Back in my days as a market maker on the floor of the Chicago Board of Options Exchange (CBOE) the third Friday of the month was known as ‘gamma day.’

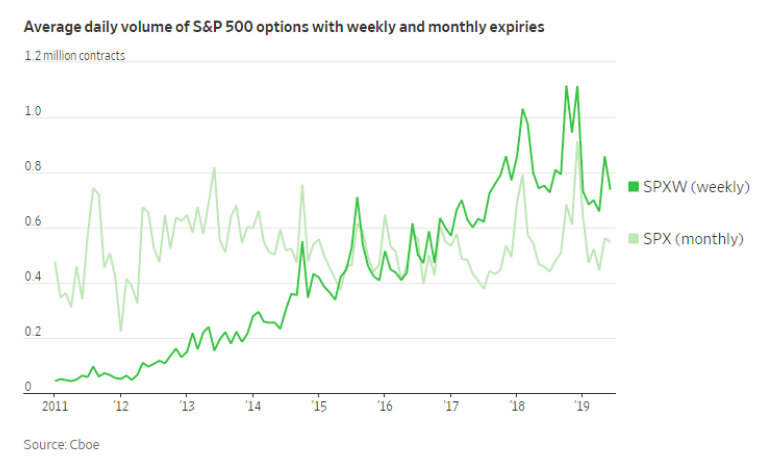

That was prior to 2005 when weekly options were introduced— to show my age, I was on the CBOE from 1991-2002 — ever since gamma day has been a weekly occurrence.

Actually, with some Index and ETFs like SPY having expiration three times a week (Monday, Wednesday, Friday), Gamma scalping has become a full-time feature of the trading landscape, as this article from the Wall Street Journal it may be warping price and volatility levels.

The nut of the piece is “There’s a powerful force at work in markets that helps explain why stocks seem to do nothing for long periods and then suddenly lurch into activity. Market players have noticed this force—known by some as a “gamma trap.”

Before getting to implications, let’s drill down into the definition and mechanics of what an options Gamma is:

Gamma is a second derivative and measures how much your delta will change per unit in price. It means that as prices rise, your delta increases. Or, more pertinently, as prices decline, your delta turns more negative, meaning you get longer as prices go up, and shorter as prices decline. Sometimes, people confuse gamma with vega, which is a measure of volatility. They sometimes act in concert but are not related. Kinda like country and western. I have no idea what that means but you get the gist.

Notice how an option delta becomes more sensitive as expiration approaches. Essentially, on expiration day an ATM option acts just like owning or shorting the underlying shares.

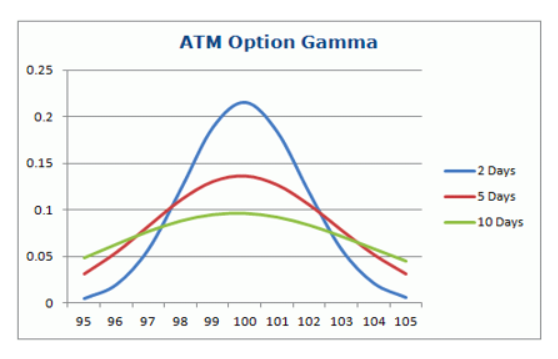

As time approaches expiration, the gamma level of an option increases. Like time premium levels, gamma also falls under the normal distribution curve with the at-the-money (ATM) options having the highest levels of gamma. This is why most people who gamma scalp elect to do so by using the ATM options to buy (or sell if reverse gamma scalping) straddles and strangles.

Here is a graph of the gamma curve:

Gamma scalping is the process of adjusting the deltas of a long option premium and long gamma portfolio of options in an attempt to scalp enough money to offset the time decay of the position.

In practice, it least my day, it simply meant buying both a put and call (usually ATM) on the day of expiration and the buying or selling shares as the underlying price rose or fell, to pick up incremental or ‘scalp small profits’ while maintaining a delta neutral position.

This had a tendency to dampen volatility because as prices rose market makers would sell stock or if buy stock as prices fell. This often led to the phenomenon known as pinning the strike price at expiration.

Since the advent of weekly options, you can see how their popularity has grown, especially over the past few years in which their volume surpassed the ‘regular monthly’ contract.

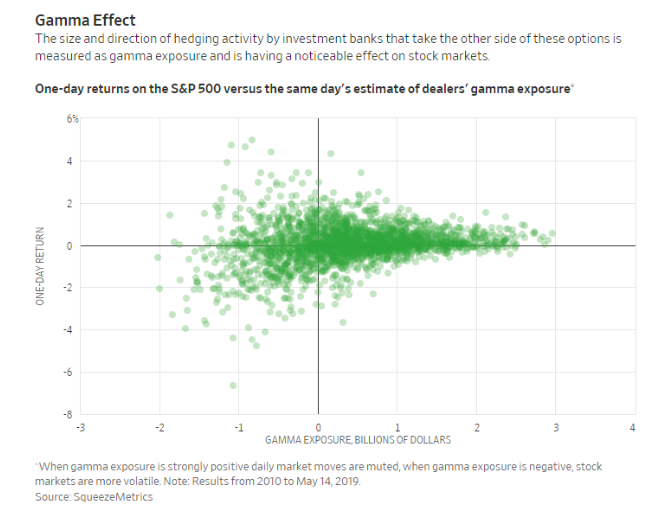

The Journal article is making the case that big investors such as institutions and hedge funds have actually been engaged in “negative gamma” which would entail selling both puts and calls to collect premium.

If you are short gamma (net short options and hence volatility) one usually has to take a defensive stance — which puts them at high risk of compounding losses and setting off a self-fulfilling bout of ever-increasing volatility.

Meaning, as prices rise, one is forced to buy or as prices fall one is forced to sell. This creates a feedback loop. We are already seeing that days with higher negative gamma are producing larger negative returns.

We saw in February of 2018 how an overabundance of people short volatility of VIX products, which is the ultimate negative gamma position, led to Black Swan known as the VIC apocalypse resulting many funds going out of business and trillions of dollars in losses.

If due to the recent drop in interest rates people are back to trying to generate income by selling option premium or shorting volatility, that is could be creating a real danger to market dynamics. It’s like picking up pennies in front of a steam roller; eventually, you and everything in its path, gets flattened.

CBOE shares were trading at $112.95 per share on Friday morning, down $2.20 (-1.91%). Year-to-date, CBOE has gained 16.52%, versus a 23.96% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CBOE | Get Rating | Get Rating | Get Rating |