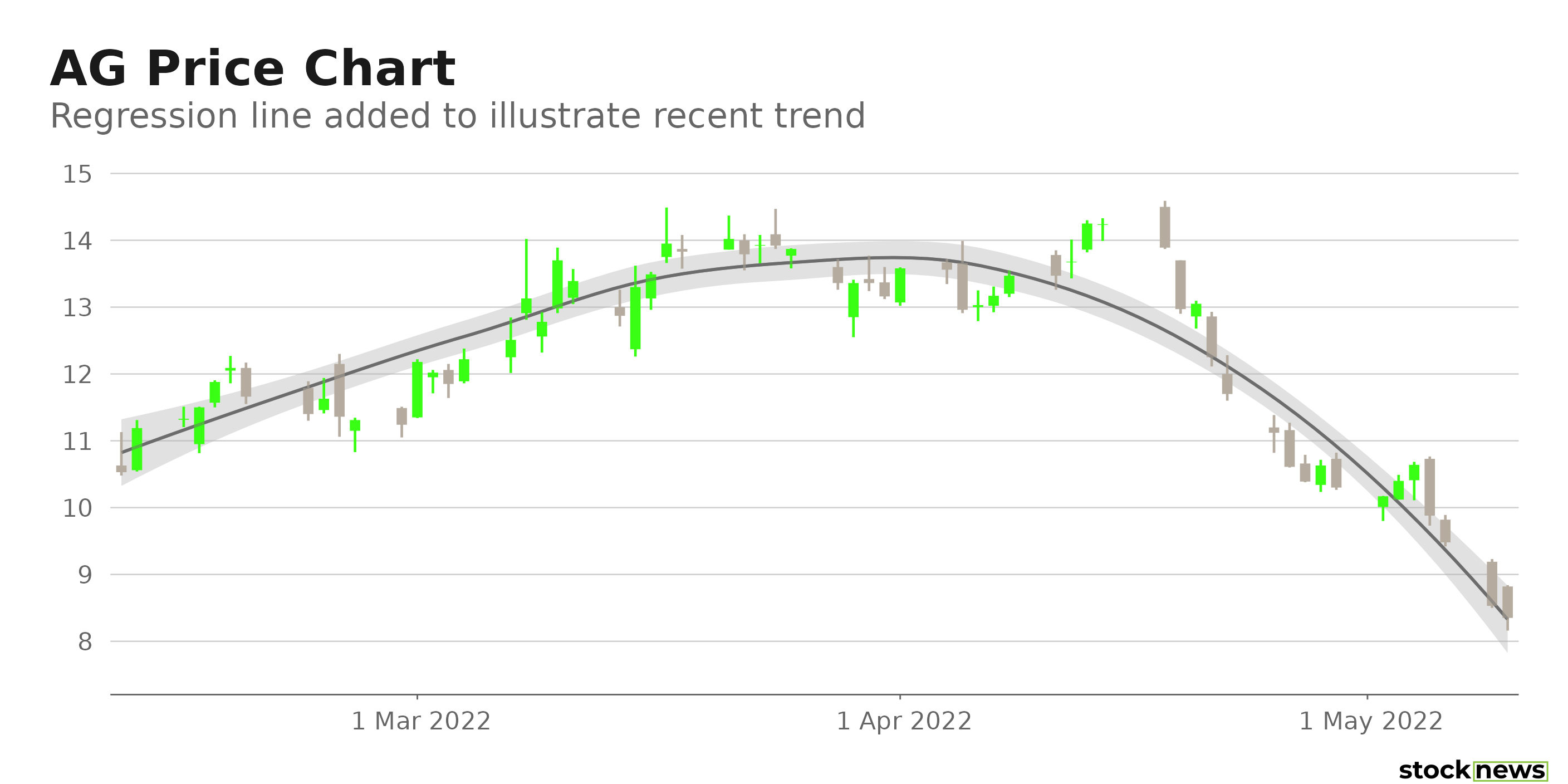

Headquartered in Vancouver, Canada, First Majestic Silver Corp. (AG - Get Rating) acquires, explores for, develops, and produces mineral properties, focusing on silver and gold production in North America. AG shares have declined 47.2% in price over the past year and 40.1% over the past six months to close yesterday’s trading session at $8.35. The stock has slumped 24.8% year-to-date. Furthermore, BMO Capital analyst Ryan Thompson lowered his price target on the stock while maintaining his Market Perform rating. The analyst also reduced his EPS expectation for the first quarter of this year.

The company produced 7.2 million silver equivalent ounces, consisting of 2.6 million ounces of silver and 58,892 ounces of gold, in the first quarter. Its total production increased 59% year-over-year, due primarily to the acquisition of Jerritt Canyon, but decreased by 16% sequentially due to high absenteeism related to an increase in COVID-19 cases in January and February, which resulted in lower processed tonnes across all Mexican operating units. Also, Thompson stated that AG’s consolidated gold and silver production for the quarter missed estimates by 14% and 19%, respectively.

AG has been trying to ramp up its operating capabilities at its mines, and “many of these efforts are expected to begin showing positive results in the second half of 2022 as we bring two past-producing underground areas, West Generator and Saval II, back into production,” said Keith Neumeyer, President, and CEO.

Here is what could shape AG’s performance in the near term:

Weak Bottom-Line Performance

For its fiscal year ended Dec. 31, 2021, AG’s revenues increased 60.5% year-over-year to $584.12 million. However, its mine operating earnings decreased 3.5% from their year-ago value to $101.42 million. The company’s net earnings came in at a negative $4.92 million, indicating a substantial decline from its year-ago value of $23.09 million, while its EPS stood at a negative $0.02 compared to $0.11 in the prior year. AG’s total comprehensive income declined 156.7% year-over-year to a negative $18.72 million. And its adjusted net earnings were $6 million, or $0.02 per share.

