Stocks are now on track for their worst December since The Great Depression. That’s thanks to a number of big risks piling up including Fed rate hikes, the trade war, slowing economic growth (in the US and globally), crashing oil prices, and fears about the yield curve inverting.

Now investors have yet another risk to worry about, a possible government shutdown this weekend (the third one in 2018). Let’s take a look at just how serious this might be for the country, America’s slowing economy, and your portfolio.

Why the Government May Shutdown This Weekend

On Friday at midnight, nine federal departments and some smaller government agencies (like NASA, the FDA, and EPA) representing 25% of the Federal government have their funding run out. These include Homeland Security, Agriculture, Commerce, Interior, Agriculture, Housing and Urban Development, Justice, and Transportation.

This risks the third government shutdown of the year. Lawmakers have the legislation in place to fund these agencies but the issue is President’s Trump insistence on receiving $5 billion to fund his Mexican border wall, a key campaign promise. The current funding proposal calls for just $1.6 billion for that Wall and Trump said last week that he would be “proud” to veto such a bill and force a shutdown over the issue.

This week the President walked back that threat when White House press secretary Sarah Huckabee Sanders told reporters “We have other ways that we can get to that $5 billion” and will “work with Congress” to do so. The administration has hinted that Trump would be willing to sign a short-term spending bill that pushes back a possible shutdown until January when the new Democratically controlled House gets seated.

In order to avoid a shutdown starting this weekend, current Senate Majority leader Mitch McConnell has proposed a compromise in which $1.6 billion in funding is provided for the border fence (even $5 billion isn’t enough for an actual wall) plus a $1 billion increase for immigration. However, Democrats, including incoming House Speaker Nancy Pelosi have called this $1 billion in added funding a “slush fund” and have rejected the idea.

Democrats have made two proposals of their own. The first is to just punt and pass a short-term spending resolution that moves the entire issue to January. The second is to pass funding for six of the seven agencies (with Homeland Security getting the same funding) and the border fence funding issue alone being pushed back a few weeks.

The last two government shutdowns this year lasted one and three days, respectively, and were ended by short-term funding resolutions.

After his first compromise was rejected, McConnell announced that the Senate (run by the GOP) will be passing a funding bill to keep the government open through February 8th. The bill will be a continuing resolution with the same $1.6 billion in currently approved border fence funding.

Trump’s latest tweet, not surprisingly, was full of braggadocio, “one way or the other, we will win on the Wall!” One way that Trump has hinted he might do that is to divert money from the Pentagon towards the border fence. Budget experts say such a move would be illegal and require the approval of four Congressional committees, two of which will be controlled by Democrats in two weeks.

According to a Politico/Morning Consult poll (the most recent on the issue), 55% of Americans are opposed to shutting down the government over the border fence funding, while 31% are in favor. Trump’s base is in favor of a shutdown over such funding, 60% to 31%. Among all Americans, 41% would blame the President (58% the GOP) vs 31% who would blame Democrats for the third shutdown of the year.

Ok, so the government shutdown is just an example of our dysfunctional and hyperpolarized government in non-action. But what does this potential shutdown mean for the economy and the stock market?

What It Would Mean For The Economy

Due to security concerns, 420,000 employees of these affected departments and agencies would be exempted from being furloughed. 380,000 employees would be told to stay home and would not receive pay until the funding issue is resolved (they’ll get back pay later). The interruption in pay could hurt those without sufficient emergency funds and could have a small negative impact on holiday shopping (which was expected to be robust this year).

According to a 2014 Congressional Research Service report each week the US government is shutdown costs the economy 0.1% of GDP growth. That equates to about 0.0143% of growth per day, an insignificant amount unless the shutdown drags on for weeks (the longest in history was a 21-day shutdown in 1996).

Now don’t get me wrong, with 12.5% effective tariffs on 50% of Chinese imports (plus various other tariffs in place as well) the US economy is already facing some headwinds.

