- Sector rotation caused a huge recovery in the energy sector

- OPEC’s decision lifts oil above the 2020 high

- US Energy policy supports the oil price

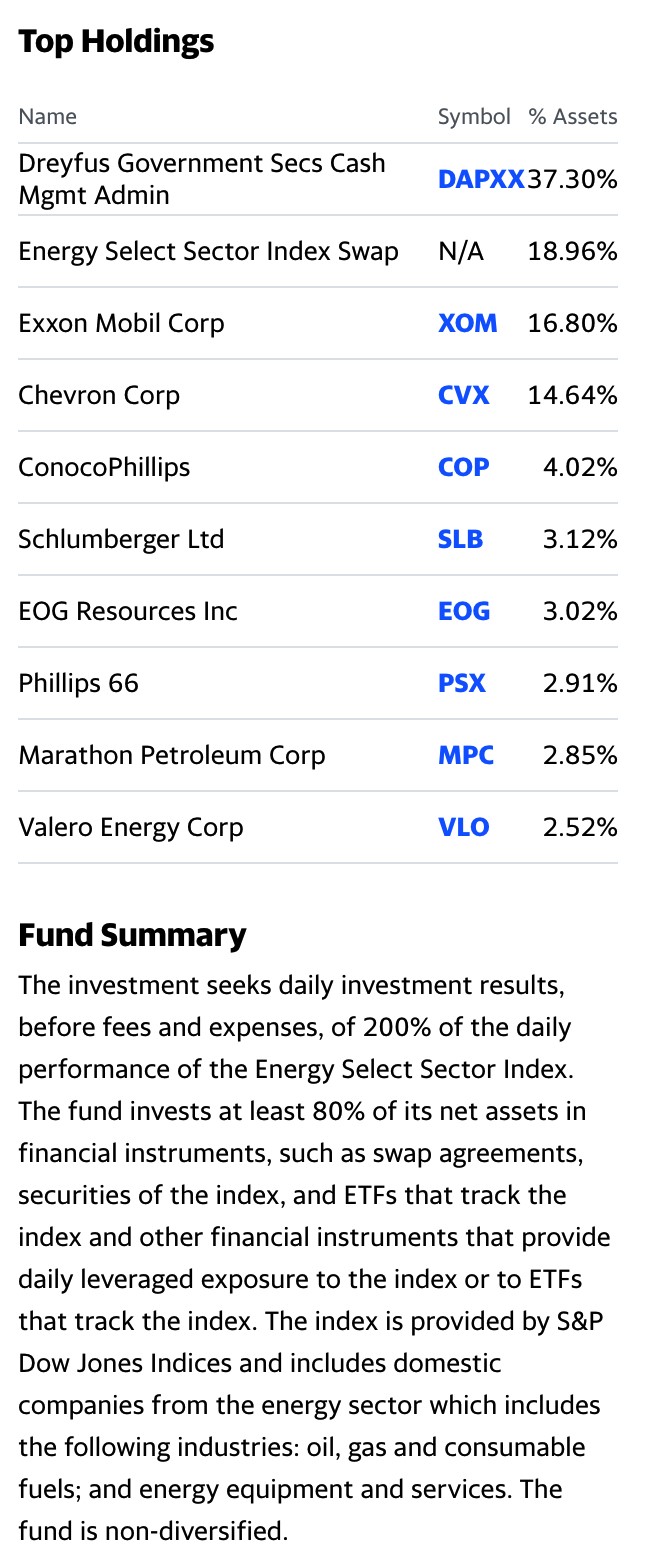

- ERX is the bullish trading product

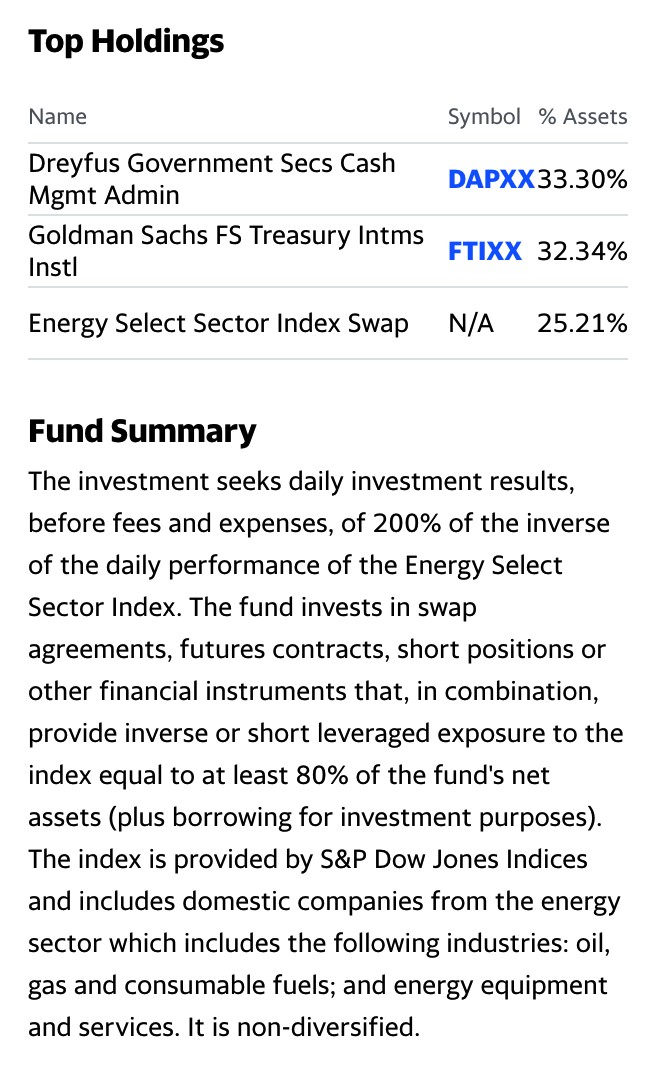

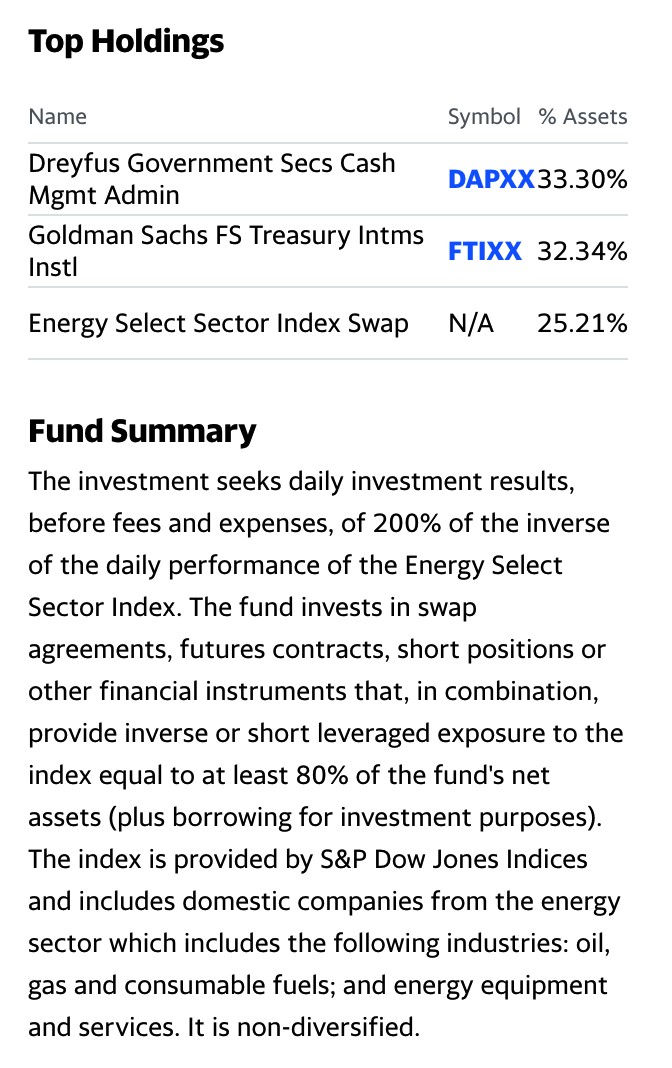

- ERY goes the other way

Sector rotation in markets can be a powerful force. Over the past years, energy-related stocks had been the dogs of the stock market, underperforming other share prices, and even the oil price. After reaching highs in 2014, most energy stocks made lower highs and lower lows. When the stock market exploded higher, the energy stocks lagged. When stocks corrected during risk-off periods, the energy sector led the plunge.

In early 2021, the tables have turned for many of the leading energy companies that survived the past years of awful performance. Starting in early November 2020, the laggards became the leaders. Over recent weeks, the energy sector has led the stock market at a time when the oil price is rising, and some other stock market sectors are faltering.

In March and April 2020, crude oil and energy stocks plunged. In March, energy stocks hit multi-year lows, and some even plunged to the lowest price of this century. On April 20, 2020, crude oil traded below zero for the first time since trading began on the CME’s NYMEX division in the early 1980s.

What a difference a year can make.

In early March 2021, energy is back and better than ever. Even as interest rates rise, crude oil is making new highs, and oil-related equities are reaching new short-term milestones on the upside. The Direxion Daily Energy Bull 2X Shares (ERX - Get Rating) and its bearish counterpart (ERY - Get Rating) are short-term turbocharged trading tools that follow the prices of the leading energy company shares higher and lower.

Sector rotation caused a huge recovery in the energy sector

In late October and early November, crude oil and energy-related stocks hit bottoms. The lows turned out to be higher than in March and April 2020.

Source: CQG

Source: CQG

The chart shows that NYMEX crude oil futures found a higher low at $33.64 on November 2 and rose to a high of $67.98 last week as the energy commodity doubled and gained just over 102%.

