I’ve been patiently waiting to add Toll Brothers (TOL), which is my favorite name in the housing sector and I think the moment has arrived. Toll stock got hammered by as much as 10% on Tuesday morning before sharply recovering. The stock has been in a steady decline losing some 38% so far this year.

But now, I think following the reaction to its earnings report on Tuesday, the set may be building a base and setting up a good risk/reward entry point.

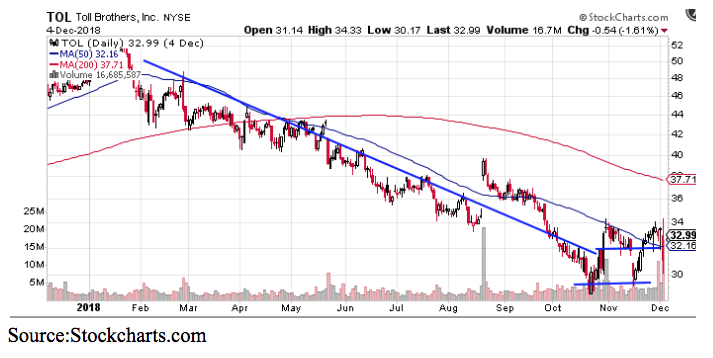

You can see on the chart shares held a double at the $30 level and by bouncing back towards $33 have broken the long-term downtrend. What was interesting to see on Tuesday was that the stock initially dropped 10%, following the earnings report. But by midday, it actually turned positive before settling fractionally lower.

That is the type of price action suggestive of a washout that occurs when a bottom is being formed.

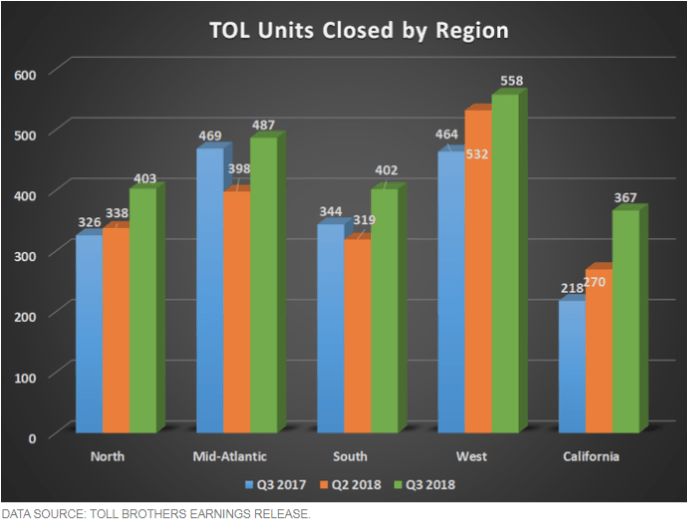

Toll beat earnings estimates but lowered its forecast due to weak demand in November, reflecting a declining demand followed by further softening in November. The biggest decline being in California.

During fiscal fourth-quarter, net signed contract value of homes sold 15% from a year ago — to $1.50B. The number of contract units of 1,715 was a decline of 13%. This being the first year-over-year declines since 2012.

During the conference call, Toll CFO Martin P. Connor said, “current market conditions create a wide range of possible scenarios for our full year results. While we are targeting modest community count growth by FYE 2019, we have limited our forward-looking income statement guidance to the first quarter of 2019.”

This is sharp contrasts from just a month ago when Conner told analysts that Toll has better visibility than its peers — thanks to a longer backlog and its high price point homes. This quarter, the average sale price was $850,000, with luxury buyers who are less sensitive to an incremental increase in interest rates being targeted.

But here’s the deal…

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!