Quest Diagnostics Inc. (DGX - Get Rating) provides diagnostic testing information services, ranging from routine testing for medical examinations to advanced laboratory testing services for new drugs, vaccines and medical devices to risk assessment services for the life insurance industry. According to the Secaucus, New Jersey-headquartered company, its offices serve one in three adult Americans and half of the nation’s physicians and hospitals.

Earlier this week, DGX announced an agreement with the Centers for Disease Control and Prevention to provide genomic sequencing for identifying new mutations in, and patterns of transmission of, SARS-CoV-2, the virus that causes COVID-19.

DGX has also displayed a knack for making the news with a variety of diverse initiatives. During 2020, the 47,000-workforce company won several awards for its employee health program, and it also partnered with Walmart (WMT) on a pilot program for drone deliveries of COVID-19 at-home self-collection kits. Furthermore, DGX teamed with the Choose Healthy Life Black Clergy Conclave on improving COVID-related healthcare within the African-American community.

DGX was founded in 1967 by Dr. Paul A. Brown, a pathology resident at New York Presbyterian Hospital who financed his start-up with a $500 loan from his father-in-law. This company, called Metropolitan Pathology Laboratories, was acquired by Corning Glass Works in 1982 and became a separate publicly-traded company in 1997.

Here’s how our proprietary POWR Ratings evaluates DGX:

Trade Grade: A

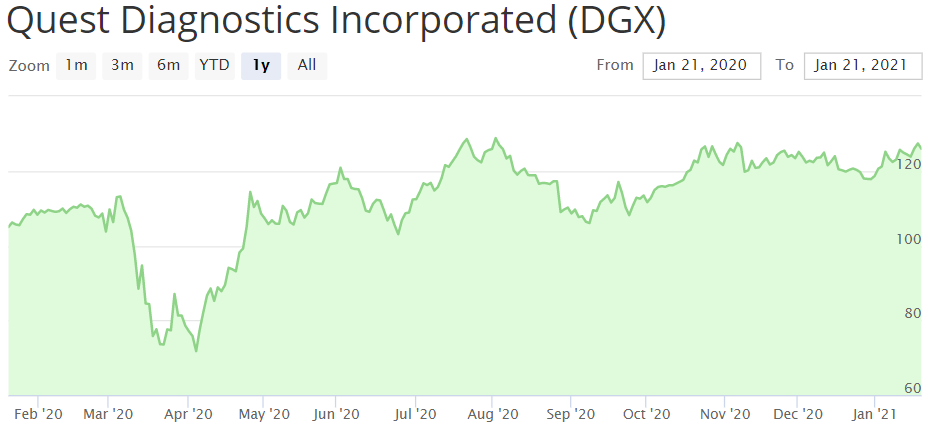

DGX is currently trading at $127.36, which is closer to its 52-week high of $131.81 and quite some distance from its 52-week low of $73.02. The stock dropped with the rest of the market last March when the pandemic took hold and had a somewhat bumpy course until late September when it began to stabilize and ascend.

Buy & Hold Grade: A

The stock’s proximity to its 52-week high is a key factor in our Buy & Hold Grade, and DGX’s strong Q3 earnings helped to solidify the stock’s attractiveness.

The Q3 earnings found revenues of $2.79 billion, up 42.5% year-over-year, with diluted earnings per share from continuing operations of $4.14, up 164.6% from 2019, and adjusted diluted EPS of $4.31, up 144.9% from 2019. Also during the company, the company took the unusual step of pledging to return the $138 million it received in CARES Act funding, an obvious symbol of its vitality.

“Turning to guidance, we raised our full year 2020 outlook as follows: revenue is now expected to be between $8.8 billion and $9.1 billion, an increase of approximately 13.9% to 17.8% versus the prior year,” said Mark J. Guinan, executive vice president and chief financial officer, during the Q3 earnings call. “Reported EPS is expected to be in a range of $8.22 to $9.22 and adjusted EPS to be in a range of $9 to $10. Cash provided by operations is expected to be at least $1.75 billion; and capital expenditures are expected to be approximately $400 million.”

Guinan predicted that the pandemic will continue to dominate the company’s operations, noting that COVID-19 testing volumes were forecast to average roughly 90,000 tests per day for the molecular test and 10,000 tests per day for Q4.

“Demand for COVID-19 testing is likely to persist well into 2021,” he added. “We believe that molecular PCR testing will continue to play a very important role in diagnosing, tracking and tracing active COVID-19 infections and that there will eventually be a growing need for serological testing as vaccines and additional therapies coming to the market.”

Peer Grade: B

DGX is ranked #6 out of 64 stocks in the Medical – Diagnostics/Research category. The stock’s high ranking is a tribute to the company’s long history of well-focused leadership and its sector leadership during the pandemic.

Industry Rank: A

The Medical – Diagnostics/Research industry ranks #14 out of 123 stock categories and carries an overall average POWR Rating of A.

Overall POWR Rating: A

DGX’s prominence within its space during the ongoing pandemic has strengthened its financial position, earning it an “A” (Strong Buy) rating.

Bottom Line

As long as the pandemic continues, DGX will be in the diagnostic testing forefront. However, in the Q3 earnings call, Chairman-CEO-President Stephen H. Rusckowski, Chief Executive Officer and President gave a hint of where DGX’s QuestDirect testing services could be focused in a post-pandemic era.

“We do believe, going forward, there’s going to be increased demand for telehealth in terms of its role in our business overall,” he said. “And then, secondly is testing and getting that either indirectly through QuestDirect or getting that through a telehealth provider as well. And we’re very well positioned in that regard with our relationships with telehealth companies, but also with QuestDirect. Before the pandemic, we kicked this program off and so we have a nice platform that’s been building up volume and we feel that there’s going to be more opportunities in front of us as this demand, given the circumstances, continue to have a lot of interest for consumers.”

With a steady control over today’s crises and a clear eye on the future, DGX is a great stock to have in one’s portfolio.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Outperform the Stock Market?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

DGX shares were trading at $125.66 per share on Thursday afternoon, down $1.70 (-1.33%). Year-to-date, DGX has gained 5.92%, versus a 2.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DGX | Get Rating | Get Rating | Get Rating |