I think we can all agree that the political uncertainty coming out of Washington in the last few months hasn’t been great for stocks. In fact, the combination of mixed messages from both the Fed and the White House over several key risks has largely been responsible for the most severe correction since The Great Recession (S&P 500 closed 19.8% off its all-time high on December 24th).

Now the government shutdown, which is on day 11 and counting, threatens to pile even more uncertainty onto a frightened and highly volatile market. While we all hope for a quick resolution to this partisan gridlock to alleviate this needless risk, it’s important for investors to know just how bad things could get if our leaders continue to mess up and drag this out too long.

There’s one risk in particular that the media and market have been largely ignoring, but which might end up giving stocks fits if the shutdown doesn’t end soon.

Why The Government Shutdown Could Drag On For Weeks Or Even Months

Back in February (the last shutdown), President Trump warned that he would never again sign a spending bill that didn’t include money for his border wall (a key 2016 campaign promise). Specifically, Trump is demanding $5.1 billion for a “steel slatted fence with pointy tops” (not technically a wall).

The current budget provides $1.3 billion for Mexican border fencing and ultimately this is what the shutdown showdown is all about. Both the House and Senate have the ability to pass a continuing resolution spending bill that would keep the government open through February 9th (thus kicking the can down the road).

But since such a bill would merely push off the final showdown, the President is determined to finally deliver on his campaign promise. The administration has offered to compromise and last week reduced its demand to $2.5 billion. That deal was rejected by the Democrats who are facing their own complex internal political battle.

Specifically, the Democrats are taking over the House on Thursday, January 3rd. However, while Nancy Pelosi, the current Minority Leader, has said she’ll immediately propose a continuing resolution (that the House would vote on) to end the shutdown, that bill, if passed, would have just $1.3 billion in border fence funding.

Trump would likely veto that, even if the Senate passed it. And since funding bills require a filibuster-proof 60 Senate votes, there is no guarantee that such a bill would even make it to Trump’s desk.

In fact, given that Pelosi is facing a major leadership challenge from new progressives that won in November, her bill might not even pass. That’s because progressives are dead set against the wall arguing that it’s both unnecessary and implicitly racist. Thus new house members like Alexandria Ocasio-Cortez (the first openly socialist House member in history) has argued that Pelosi should offer zero in fence funding.

Terry McAuliffe, former head of the DNC, Virginia governor, and possible presidential hopeful in 2020 is not nearly so extreme, but even he has said that $1.3 billion is more than enough and that Democrats “shouldn’t give an inch” on the Wall.

The trouble is that both sides appear to be getting further apart and digging in for a long fight. Pelosi won’t officially be made Speaker of the House until her party caucus votes, which is expected to be in mid-January. Thus this appears to be the most realistic timetable on her compromising on wall funding above $1.3 billion. Insiders are telling the press that any compromise before then would risk her losing the top job to a challenger who is seen as “standing up to Trump”.

But it’s also possible that the shutdown lasts beyond mid-January, at which point it would already be over three weeks in duration and the longest in US history. That’s because some Democrats feel that they are “winning” on this shutdown fight because the most recent poll (Dec 27th) shows that Trump is blamed by 47% of Americans for this mess while 33% blame Democrats.

But Republicans point to the fact that during the 2013 shutdown (over repealing Obamacare) they were also blamed but recovered within 13 months and then picked up seats in the 2014 midterms. Meanwhile, Democrats are seeing their base energized by this fight, because it’s a chance to challenge Trump on what he appears to care about most.

Ultimately both parties, while caring about winning in 2020, are currently betting that voters will have shorter memories than their core supporters. Thus there is a real risk that the shutdown fight drags on not just for two more weeks, but possible for several months.

While I certainly hope that doesn’t happen, and that this fiasco is over by mid-January, such a scenario could prove disastrous to both the economy and the stock market.

The Big Threat That Everyone Is Missing

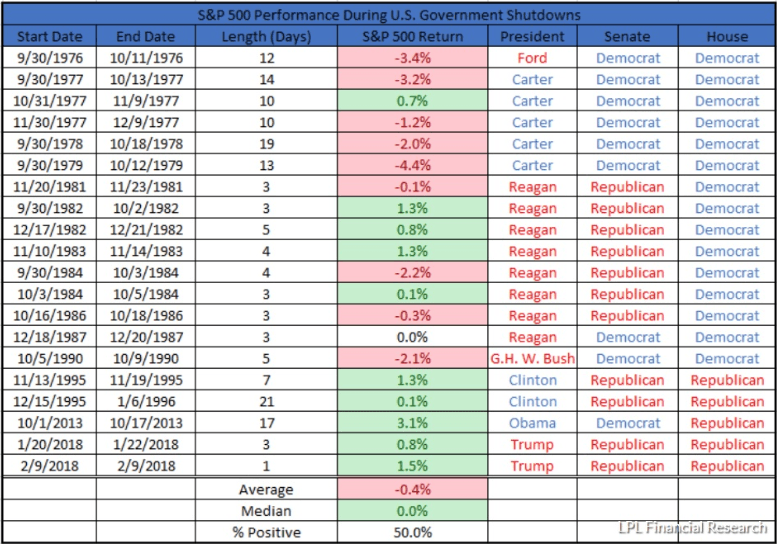

In the past, I’ve already explained in detail what the major risks to the economy and stock market are from a shutdown. The risk of a rapid market meltdown is relatively small since historically stocks tend to remain flat during most shutdowns.

