Salesforce.com Inc (CRM): Price and Financial Metrics

CRM Price/Volume Stats

| Current price | $262.71 | 52-week high | $318.71 |

| Prev. close | $256.52 | 52-week low | $193.68 |

| Day low | $257.07 | Volume | 6,127,323 |

| Day high | $264.49 | Avg. volume | 6,816,876 |

| 50-day MA | $253.03 | Dividend yield | 0.62% |

| 200-day MA | $261.66 | Market Cap | 254.57B |

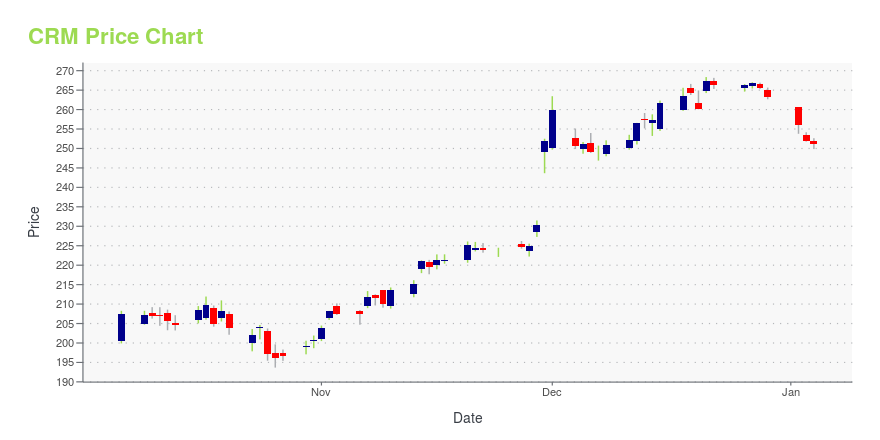

CRM Stock Price Chart Interactive Chart >

Salesforce.com Inc (CRM) Company Bio

Salesforce.com Inc is a software-as-a-service company that provides enterprise cloud computing solutions, offering social and mobile cloud apps and platform services, as well as professional services to facilitate the adoption of its solutions. Salesforce was founded in San Francisco in 1999, becoming the first company to develop customer relationship management software (CRM) hosted on the internet cloud. The company’s Customer 360 software-as-a-service (SaaS) allows businesses to integrate their sales, marketing, ecommerce, service, and IT departments under one platform. With offices on every major continent, Salesforce employs over 50,000 people worldwide. Marc Benioff, one of the original founders, has served as Chief Executive Officer since the company’s inception.

Latest CRM News From Around the Web

Below are the latest news stories about SALESFORCE INC that investors may wish to consider to help them evaluate CRM as an investment opportunity.

The 7 Best Reddit Stocks to Buy NowThese best Reddit stocks to buy are defying the usual high-risk investing stereotype and offer strong upside ahead for investors. |

Is Salesforce Stock A Buy Amid Hope For AI Revenue Boost?Rising corporate spending on digital transformation projects has boosted CRM stock. With the Slack deal closed, merger synergies will be key. |

Insider Sell: Salesforce Inc CFO Amy Weaver Disposes of 3,569 SharesOn December 26, 2023, Amy Weaver, the President and CFO of Salesforce Inc, executed a sale of 3,569 shares of the company. |

3 AI Stocks Ripe to Be One of the Next Magnificent 7These 3 AI-enabled stocks have legitimate long term chances to enter the Magnificent 7 level of the equity market. |

25 Best Online Computer Science Degree Programs Heading Into 2024In this article, we will be looking at the 25 best online computer science degree programs heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Online Computer Science Degree Programs Heading Into 2024. Software Development Industry: Career Spotlight Joining the software development industry is a […] |

CRM Price Returns

| 1-mo | 8.21% |

| 3-mo | -4.07% |

| 6-mo | -5.89% |

| 1-year | 17.02% |

| 3-year | 8.19% |

| 5-year | 64.70% |

| YTD | 0.12% |

| 2023 | 98.46% |

| 2022 | -47.83% |

| 2021 | 14.20% |

| 2020 | 36.82% |

| 2019 | 18.74% |

CRM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CRM

Want to do more research on Salesforcecom Inc's stock and its price? Try the links below:Salesforcecom Inc (CRM) Stock Price | Nasdaq

Salesforcecom Inc (CRM) Stock Quote, History and News - Yahoo Finance

Salesforcecom Inc (CRM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...