Supply vs Demand Explains Why

It is unusual to see such a divergence in between oil and gas, especially one this extreme. But recent developments in drilling, particularly in fracking has changed the supply/demand equation.

Essentially the world now has too much of light crude oil, that comes mostly from the U.S., which are most suitable for producing gasoline and too little of the heavier crude oil varieties that come from OPEC and South America which are better for diesel, jet fuel, and fuel oil.

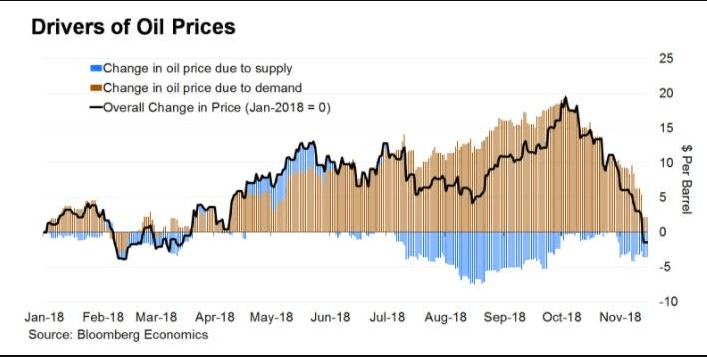

The consensus is that the decline in oil is mostly the result of too much supply, as OPEC failed to stick with their proposed production cuts. Russia and Saudi Arabia are now reportedly discussing cutting output by 1.4 million barrels per day.

Ziad Daoud of Credit Suisse calculates that weaker demand accounts for $18, or 85%, of the price decline, while supply is responsible for the remaining 15%. In deriving his calculation, Daoud observed that the IEA (and even OPEC) recently lowered their forecasts for the growth in oil demand next year, citing a slowing global economy caused by rising trade tensions, higher interest rates and turmoil in emerging markets, as the reason behind the downgrade.

On the other hand, natural gas demand has increased the first half of 2018 by 12%, compared with a year earlier. Exports have also doubled on average this year compared, with 2017, according to the EIA.

This record natural gas consumption comes as we now head into the winter heating season, with fewer supplies in storage than any other year since 2005.

The Northeast, which lacks the pipelines needed to move natural gas, experienced even sharper price increases, which could impact heating bills this weekend.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!