- Bearish reversals in gold and silver- Platinum goes the other way

- Crude oil reverses higher

- Coffee and cocoa reverse higher

A key reversal trading pattern can be a powerful force in markets. Trend-following traders often look for technical patterns, so a reversal can cause follow-through buying or selling.

A bullish key reversal occurs when an asset’s price falls below the previous period’s low and closes above it’s high. A bearish key reversal pattern includes a rise to a new high compared to the past period and a close below its low. While technical analysts watch for these technical patterns over all periods, they can substantially influence buying and selling when they occur on longer-term charts.

When I first began trading four decades ago, an early boss told me that markets move higher when there are more buyers than sellers and lower when selling overwhelms buying. Key reversal patterns often prompt new risk positions or closing existing ones for trend-following market participants.

On Monday, November 30, six different commodity futures markets put in key reversals on their monthly charts, which could cause lots of volatility over the coming weeks.

Bearish reversals in gold and silver- Platinum goes the other way

The gold (GLD - Get Rating) and silver futures (SLV - Get Rating) markets had a rough November. After rising to higher levels than during the previous month, the prices fell and closed below the lows of October, putting in bearish key reversal trading patterns on the monthly charts.

Source: CQG

Source: CQG

As the monthly chart highlights, gold reversed to the downside in November. Gold closed November at over $80 below the October low. However, the price of the yellow metal did not experience follow-through selling over the first few sessions in December as it recovered to over the $1835 level.

Source: CQG

Source: CQG

Silver also put in a bearish reversal in November, but it was a lot closer call than in the gold futures market. Silver only closed 9.1 cents below the October low. Like gold, silver recovered over the first trading sessions in December and moved back over the $24.20 per ounce level.

While gold and silver put in bearish reversals, platinum did just the opposite.

Source: CQG

Source: CQG

Platinum put in a marginally lower low on the monthly chart in November as the price dropped only $5.30 under October’s bottom before closing the month above the previous month’s high. In early December, platinum followed through on the upside with the price over the $1070 per ounce level at the beginning of the final month of 2020.

As of the end of last week, gold and silver failed to experience follow-through selling after a pair of bearish reversals, but platinum’s bullish reversal propelled the price higher to the highest level since September 2016.