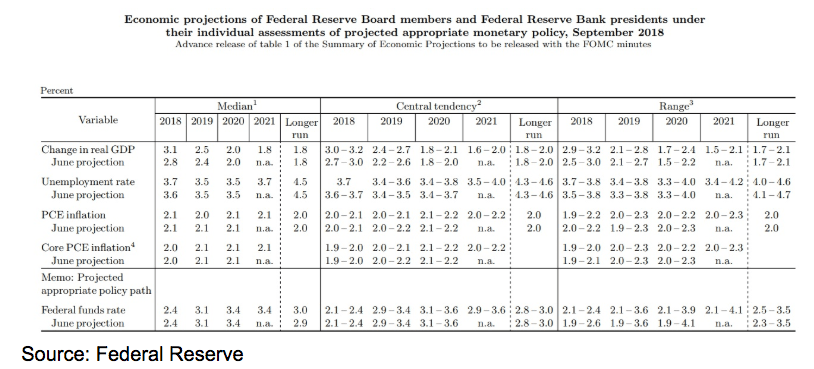

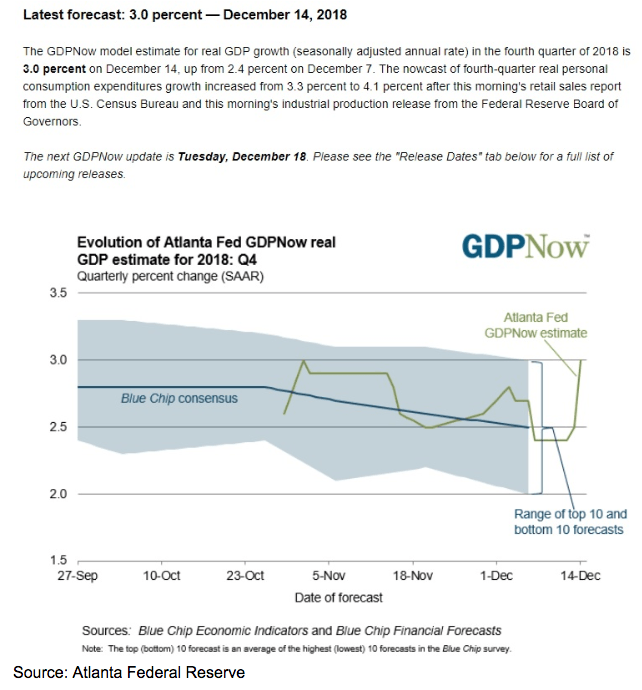

For instance, the Fed was already expecting GDP growth to slow from 3.1% this year to 2.5% in 2019, 2.0% in 2020 and 1.8% in 2021. The trade war, combined with this expected slow down in growth, has resulted in economists lowering their Q4 2018 GDP growth forecasts in recent weeks.

What A Shutdown Would Mean For The Stock Market And Your Portfolio

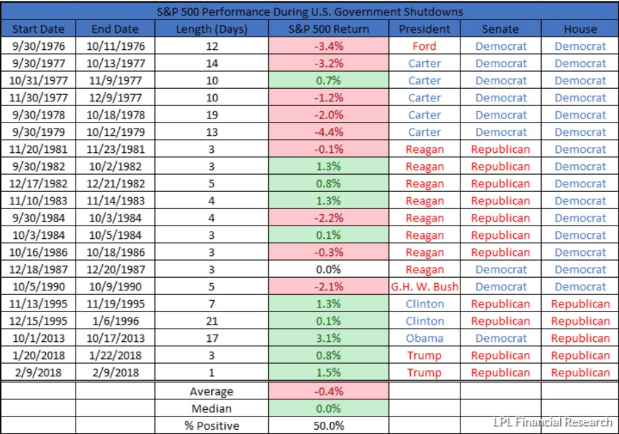

Since 1976 we’ve had 20 government shutdowns and the worst market performance during this time was a modest decline of 3.4%. The average shutdown lasts eight days and sees the market decline by just 0.4% with a median loss of zero.

That’s not to say that shutdowns are totally benign. According to Dow Jones Market Data since 1976 the stock market’s average daily gain has been 0.04%. Thus the average government shutdown ends up hurting total market returns by about 0.3% to 0.7% relative to if it hadn’t occurred.

In addition, in today’s extremely bearish market environment, where investors are hyper-focused on all risks and fear rules the street, it’s possible that a shutdown might create even greater short-term selling pressure. That’s especially true if it ends up dragging on for a long period of time.

Typically a shutdown of less than a week hasn’t hurt the market though that positive track record has to be taken in the proper context. With the exception of the most recent one-day shutdown in February 2018 (which occurred during a correction) the last four shutdowns have all occurred during strong periods for stocks. Thus should one happen now, it might be a nervous few days for investors who are already on edge over worries about slowing economic growth and glued to all news pertaining to trade negotiations with China.

But it’s important to always take a long-term view and remember that most of what happens in DC is not important for stocks in the long-term. As Mark Stoeckle, the CEO of Adams Funds, explains “events like a government shutdown are just part of the growing noise coming out of Washington that investors should ignore.”

While A Government Shutdown Could Boost Volatility, It’s Not Likely To Hurt the Economy Or Your Portfolio Long-Term

Don’t get me wrong, I too am tired of the seemingly never-ending string of bad news and drama that’s coming of Washington these days. But the good news is that a shutdown is far from certain to happen (McConnel has vowed it will not) because both sides are well aware of the fragile nature of consumer and investor sentiment these days.

Even if one does occur, it is likely to have a modest impact on the economy (the fundamentals) and even then only if it drags on for at least a week (55% of shutdowns don’t). And while investors don’t need yet another reason to fearfully sell off stocks right now, the good news is that the average shutdown has historically dinged the market by just 0.3% to 0.7%. That insignificant amount means that even should one occur this time it would be unlikely to plunge us into a bear market.

Thus the best thing for investors to do is to remain calm, and trust your long-term asset allocation to protect your wealth in these turbulent times. There continues to be little risk that we’re in a bear market and a government shutdown is certainly no reason to panic sell at what is likely to be close to the lows of this correction.

The Greatest Trading Book Ever Written

I have been working very hard to introduce you to the greatest trading book ever written. At my trading firm, the very first thing that any new trader had to do was read this book. They wouldn’t be allowed in my office if this book was not read. Now, I’ve taken this book and built an entire trading system around it. For anyone that has any interest in trading, this is a must-read. It’s about success, failure and then success again. This book is being offered today, Get Your Copy Now

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!