- Combining technology and pet supplies

- A decline from the highs

- A bullish trend in revenues and earnings

- Chewy is back in the buy zone

- A long-term investment in a recession-proof business

We love our pets. They provide an unconditional love that goes both ways. Cats, dogs, and other pets become a part of the family and become attached to us.

Our family cat, Gia, is getting on in years, and she requires a special diet. The Vet prescribes a specialty food, and Chewy (CHWY) makes sure it arrives each month before we run out.

Chewy is a company that shows its love for pets and their owners by delivering high-quality products to doorsteps. The company has been in business since 2010, with its headquarters in Dania Beach, Florida. In March 2020, when the global pandemic caused selling across all asset classes, CHWY shares found a bottom at $20.62. The convenience of ordering pet food and supplies for home delivery sent the shares to an all-time peak at $120 in February 2021, where it ran out of upside steam.

At the $67.75 level at the end of last week, CHWY is back in the buy zone. The company has plenty of room for growth. The love for our pets makes CHWY as close to a recession-proof business as you can get.

Combining technology and pet supplies

CHWY and its subsidiaries are a pure-play e-commerce business in the United States. The company sells pet food and treats, pet supplies and medications, and other pet-health products and services for dogs, cats, fish, birds, small pets, horses, and reptiles through its chewy.com retail website and mobile applications.

The company offers approximately 70,000 products from 2,500 partner brands.

Aside from its e-commerce position, Chewy’s customer service is one of the best in the business. When my family calls the company hotline, the employees cannot be more helpful. They often know the name of our cat Gia and our ordering history. They work with veterinarians to supply prescribed foods, supplements, and medications with swift delivery.

When there have been supply issues, they have contacted us to rectify the situation. Friends that have lost pets have told us the company sends sympathy cards when they cancel orders because of the loss. Chewy also sends a welcome package for new pet owners. The company goes the extra mile, which secures customer loyalty. Chewy’s employees care about our pets as much as we do, making the company a partner with its clientele.