Of course, since the market’s average daily gains are 0.06% that means that the typical shutdown still knocks 0.3% to 0.7% off the market’s returns compared to it not occurring.

The damage to the economy, according to a 2014 government study, amounts to about $5 billion per week, or about 0.1% off that quarter’s GDP. That’s largely due to 800,000 government workers (25% of the Federal workforce) not getting paid which puts financial stress on families and hurts consumer spending (65% to 70% of our economy).

So theoretically if the shutdown were to last all quarter, US GDP could fall from 2.1% (New York Fed’s latest estimate) to 0.9%. That’s dangerously low and would set off major warning flags. Or it would except for the biggest shutdown risk that few people realize even exists.

That would be the fact that the US government, among its many roles, provides a treasure trove of critical economic data each week. The Labor Department is thankfully funded through September 2019 so we’ll continue to get jobs related information (like January 4th’s jobs report).

However, the Commerce Department (Burea of Economic Analysis and Census Bureau) and Agricultural Department are shut down. This means that critical information about trade, financial flows, and inflation is going to be missing or severely delayed the longer this goes on.

And while you may scoff at the idea of a self-described macro nerd being worried about a lack of data, consider this. The Fed is meeting eight times in 2019 and has said that every meeting is “live” meaning that changes to interest rates are possible at each meeting.

On December 19th and 20th, the stock market tanked because the Fed signaled two more hikes next year and said it would continue rolling off its balance sheet, thus sucking $300 billion out of the economy each year. Fed Chairman Jerome Powell and New York Fed President William Dudley also said that there was a lot of uncertainty about both rate hikes this year, and how long quantitative tightening (balance sheet roll-off) would last. Ultimately the Fed’s interest rate and monetary policies in 2019, on which the stock market is focused on like a laser, is 100% data dependent.

Specifically, the Fed, including regional banks like Atlanta and New York, (both which have their own real-time GDP growth models) will be looking at their best estimate of how fast our economy is growing and what inflation is doing.

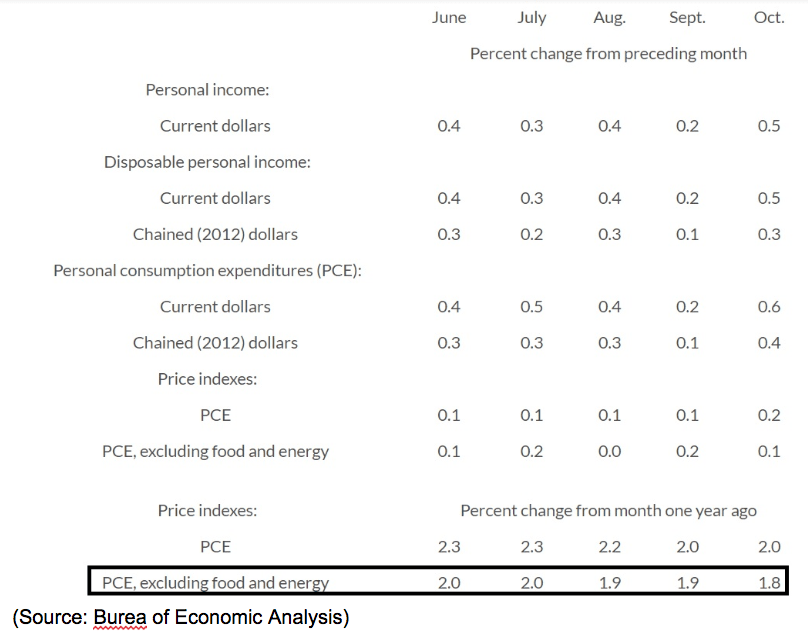

The key inflation measure the Fed uses is core PCE, which it wants to average 2.0% over time. The latest data from the BEA (now shut down) shows that core inflation never broke above the Fed’s long-term target and has actually been falling in recent months.

If the Fed saw that core PCE was continuing to fall (the most recent inflation reports indicate it probably will) then the FOMC would have all the justification to avoid hiking rates any more, at all.

