With an extensive array of 3D printing solutions ranging from a quick prototype to mass production, Desktop Metal, Inc. (DM - Get Rating) in Burlington, Mass., is speeding up the manufacturing revolution. The World Economic Forum designated Desktop Metal as one of the world’s 30 most promising Technology Pioneers, and it was also named on MIT Technology Review’s list of 50 Smartest Companies.

However, its shares are down 74.6% in price over the past year and 26.7% year-to-date to close yesterday’s trading session at $3.63. In addition, the stock is currently trading 76.6% below its 52-week high of $15.48, which it hit on June 06, 2021.

Also, the company’s widening losses and negative profit margins represent a bleak outlook.

Here is what could shape DM’s performance in the near term:

Lawsuit

In January, the Schall Law Firm, a national shareholder rights litigation firm, reminded investors of a class-action lawsuit filed against Desktop Metal, Inc. for violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as well as the Securities and Exchange Commission’s Rule 10b-5 promulgated thereunder. According to the complaint, the company issued false and misleading claims to the market. EnvisionTEC, Desktop Metal’s most recent acquisition, had manufacturing and quality issues. The commercialization of the product for which the company had bought EnvisionTEC was jeopardized due to these ongoing issues. Based on these facts, the company’s public statements were false and materially misleading throughout the class period.

Poor Bottom line Performance

DM’s total revenue increased 582.5% year-over-year to $112.41 million for the year ended Dec. 31, 2021. However, its operating expenses increased 185.4% from its year-ago value to $219.75 million. Its operating loss grew 118.8% year-over-year to $201.46 million. The company’s net loss surged 606.6% from the prior-year quarter to $240.33. And its loss per share came in at $0.92 over this period.

Poor Profitability

DM’s 18.2% trailing-12-months gross profit margin is 37.6% lower than the 29.2% industry average. Its 0.11% trailing-12-months asset turnover ratio is 85.8% lower than the 0.78% industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 17.3%, 213.8%, and 11%, respectively.

POWR Ratings Reflect Uncertainty

DM has an overall F rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. DM has an F grade for Quality and a D for Stability. Its poor profitability is in sync with the Quality grade. In addition, the stability grade represents the stock’s higher volatility than its peers.

Among the eight stocks in the F-rated Technology – 3D Printing industry, DM is ranked #6.

Beyond what I have stated above, one can view DM ratings for Value, Momentum, Growth, and Sentiment here.

Bottom Line

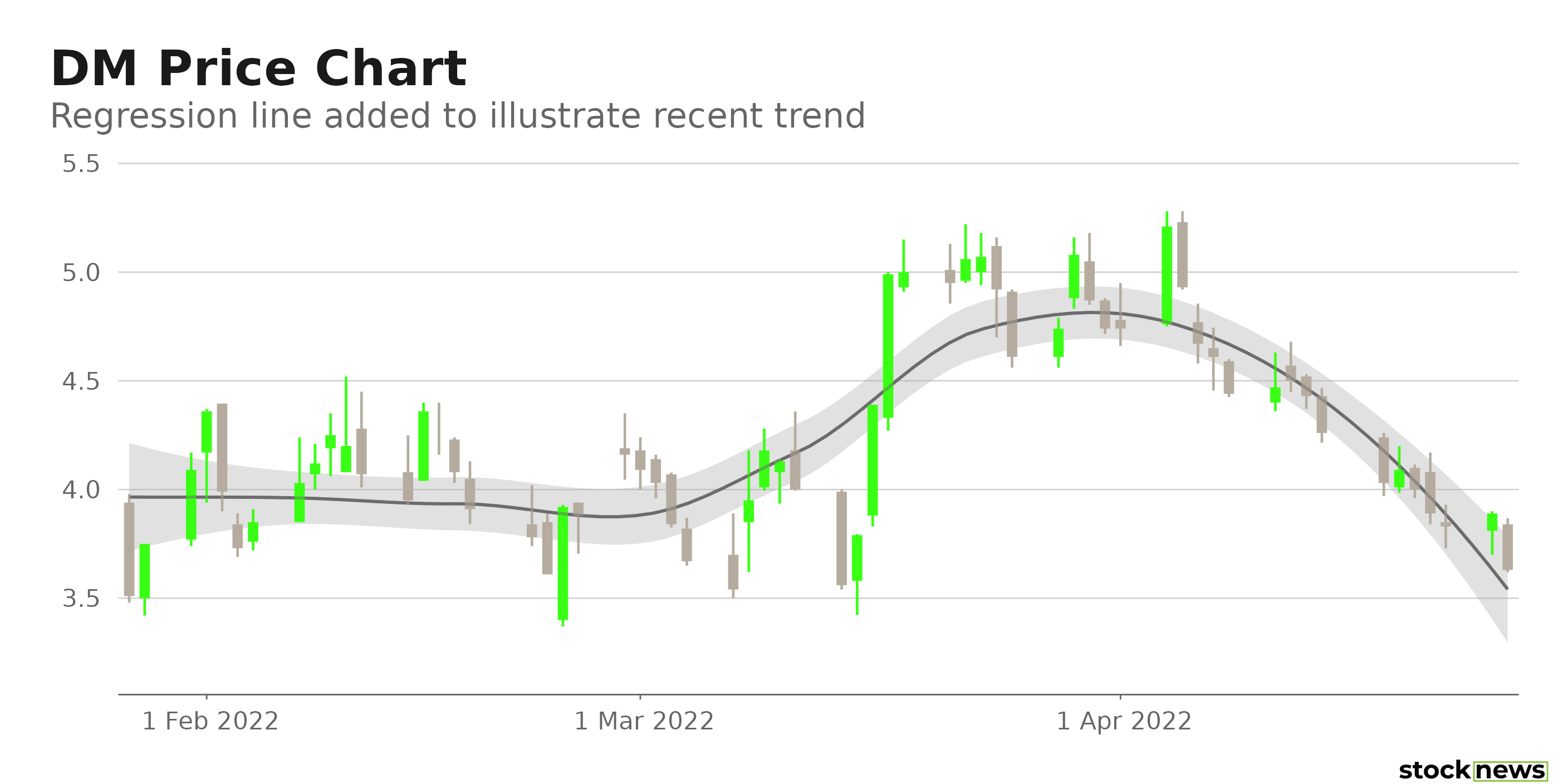

While the company reported solid revenue growth in the last quarter, its worsening bottom-line performance is concerning. In addition, analysts expect its EPS to decline 533.3% in the current quarter (ending March 31, 2022) and 28.6% in the current year. Furthermore, the stock is currently trading below its 50-day and 200-day moving averages of $4.29 and $6.24, respectively, indicating bearish sentiment. So, we believe the stock is best avoided now.

How Does Desktop Metal Inc. (DM) Stack Up Against its Peers?

While DM has an overall F rating, one might want to consider its industry peer, Materialise NV (MTLS - Get Rating), which has an overall B (Buy) rating.

Want More Great Investing Ideas?

DM shares rose $0.03 (+0.83%) in premarket trading Wednesday. Year-to-date, DM has declined -26.26%, versus a -11.93% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DM | Get Rating | Get Rating | Get Rating |

| MTLS | Get Rating | Get Rating | Get Rating |