Lofty Valuation

In terms of forward EV/Sales, AG is currently trading at 3.01x, which is 96.3% higher than the 1.53x industry average. Its 35.54x forward P/E is 195.6% higher than the 12.03x industry average. Also, AG’s 2.78 forward Price/Sales ratio is 123.6% higher than the industry average, while its 9.35 forward Price/Cash Flow ratio is 36% higher than the industry average.

Poor Profitability

AG’s 8.01% EBIT margin is 44% lower than the14.31% industry average. Also, its net income margin and levered FCF margin of negative 0.84% and 1.68%, respectively, are substantially lower than the 8.76% and 5.62% industry averages. Also, AG’s ROE and ROA of negative 0.44% and 0.23%, respectively, compare with the 13.16% and 5.26% industry averages. And Its 2.20% ROTC is 70.1% lower than the 7.37% industry average.

Unfavorable POWR Ratings

AG has an overall D rating, which translates to Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a D grade for Quality, consistent with its bleak profit margins.

AG has a D grade for Value. Its stretched valuations justify this grade.

Among the 10 stocks in the F-rated Miners – Silver industry, AG is ranked #8.

Beyond what I have stated above, you can also view AG’s grades for Sentiment, Growth, Momentum, and Stability here.

View the top-rated stocks in the Miners – Silver industry here.

Click here to check out our Gold and Silver Industry Report for 2022

Bottom Line

Geopolitical issues and rising inflation are fostering major uncertainty on Wall Street. Many investors consider silver and gold mining stocks a safe haven amid market turbulence and a hedge against inflation, which could attract renewed attention to AG. However, considering its fundamental positioning, I think the stock is not worth buying now.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low-priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

Want More Great Investing Ideas?

AG shares rose $0.30 (+3.59%) in premarket trading Wednesday. Year-to-date, AG has declined -24.80%, versus a -15.71% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AG | Get Rating | Get Rating | Get Rating |