How Do Theatrical Releases Impact Share Prices of Movie Stocks?

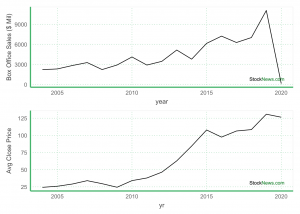

For Disney, success at the box office has been a vital part of its business. Box office revenue for Disney movies has soared from 2004 to 2019, mirroring the sharp ascent in the share price of its stock. As Nabila Amarsy of Strategyzer notes:

Once a movie becomes a hit, Disney leverages its brands and offers licensing rights that allow manufacturers to use Disney characters on their products. You can relive the magic of Disney movies at theme parks. Everything from the shows that people can watch to the souvenirs they buy are based on the Disney brands. Disney’s business model is scalable: Its brands fuel many value propositions and generate diverse revenue streams.

The charts below show Disney’s share price (DIS - Get Rating) relative to its average production budget for each of its movies. The correlation was clearly quite strong (approximately 0.9) prior 2020 and the COVID-19 pandemic, which resulted in a shutdown of movie production. Disney’s (DIS - Get Rating) share price continued to rise throughout the year in spite of this, but as we enter 2021, will we see a return to movie production and Disney’s strategy of stories that can be monetized in a variety of ways? If so, how can investors and traders position themselves?

In this paper, we specifically explore how Disney’s share price has behaved on the opening day of its major theatrical releases. What kind of trading opportunities have they presented historically, and what might that portend for traders and investors going forward?

Methodology

All five of the major live-action Star Wars releases since Disney acquired LucasFilm in 2012 were included in this study. The share price of Disney (DIS) was observed for the calendar month and year were during which each film was released, and the overall range of the stock for seven calendar days after each movie release was also observed. This approach ensured that the opening box weekend box-office numbers were released and given time to be digested by the market. The average range of the price of DIS for all films during the week of its release was then compared to the range of DIS for all other weeks. For the stock price outside of a release week, DIS stock was observed from December 2014 to December 2020. This approach would help us understand if share price movement is more volatile during a major release week versus a non-release week.

Results: Buy the Hype, Sell the Release?

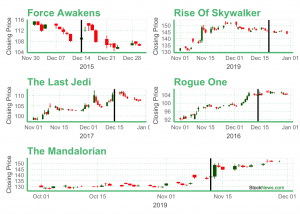

The results indicate that DIS share price tends to close lower than its open on the release date of a major live-action Star Wars film. This was the case in four out of the five film releases. The five films included in this analysis were The Force Awakens (12/14/2015 release date), Rogue One (12/16/2016 release date), The Last Jedi (12/15/2017 release date), Solo (5/25/2018 release date), and The Rise of Skywalker (12/20/2019 release date). Curiously, though, while the range of release periods was smaller, there was a greater tendency for price to decline in that period than on “regular” (i.e. trading days outside of when a movie was released). In simple terms, over the past 6 years, the average move in Disney’s stock has been much more likely to fall to the downside when movies are released than on other days. Specifically, DIS tends to fall just $.0176 on regular days, but falls $.514 on box office opening periods (only intraday moves were observed; gap moves between close and the following open were excluded).

In addition, a comparison of the DIS stock price from December 2014 through December 2020 was done looking at DIS during the premiere week of a major release versus DIS “regular” price movement to observe the difference in volatility. The range of DIS stock price during the week following a major release was an average 12% lower than its range outside of a premier week, suggesting movie release times are less volatile trading periods. Specifically, the average range of DIS during a release week was $1.74 compared to $1.98 outside of a release. The last film, The Rise Of Skywalker, had the greatest price range for DIS of $2.11, moving from a low of $145.77 to a high of $147.88 on the day of its release. Conversely, the lowest range of just under a dollar was observed with Rogue One, the first live-action Star Wars film outside any of the trilogies.

The charts below visualize the performance of DIS around these release dates; the solid black line on each chart denotes when the movie was released.

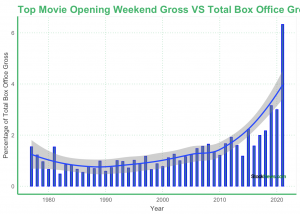

The Star Wars movies were all massive box office draws for the year they were released. Two of the Star Wars films released during this period were the top grossing films in the domestic market for their respective years, both taking in well over a billion in the worldwide market. 2015’s The Force Awakens dominated the box office for that year, reeling in 248 million during its opening weekend. The Last Jedi was the top grossing film for 2017, taking in 620 million domestically, or just over 12% of all the domestic box office gross for that year.

Looking at the chart comparing the yearly top domestic film’s opening weekend and the overall domestic box office receipts for the year, both Star Wars movies had premiers that drew in upwards of 2% of the entire domestic market for their respective years. Even prior to 2020, we see a trend in which box office opening day ticket sales were an increasingly large share of total revenue – and thus a better prognosticator of a film’s overall performance at the theaters and its potential significance to film studios like Disney. Long-term and/or conceptual investors who believe in Disney’s core business strategy – that stories drive multi-channel revenue – may wish to observe box office openings to see if the stories being sold are being bought and believed in.

What Does This All Mean for Traders?

Unfortunately, the movie market has been forced to change dramatically due to COVID-19. According to boxofficemojo.com, there was a 81.6% drop in domestic box office revenue in 2020 versus 2019. With the current status of the pandemic, this trend may very well continue forcing companies to release films online, and potentially change the entire calculus of how stories and box office performance drive the long-term business model and revenues of media companies like Disney.

If vaccination, therapeutics like Ivermectin, and/or widespread immunity derived via infection prevent help return life to normal socialization and box office performance, the trends observed here come back into play. If so, this would benefit traders who employ strategies designed to benefit from reduction in volatility when Disney announces major releases, as well as traders who have an intraday short bias during release weeks. For longer-term investors and those focused on underlying business models, a resumption to moviegoing may be worth watching to see how Disney’s core operating philosophy – that successful stories lead to multi-channel revenue – is faring.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

#1 Ingredient for Picking Winning Stocks

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

DIS shares were trading at $163.63 per share on Wednesday morning, down $5.93 (-3.50%). Year-to-date, DIS has declined -9.69%, versus a 0.95% rise in the benchmark S&P 500 index during the same period.

About the Author: Brian Wildner

Brian Wildner is an equities research analyst with over a decade of experience. His career started in 2010 when he joined FactSet Research Systems, where he initially focused on the technology, media, and telecommunications sector. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DIS | Get Rating | Get Rating | Get Rating |