Health insurance shares have been falling ill lately. But, the prognosis may take time, and there may be occasional setbacks along the way. Here’s an option’s strategy to pad your portfolio during the process of recuperation.

Even as the broader market has rallied shares of health insurers such as Humana Inc. (HUM), United Healthcare (UNH), and Cardinal Health (CAH) dropped some 15% over the past two weeks and are now near 52-week lows.

The cause of their sickness, are politicians such as left-leaning congress members, and potential presidential candidates, who float wide expansion plans of Medicaid/care, some even proposing complete elimination of private insurers.

If history is an indicator, nothing of substance is going to change, at least until 2020. But, the rhetoric will likely keep a pall over the shares. That said, I think the worst case scenario of elimination of private insurers and drug price rebate limitations have mostly been priced in.

In the meantime, healthcare spending is expected to grow at an average rate of 5.5% every year, reaching nearly $6 trillion by 2025, according to a Centers for Medicare & Medicaid Services study.

I’m not a fan of the rising costs, or that healthcare that now represents nearly 17% of the U.S. economy. But, these are the facts. And another fact is that the health insurance companies are extremely profitable, and will likely remain — even if some changes are made to the system.

The industry has shown itself very adept at adopting to regulations; remember Obamacare was supposed to be a negative, and it turned out to be a major positive, as subsidies covered the least profitable customers. Federal and state governments now fund nearly 45% costs, while allowing them to hike rates across the board.

The insurers are already taking measures to insulate themselves from cutbacks to drug price rebates, telling pharmaceutical companies they need two years to make any changes in price, or a rebate policy to come into effect.

By their very nature, insurers are relatively immune to economic cycles, and will keep delivering profits and paying dividends — even in a downturn. After the recent stocks sell-off, they’re now historically cheap on a valuation basis.

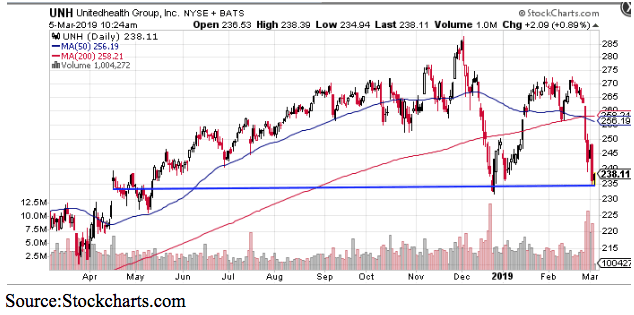

From a technical standpoint, many are now at key support levels. As you can see, United Healthcare, my top pick of the group, has major support in the $230-$235 level.

With the shares currently around $236, one can establish a bull put spread using the April expiration to collect the premium and/or establish the discounted price to purchase shares.

For example, one can sell the April 230 strike puts and buy April 220 strike puts for a net credit of around $3.00 or $300 per spread. If shares remain above $230 at the April expiration you keep that premium which would translate into a 42% return on risk over the next two months.

If the stock drops is below $230 at expiration, you can take assignment of the stock giving you an effective cost basis of $227 per share. That’s a 5% discount to the already-beaten down price.

Either way, this strategy positions you for a very healthy return, as I expect the stock to recover in coming months.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!