Source: Barchart

Source: Barchart

The chart shows the SPDR Energy Select Sector ETF (XLE), which holds a diversified portfolio of US energy-related companies shares moved from $26.98 in late October to a high of $54.37 per share or 101.5% last week. For the first time in years, the energy stocks kept pace with the price action in the crude oil market and outperformed the overall stock market over the past months. Sector rotation in stocks lifted the energy-related shares that have been underperforming since the XLE reached its high in June 2014.

OPEC’s decision lifts oil above the 2020 high

Going into the last OPEC+ meeting, crude oil was approaching its critical technical resistance level at the January 2020 $65.65 high. OPEC and the Russians agreed to hold production quotas steady even though the price of crude oil has appreciated since the last meeting.

The Saudis warned that the cartel needs to take a “cautious” approach because if the cartel puts too much petroleum on the market quickly, it could cause the price to fall. Saudi energy minister Prince Abdulaziz bin Salman said, “At the risk of sounding like a stuck record, I would once again urge caution and vigilance.”

Meanwhile, the Saudi oil minister’s more telling comment from the recent meeting was, “Drill, baby, drill is gone for ever.” OPEC’s mission is to achieve the highest possible petroleum price for its members that balances the energy commodity’s fundamental equation. The threat of a flood of US shale production at higher prices has declined dramatically, putting OPEC in a position to squeeze the price higher. After years of watching the US output increase with oil prices, the Biden administration has passed the oil market’s pricing power back into the cartel’s hands.

OPEC would rather sell fewer barrels at higher prices than more crude oil into a falling market. As optimism that the end of the global pandemic will increase energy demand, the US’s market position is declining by choice.

US Energy policy supports the oil price

On his first day in office, US President Joe Biden canceled the Keystone XL pipeline project that carries petroleum from the oil sands in Alberta, Canada, to Nebraska and beyond to the NYMEX WTI delivery point in Cushing, Oklahoma.

Moreover, with his party holding majorities in the House of Representatives and the Senate, President Biden is fulfilling his pledge to address climate change by increasing oil and gas production regulations. The administration’s energy policies will limit output after four years of “drill-baby-drill” under the Trump administration.

In March 2020, the Energy Information Administration reported that US daily crude oil output reached an all-time high at 13.1 million barrels per day. As of March 5, 2020, production had dropped 16.8% to 10.90 million bpd. The shift in US energy policy under the Biden administration will likely cause the March 2020 output record to stand for years. Even if the oil price continues to rise, the stricter regulatory environment will prevent production from reaching the previous record.

The shift in US energy policy supports the transfer of pricing power back to OPEC and Russia. We have already seen signs where the cartel is having a more dramatic impact on pricing. The oil price rose in January when Saudi Arabia announced a surprise one million bpd cut. At the latest OPEC meeting, the cartel’s decision to leave output steady caused the price of NYMEX futures to move above the January 2020 $65.65 high.

Moreover, a drone attack on Saudi oil facilities early last week pushed crude oil to its latest high at $67.98. The attack by Iran-backed Houthi rebels fighting a proxy war in Yemen pushed nearby Brent futures to a high of $71.36 on March 8. The Brent price moved within 63 cents of its January 2020 $71.99 high and critical technical resistance level.

The bottom line is that US energy policy under President Biden shifts the pricing power back in the direction of Saudi Arabia, Russia, and the other OPEC members at a time when demand is returning as the threat of the pandemic declines. Shares of energy-related companies have been rallying since late October, and the trend remained higher at the end of last week.

ERX is the bullish trading product

ERX is a short-term leveraged product that turbocharges the price action in the XLE. The top holdings and fund summary for ERX includes:

Source: Yahoo Finance

Source: Yahoo Finance

ERX has net assets of $626.20 million, trades an average of over 5.5 million shares each day, and charges a 1.0% expense ratio. The XLE posted a 101.5% gain from the late October low to the March 8 high.

Source: Barchart

Source: Barchart

Over the same period, the leveraged ERX product rose from $7.48 to $28.75 per share or 284.4%.

ERY goes the other way

ERY operates inversely to ERX. The top holding and fund summary for ERY include:

Source: Yahoo Finance

Source: Yahoo Finance

ERY has net assets of $33.19 million, trades an average of over 855,000 shares each day, and charges a 1.05% expense ratio.

Source: Barchart

Source: Barchart

The chart illustrates the decline from $83.34 to $15.51 per share or 81.4% from late October through early last week.

ERX and ERY are powerful trading tools that are only appropriate for short-term risk positions that follow and turbocharge the price action in the XLE index. Meanwhile, US energy policy continues to transfer petroleum pricing power back to the international cartel. While the US may achieve energy independence with alternative sources over the coming decades, crude oil continues to power the world, and that is not likely to change over the coming years.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

5 WINNING Stocks Chart Patterns

ERX shares fell $0.77 (-2.83%) in premarket trading Tuesday. Year-to-date, ERX has gained 85.99%, versus a 6.15% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ERX | Get Rating | Get Rating | Get Rating |

| ERY | Get Rating | Get Rating | Get Rating |