A decline from the highs

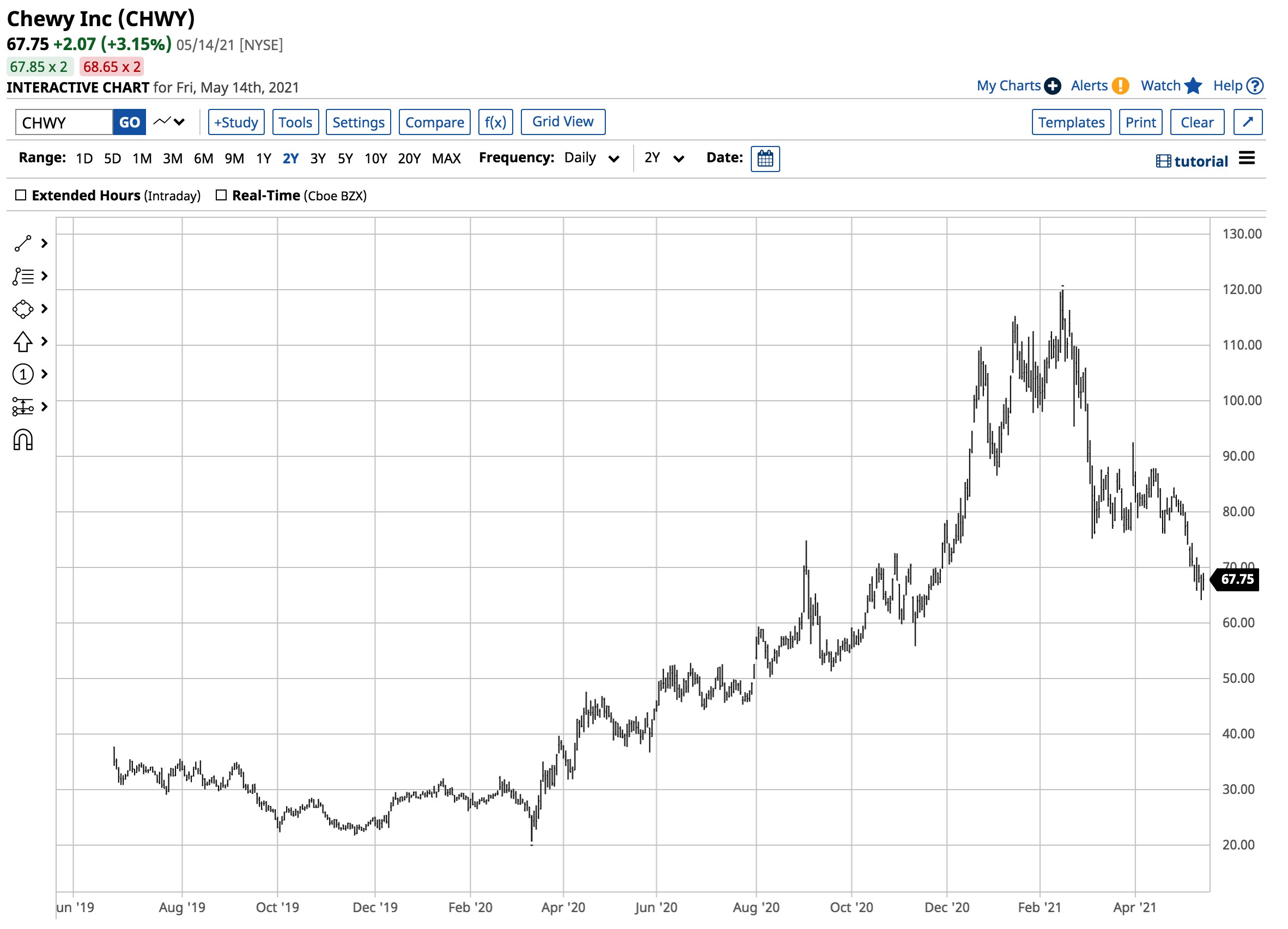

CHWY shares experienced an explosive rise from the May 2020 pandemic inspired selloff to the mid-February 2021 all-time high.

Source: Barchart

Source: Barchart

The chart shows the move from $20.62 to a high of $120, and the decline over the past months to below the $68 level at the end of last week. CHWY shares overextended on the upside at the $120 level and have come back down to earth. The first level of technical support stands at the mid-November 2020 $55.81 low. The stock was trading just below the 50% retracement level of the move from the March 2020 low to the February 2021 high at the end of last week.

A bullish trend in revenues and earnings

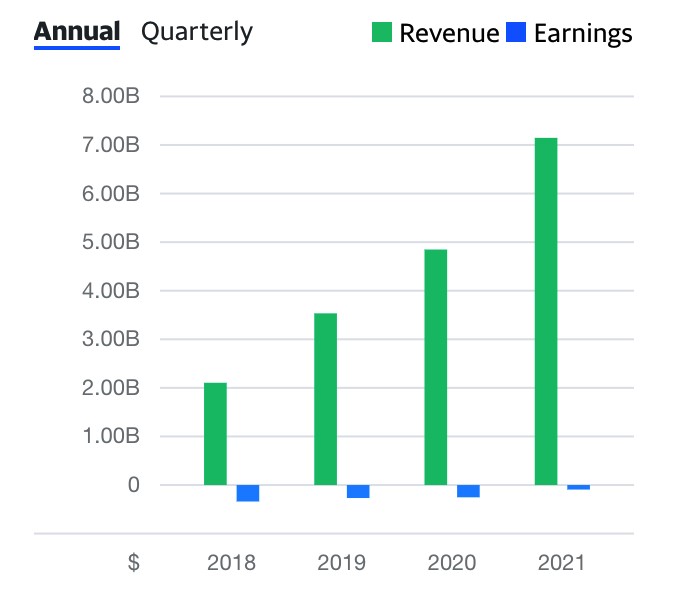

Chewy posted a profit in only one of the past four quarters. Still, its trend in earnings and revenues point to a continuation of profitability over the coming months and years.

Source: Yahoo Finance

Source: Yahoo Finance

While the company reported losses in three of the past four quarters, it beat analyst EPS forecasts in all four, with a positive trend in earnings. In Q1 2021, the company beat estimates by 15 cents, reporting a 5 cents profit for the quarter.

Source: Yahoo Finance

Source: Yahoo Finance

The annual revenues and earnings trend is positive, with revenues showing steady growth and earnings moving towards profitability.

Source: Yahoo Finance

Source: Yahoo Finance

The quarterly snapshot shows the same bullish trend in revenues and earnings. CHWY will report its fiscal second-quarter 2021 results on June 7. The market expects a three cents loss, but the company will beat the expectations again and report a profit if the trend continues.

Chewy is back in the buy zone

A survey of fourteen analysts on Yahoo Finance has an average price target of $100.71 for CHWY shares, with estimates ranging from $75 to $133 per share. At below the $68 level, CHWY is trading below the low end of the range, putting the stock back in the buy zone.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows the recent descent of CHWY shares with technical support at the $55.81 and 51.25 levels. A continuation of selling to challenge those levels would only make an investment in the company more attractive.

A long-term investment in a recession-proof business

We love our pets, and so does Chewy. As family members, pet food and supplies are not discretionary spending but essential, making CHWY as close to a recession-proof business as it can get.

The move to $120 per share was a bit of irrational exuberance for the company. However, at nearly half that level, CHWY now offers value for portfolios.

CHWY is our go-to company for our cat Gia’s needs, and the stock is a go-to long-term component of our investment portfolio. We will continue to buy CHWY shares on a scale-down basis as we believe the company has excellent long-term growth prospects.

Want More Great Investing Ideas?

CHWY shares were trading at $71.91 per share on Tuesday morning, up $1.70 (+2.42%). Year-to-date, CHWY has declined -20.00%, versus a 11.57% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CHWY | Get Rating | Get Rating | Get Rating |