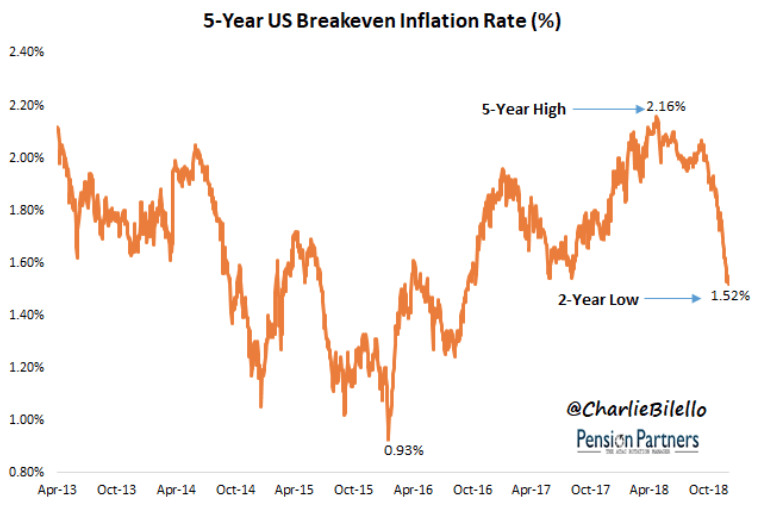

The bond market is currently anticipating inflation averages just 1.5% over the next five years. And over the next 10 and 30 years inflation expectations are running at 1.7% and 1.8%, respectively both beneath the Fed’s target. In fact, bond market inflation expectations are centered on the consumer price index, not the personal consumption expenditure index. CPI tends to run 0.1% to 0.3% higher than PCE over time which means that core PCE might be headed to 1.2% to 1.4% in the coming months.

Normally the Fed would take such information and NOT hike anymore. In fact, it would likely end QT as well, for fear of slowing the economy too much. That could help boost stocks or at least keep them from falling much further below today’s levels.

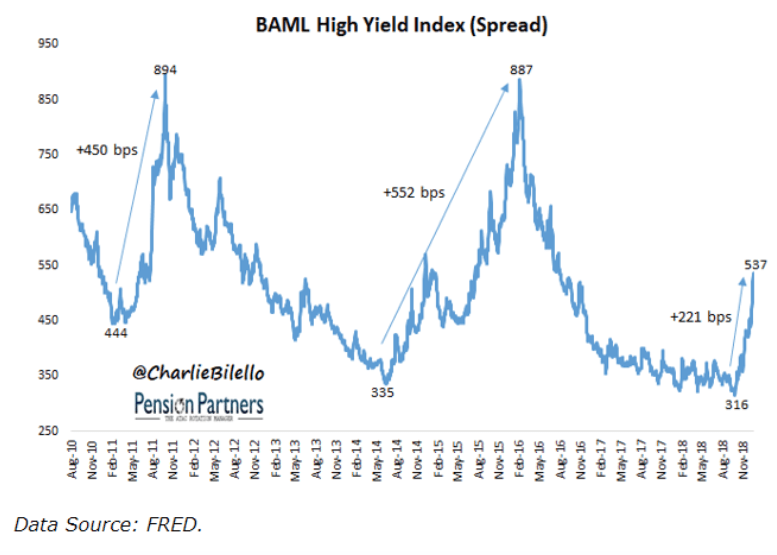

That’s especially true given that slowing economic growth expectations, crashing oil prices, and generally more fear in financial markets has caused junk bond spreads (relative to investment grade bond yields) to soar in recent months.

Corporate debt has doubled since 2007 and trillions of additional junk bonds have been borrowed by financially shaky companies. Corporate bond yields, in general, have been rising (by about 2%) since the Fed started hiking. Now junk bond yields are soaring meaning that weaker companies are going to have a far more difficult time refinancing their maturing debt in the coming years (if these spreads persist over time).

None other than the Fed itself, both in recent reports and former Fed Chair Janet Yellen, have warned that junk bonds (leveraged loans in particular) are a potential catalyst for another financial crisis and could tip us into a recession. While a 2008-2009 style meltdown would be unlikely (because big banks that underpin the credit markets are not the ones holding those loans) should financial conditions worsen too much then we could see a wave of corporate bankruptcies that accelerates beyond the ability of the job market to replace layoffs.

