Recently, CRM addressed the issue of excessive expenses, announcing job reductions and office closures in order to trim costs. It is clear that the company is prioritising its long-term health and outlook as it moves further into the future. In response, famed trader Michael Burry boldly stated, “CRM should have been down 25% on those job cuts. Job cuts are so not the reason to own that.”.

If Burry is right in that Salesforce is overvalued, the picture may look much bleaker for its competitors — the majority of whom have less revenue, less profit, and less market share. In this article, we’ll take a look at CRM and some of its underlying fundamentals, as well as how it compares against one of its main rivals in the customer relationship management space — Hubspot.

CRM vs. Hubspot: Business Differences

Salesforce is a cloud-based customer relationship management (CRM) platform. It helps businesses manage and track customer interactions, automate customer service tasks, and analyze customer data to create better customer experiences. It also enables businesses to improve marketing and sales capabilities, as well as facilitate communication and collaboration between teams. Hubspot, one of its main rivals, is also in the customer relationship management space — but while Salesforce’s primary focus is on customer data, Hubspot’s main focus is on digital marketing, reporting, and analysis.

Income Differences in CRM and Hubspot

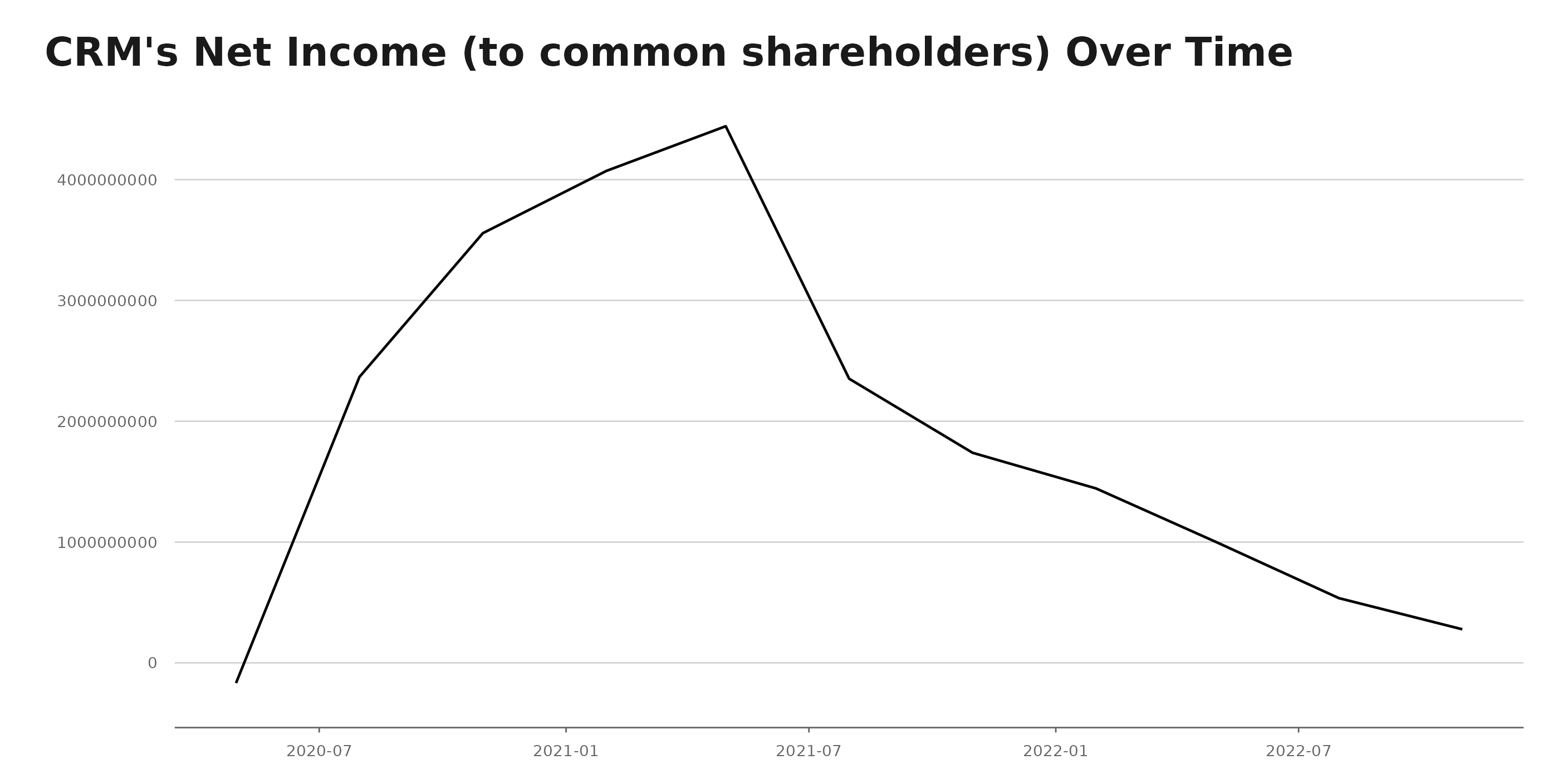

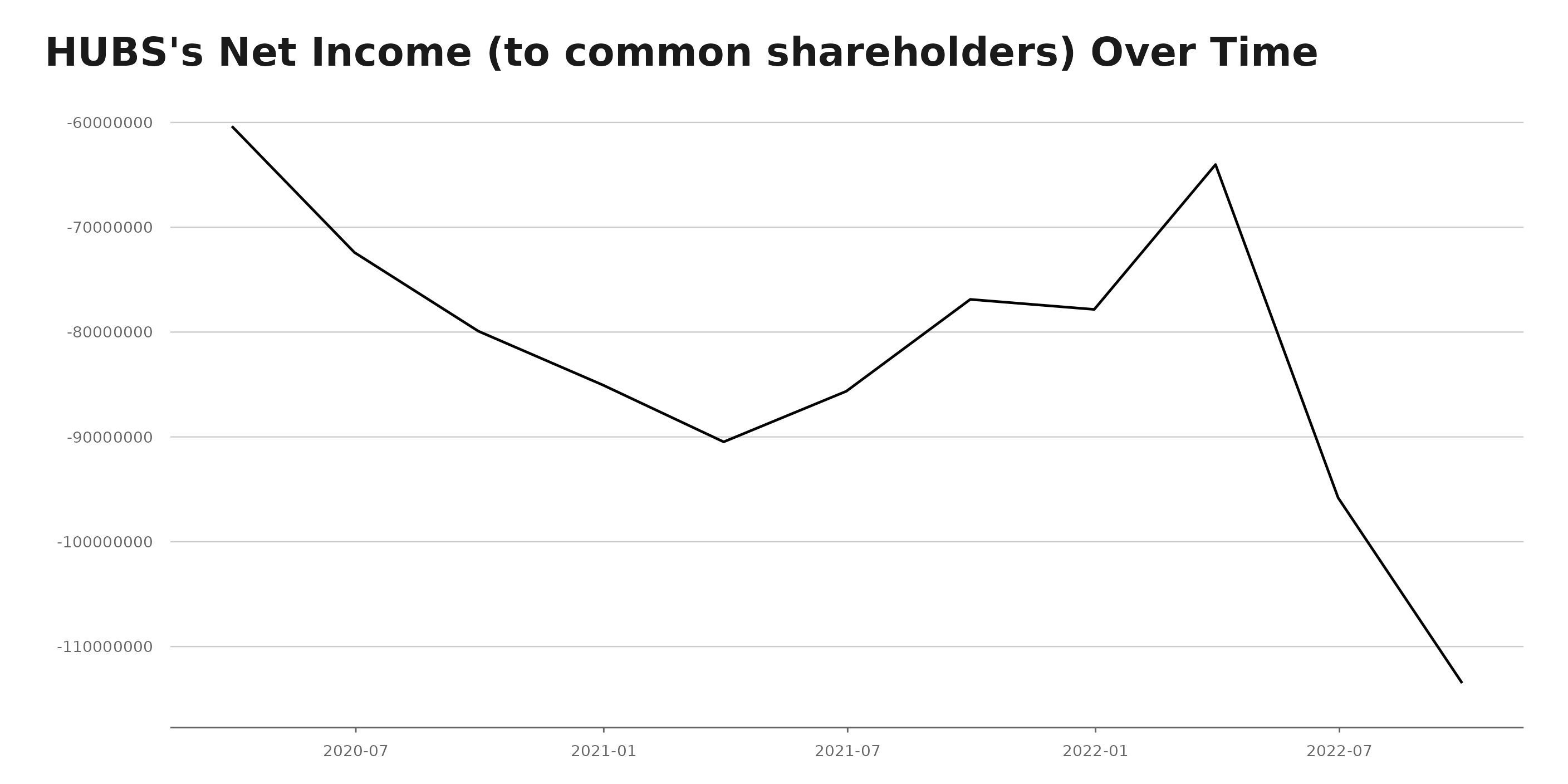

The distribution and growth rate of net income (to common shareholders) for CRM and HUBS varies significantly. CRM’s trailing twelve month net income (to common shareholders) spiked sharply to over 4 billion in the middle of 2021, but has fallen since; it now stands at approximately $278 million. On the other hand, HUBS’ trailing twelve month net income was -$110 million in the most recent quarter, compared to -$64 million in March of 2021 — essentially a doubling of losses. If Salesforce, a profitable company, is shedding employees and office space in the face of a recession in an environment where fundraising is harder, the outlook for a unprofitable competitors with smaller market share might be worse.

The chart below shows the income over time for CRM.

And here is the Net Income to common shareholders for Hubspot:

Net margin tells a similar story. For CRM, the Net Margin has declined since the summer of 2021, going from near 20% to its current level of near 1%. Hubspot, meanwhile, has seen its net margin go from -4% to -7% in this year. In sum, CRM may be in trouble — but it seems to be faring better than many of its competitors.

Want More Great Investing Ideas?

shares . Year-to-date, has declined -0.80%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CRM | Get Rating | Get Rating | Get Rating |

| HUBS | Get Rating | Get Rating | Get Rating |