Corbus Pharmaceuticals Holdings Inc. (CRBP - Get Rating) is a clinical-stage pharmaceutical company that is developing therapeutics for the treatment of chronic and rare inflammatory and fibrotic diseases. The company’s stock is often grouped in the cannabis sector because of its primary product candidate, the synthetic oral endocannabinoid drug lenabasum that is currently in Phase III clinical trials for treating systemic sclerosis and dermatomyositis and in Phase IIb clinical trials for treating systemic lupus erythematosus and cystic fibrosis.

Headquartered in Norwood, Massachusetts, the company was founded in 2009 and is based in Norwood, Massachusetts. CRBP is approaching its second anniversary as a publicly traded company, having joined NASDAQ on January 25, 2019 at a public offering price of $6.50 per share.

Here’s how our proprietary POWR Ratings evaluates CRBP:

Trade Grade: C

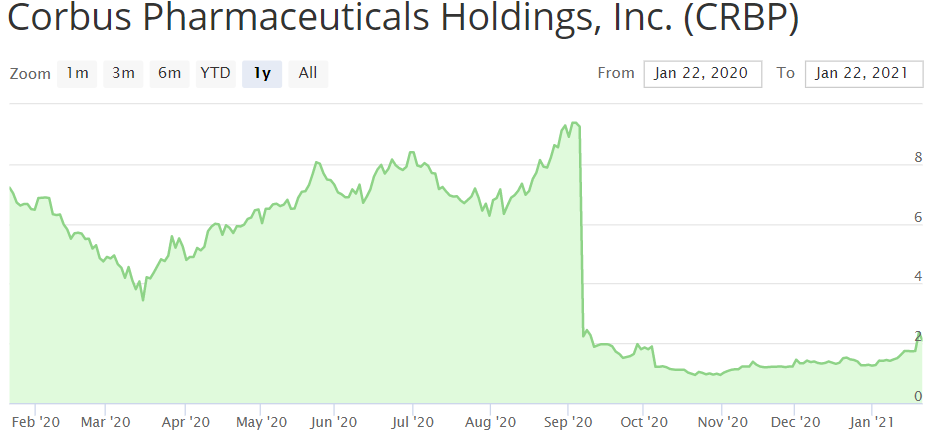

CRBP is currently trading at $2.36, which is some distance from its 52-week high of $9.78 and closer to its 52-week low of $0.91. Much of its current anemic performance can be traced back to September 8 when the stock crashed roughly 77% in pre-market trading following bad news from a clinical trial when lenabasum failed to outperform a placebo in primary and secondary endpoints for patients with the rare autoimmune disorder diffuse cutaneous systemic sclerosis. The stock was within sight of its 52-week high when it plummeted, and had just come off a slow but steady recovery from the market’s pandemic-fueled tumble in March.

Buy & Hold Grade: F

The stock’s proximity to its 52-week high is a key factor in our Buy & Hold Grade, and CRBP’s disastrous September performance has contributed to its very low grade.

Dr. Yuval Cohen, CRBP’s CEO, acknowledged this setback in the Q3 earnings announcement, stating that the company had “a solid understanding of what led to those outcomes” and would “further analyze the data and potentially explore paths forward in these programs.”

CRBP’s Q3 saw a net loss of approximately $34.9 million (a net loss per diluted share of $0.43), an unfortunate year-over-year performance when compared to a net loss of approximately $20.8 million (a net loss per diluted share of $0.32) one year earlier. The Q3 revenue of $1.2 million represented a $1.4 million year-over-year drop, which the company attributed to “revenue recognized under the Cystic Fibrosis Program Related Investment Agreement.” CRBP’s Q3 operating expenses increased year-over-year by approximately $7.5 million to $35.2 million, which was mostly blamed on increased clinical trial costs.

CRPB also reported that its on-hand cash and cash equivalents of approximately $81.9 million coupled with proceeds from the expected final $2.5 million milestone payment from the Cystic Fibrosis Foundation plus anticipated foreign tax credits would provide the funds to continue its operations and clinical plan beyond Q2 2022.

Peer Grade: D

CRBP ranks #295 out of 484 stocks in the Biotech category. The category seems to favor stock quantity over quality – only 132 stocks in that mix carry POWR Ratings of “A” or “B.” Unfortunately, CRBP is lost somewhere in lower-middle region of the category.

Industry Rank: B

The biotech industry ranks #27 out of 123 stock categories and has an average POWR Rating of “B.”

Overall POWR Rating: D

CRBP is not ready for prime time at this moment, and its stock is rated “D” (for sell).

Bottom Line

In the company’s Q3 earnings call, Dr. Cohen argued for a stay-the-course approach regarding its flagship pharmaceutical.

“We continue to believe the endocannabinoid system is a key target for the development of therapeutics for the treatment of debilitating diseases,” he said. “With these unique clinical databases now in hand, we will continue to collaborate with both systemic sclerosis and cystic fibrosis experts and explore the roadmap to potential follow-on confirmatory studies for both programs.”

However, he also cited “a very dramatic restructuring of our operations designed to reduce costs and reallocate resources toward our lenabasum clinical development program in dermatomyositis as well as our early stage pipeline. The restructuring, which included layoffs and other cost reductions was designed to extend our cash runway of $82 million to mid-2022.” Dr. Cohen also mentioned the departure of Chief Operating Officer Bob Discordia “to pursue other interests.”

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Outperform the Stock Market?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

CRBP shares were trading at $2.10 per share on Friday morning, down $0.26 (-11.02%). Year-to-date, CRBP has gained 68.00%, versus a 2.28% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CRBP | Get Rating | Get Rating | Get Rating |