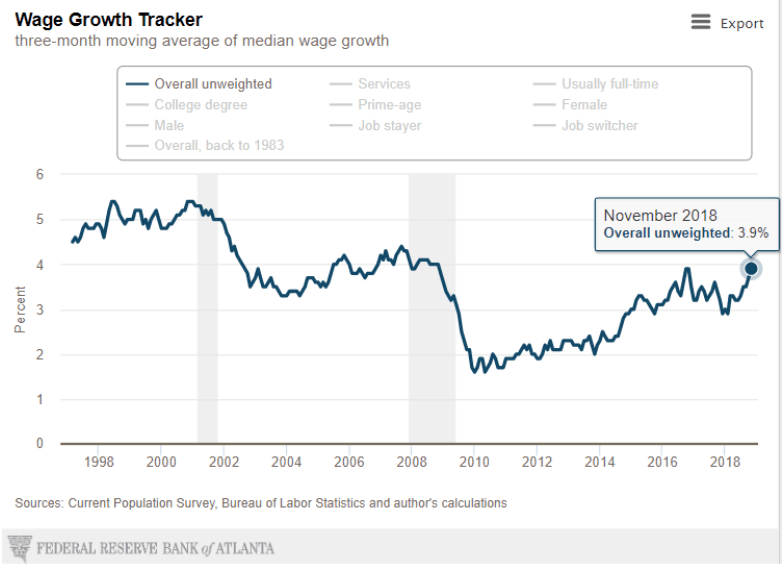

That, in turn, would mean that unemployment would start rising, and the strong wage growth that has taken a decade to achieve could quickly reverse.

Consumer spending has remained strong thanks to Main Street remaining confident and shaking off the recent correction. But that’s purely due to the best job market in 20 years (and the lowest unemployment in 50 years) causing strong and accelerating wage growth.

If interest rates, both the Fed Funds rate, and junk bonds, reach a tipping point, then a sharp acceleration in layoffs could cause negative job growth for the first time in nearly nine years. That would greatly reduce consumer confidence, and decreased spending could rapidly cause US economic growth (and corporate earnings) to decline all the way to zero or beyond.

In other words, the Fed, which is trying to orchestrate a “soft landing” for the US economy while undoing a decade of unprecedented low interest rates, is at high risk of making a mistake and triggering a recession. How big? Well since the Fed has hiked rates ahead of the last 12 recessions, including 16 times before the Financial Crisis (partially triggering the housing collapse that kicked off the Great Recession) let’s just say the Fed’s track record on rate policy leaves a lot to be desired.

And keep in mind that those 12 rate hike mistakes (Fed hiking until the economy broke) were all done with the Fed having 100% access to weekly economic data from all government agencies. If the Fed is cut off from key inflation data (all of which comes from the BEA) then Powell and company will be flying blind during a time when the shutdown itself might be slowing growth to dangerous levels.

And let’s not forget that the Commerce Department is also who supplies trade data, which our leaders need to know since trade negotiations are attempting to avoid a major escalation in the trade war (deadline is March 1st).

The point is that the two biggest risks to the economy in 2019 (and thus the stock market) are Fed monetary policies and the trade negotiations falling apart. A lack of critical economic data pertaining to economic growth, inflation and trade could greatly increase the risk of our leaders in DC making a big mistake that sends the economy into a recession and stocks plunging into a bear market.

Bottom Line: Besides Hurting The Economy The Shutdown Is Cutting Off Important Economic Data That Our Leaders Needs To Make The Right Decisions In 2019

Don’t get me wrong, I’m not trying to scare anyone out of investing in stocks right now. After all, today’s valuations mean that the S&P 500 is about 10% undervalued (historically speaking). And it’s still likely that the shutdown ends within the next few weeks, which would restore both some hope to Wall Street, as well as the vital economic data the Fed needs to make the right choices in 2019.

However, should the worst-case scenario play out, and both sides decide to go to the mat and keep the shutdown going for perceived political gain, then not just will the economy slow considerably in 2019, but worse still vital economic, inflation, and trade data won’t be available to help our leaders make smart choices.

In other words, should the shutdown drag on into February or even March, then we’ll be facing substantial economic risks at the same time as economists (including at the Fed) will be flying partially blind. That would increase the risks of the Fed making a disastrous mistake, such as not listening to the bond market’s warnings about falling growth and inflation expectations.

Thus far the bond market (the best recession predictor ever discovered) is not yet warning of a recession. But a major error on the part of the Fed (who has partially or fully caused the last 12 recessions) could change our economic outlook in a major way in 2019, and potentially cause stocks to once more begin dropping violently.

This is why it’s imperative that investors always hope for the best but are prepared for the worst. Specifically, that means maintaining a bunker portfolio that has both the right asset allocation for your individual risk profile (that will help you sleep at night and avoid panic selling stocks), as well as a diversified collection of quality companies that can withstand any nasty economic/political surprises that might come down the road in 2019.

The Greatest Trading Book Ever Written

Adam Mesh been working very hard to introduce you to the greatest trading book ever written. At his trading firm, the very first thing that any new trader had to do was read this book. They wouldn’t be allowed in his office if this book was not read. Now, he’s taken this book and built an entire trading system around it. For anyone that has any interest in trading, this is a must-read. It’s about success, failure and then success again. This book is being offered today, Get Your Copy Now

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!