing dividend income over time.

That’s why my new approach to my high savings rate, is best summarized by my two model portfolios

- Deep Value Dividend Growth Portfolio (targets 13+% long-term returns)

- Bunker Dividend Growth Portfolio (100% undervalued dividend aristocrats and kings, the ultimate recession-proof income portfolio)

Those are each built of carefully curated watchlists that represent the culmination of five years of research including a proprietary quality score based on dividend safety, business model risk, and management quality.

My goal is to not just select quality dividend stocks worth owning (at the right price) but also to know which are the true blue-chips (8 or higher on my 11 point quality scale) and which are the sleep well at night or SWAN stocks (9 or higher).

I’ve also programmed one of the spreadsheets (my “green list”) to tell me when each company is trading within 5% of its 52 week low, thus becoming an “ultra value” (undervalued blue-chip). That’s how I picked up this 5.4% yielding blue-chip last week, which is now my biggest holding.

Essentially, almost a quarter century of investing experience has taught me that there is no get rich quick scheme that you can rely on to build your fortune and ensure financial freedom.

Rather it’s a collection of quality companies (in this case mostly blue-chip dividend growth stocks), bought at opportunistic times at great prices, and then held for the long-term, that’s the best chance I (or my readers) have to achieving our dreams of a prosperous future and rich retirement.

Bottom Line: Buffett’s Success May Be Extreme, But His Approach Can Make Most People Rich Over Time

Don’t get me wrong, I’m not saying that you or I can ever live up to Buffett’s success. The greatest investor of all time is not a good benchmark to compare yourself too.

However, Buffett’s overall long-term, disciplined and value-focused approach to buying quality companies at opportunistic times is one that is backed up not just by his own $85 billion fortune, but by decades of market studies as well.

Ultimately the power of Buffett’s advice stems from its simplicity, including three of his most useful tips for anyone looking to get rich over time

- Smart money bets on the long-term success of the US economy

- Keep costs low (and save as much as possible) and stay in your circle of competence (use cheap index funds if you’re not comfortable picking stocks)

- Patience and discipline are far more important than market timing because those things are what Wall Street can’t match (your competitive advantage)

While I’m not an index investor myself, due to my needs for higher income than what most ETFs can offer, I 100% agree with Buffett’s focus on low-cost investing, with a long-term focus, and controlling what you can (such as your savings rate and invest expenses), rather than obsessing over volatile short-term market swings.

Ultimately I’m highly confident that if you follow these three Buffett tips for getting rich, then they represent your best bet at achieving financial freedom and the retirement of your dreams.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!