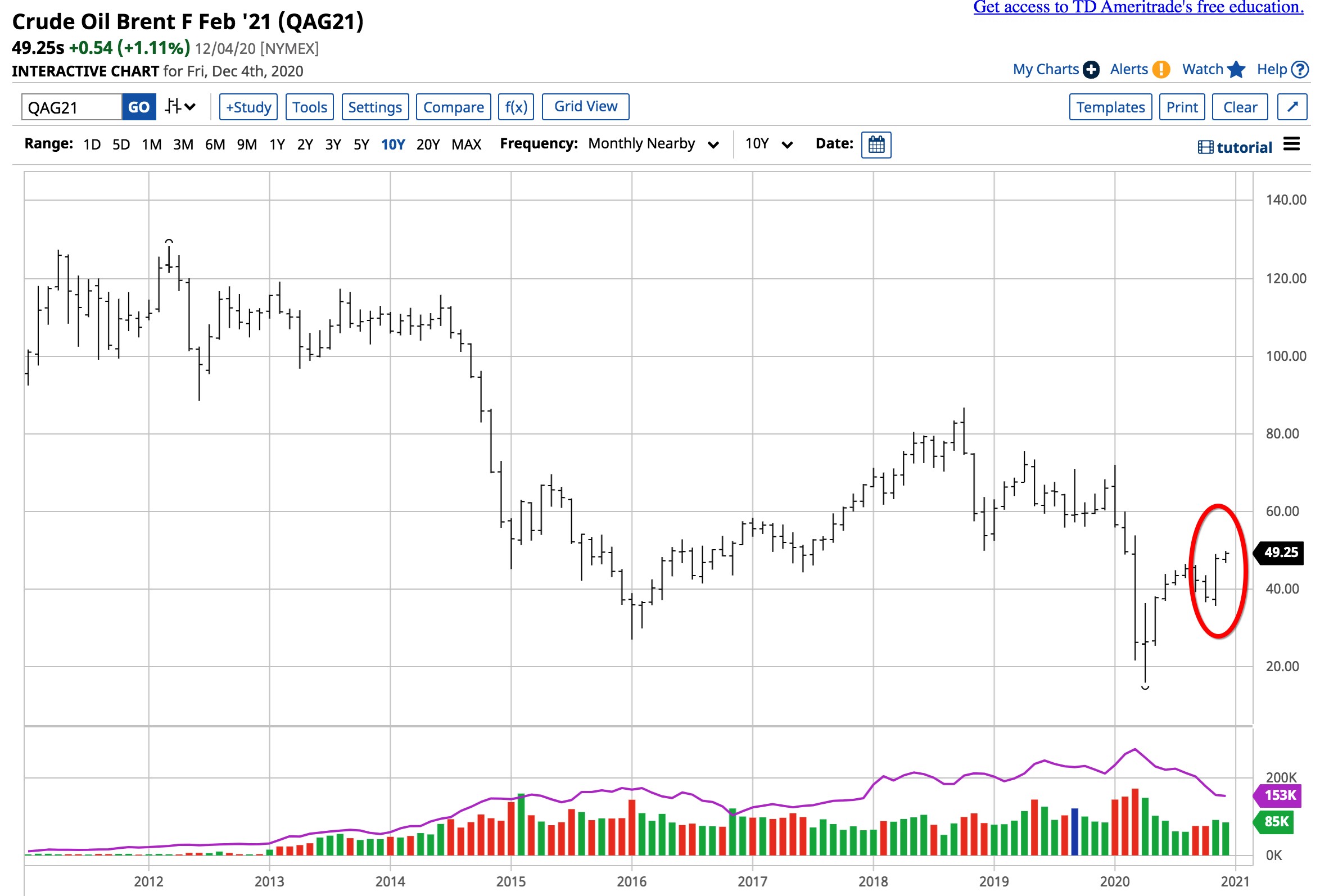

Crude oil reverses higher

Crude oil (USO - Get Rating) closed November as the world awaited news on production cuts from OPEC+. The cartel met in its biannual gathering on November 30. Failure to reach an agreement on the 7.7 million barrel per day production cut pushed the next meeting to Thursday, December 3. Meanwhile, both WTI and Brent (BNO - Get Rating) futures put in bullish reversals on their monthly charts in November.

Source: CQG

Source: CQG

The monthly chart of NYMEX crude oil futures displays the bullish reversal last month. The price of crude oil was higher at a new peak at the end of last week.

Source: Barchart

Source: Barchart

The Brent futures that trade on the Intercontinental Exchange and are the pricing mechanism for approximately two-thirds of the world’s crude oil also put in a bullish reversal on the monthly chart in November. As of the end of last week, the prices of WTI and Brent edged higher, following through on the upside so far.

Coffee and Cocoa reverse higher

A pair of soft commodities also put in bullish reversals on their monthly charts in November.

Source: CQG

Source: CQG

ICE coffee futures made a marginally lower low than the bottom in October last month before closing significantly above the previous month’s high. Coffee pulled back at the start of December.

Source: CQG

Source: CQG

Cocoa’s (NIB - Get Rating) monthly reversal was dramatic. After a weak October where social distancing interfered with chocolate demand over Halloween, the price of ICE cocoa futures fell to a slightly lower low in November. It then exploded higher on the back of futures purchases by Hershey (HSY). Like coffee, cocoa futures pulled back over the first days of December after an explosive November rally that created the bullish reversal.

Perhaps the most significant reversal of the month was in the dollar index. The index is the pricing mechanism for commodities as the US currency is the world’s reserve foreign exchange instrument.

Source: CQG

Source: CQG

The bearish reversal in the dollar index (UUP) could be a significant event as the dollar broke below a short-term support level and seems headed for a challenge of the February 2018 low of 88.15, which is long-term critical support. A falling dollar tends to be bullish for commodity prices. The dollar followed through lower over the first trading sessions of December.

Reversals on the monthly chart can be powerful technical signals. However, the falling dollar (UDN) could trump the bearish reversals in gold and silver, as we witnessed over the early days of December.

The most popular and liquid ETF/ETN products for the markets that experienced November reversals are:

SPDR Gold Trust (GLD - Get Rating)

iShares Silver Trust (SLV - Get Rating)

United States Oil Fund (USO - Get Rating)

United States Brent Oil Fund (BNO - Get Rating)

iPath Bloomberg Cocoa Subindex ETF (NIB - Get Rating)

Invesco DB USD Index Bullish Fund ETF (UUP)

Invesco DB USD Index Bearish ETF (UDN)

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Chart of the Day- See Christian Tharp’s Stocks Ready to Breakout

GLD shares were trading at $173.19 per share on Monday morning, up $0.87 (+0.50%). Year-to-date, GLD has gained 21.20%, versus a 16.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GLD | Get Rating | Get Rating | Get Rating |

| SLV | Get Rating | Get Rating | Get Rating |

| USO | Get Rating | Get Rating | Get Rating |

| BNO | Get Rating | Get Rating | Get Rating |

| NIB | Get Rating | Get Rating | Get Rating |