POWR Stock of the Week Under $10: ProFrac Holding (ACDC)

Teaser: Oil prices were nothing if not volatile last year, and nothing indicates this year will be any different. With prices trading at the bottom end of the range as we enter 2024, now may be a great time to take a look at some beaten down oil stocks. One company working to get the supply/demand mix right for its products after a rough patch in 2023 is ProFrac.

Oil certainly had an up and down year in 2023, gyrating between fears supply would be curtailed by OPEC, driving prices higher, and fears of a recession, which would crush demand, driving prices lower. And while crude finished the year near the low end of its range, now may be a perfect time to look at oil stocks as it looks more and more like a soft landing is in progress.

One oil stock which had a rough 2023 but which management feels is on track to outperform in 2024 is ProFrac Holding (ACDC). ProFrac manufactures fracking units and pumps for the oil drilling industry. The company has recently been expanding into electric fracking units which reduce both carbon emissions and noise pollution.

2023 caught the company a bit flat footed in matching their units and pumps with the erratic demand. But, as Executive Chairman Matt Wilks put it in the latest earnings release, “”Our current visibility gives us confidence that 2024 will be much improved over 2023. We are well-positioned and excited for the coming year.” Which means this could be the perfect time to pick up ACDC on the cheap.

The company currently trades at 9x earnings, and 6x forward earnings, with a PE ratio of just over 8. Its stock is going for a lowly 0.5x sales and 4.2x free cash flow, which puts it in the undervalued category in my estimation. Its gross margins currently clock in at around 30%, and operating margins close to 20%.

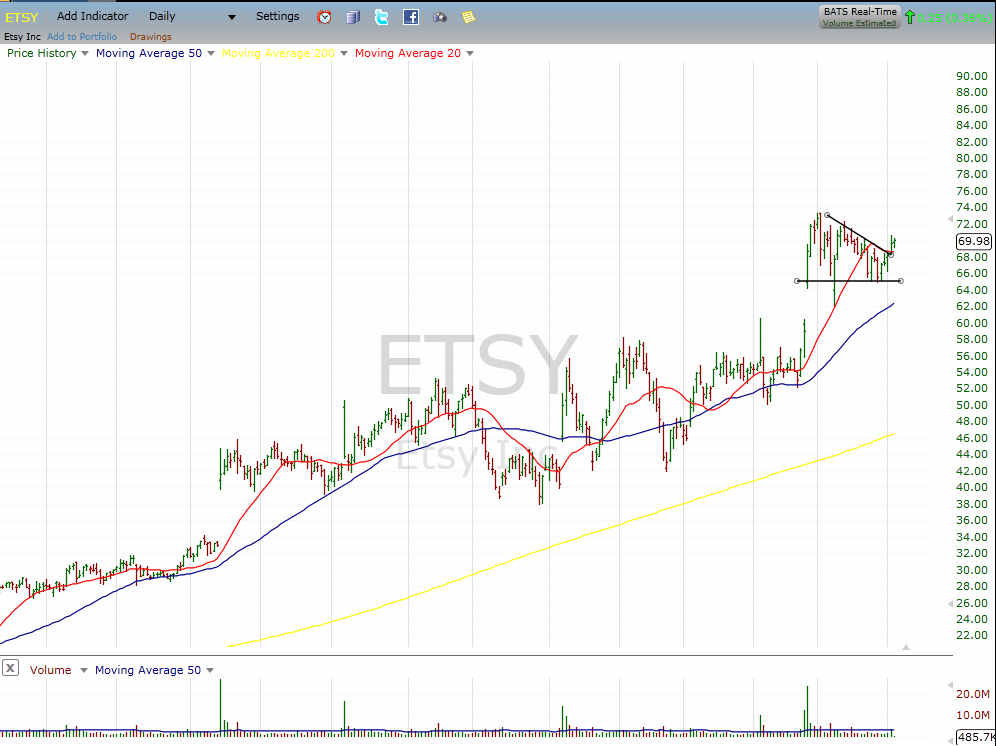

The stock, which is now just under $8, traded as high as $14.00 last year as oil prices rose over the summer. Right now the consensus target price is nearly $5 higher than the current price, which should put the company in a great position if oil bottoms out here.

What To Do Next?

If you like the stock shared above…then you will love this new special report sharing 3 low priced companies with tremendous upside potential.