- A bullish long-term trend

- Earnings met expectations

- A great dividend- IBM offers value

International Business Machines (IBM) is a global integrated technology and services company with a market capitalization of $119 billion. The stock had a lower than average 15.60 price to earnings multiple at just over $134 per share as of December 13.

In 2018, in a blow to the company, Warren Buffett sold his holdings. The long-term holder of IBM shares decided that his capital would do better elsewhere as the company struggled with declining sales. The price action in IBM stock has not been all that exciting since Mr. Buffett’s sale.

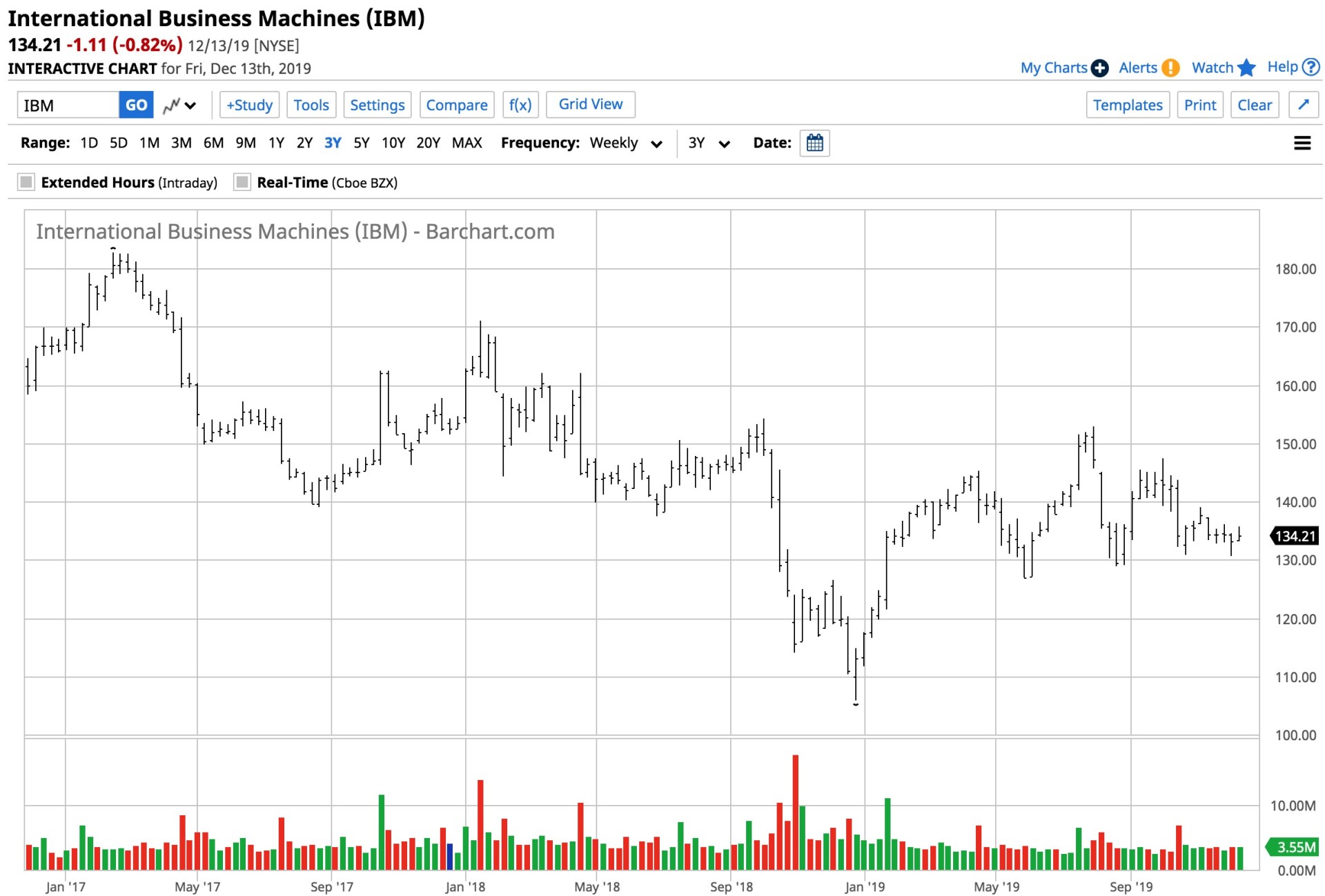

(Source: Barchart)

As the chart shows, since 2017, IBM shares have made lower highs and lower lows. However, after hitting bottom at $105.94 per share in late 2018, when all stocks hit the skids, the price rebounded to the $134.21 level at the end of last week. The 26.7% recovery from the December 2018 low has been impressive for IBM as the stock rallied with the overall market.

IBM is not an expensive stock, even though Buffett parted with his shares.

A bullish long-term trend

The shares had made lower highs and lower lows since May 2013 when the stock hit $215.90 per share and underperformed the overall stock market over the period.

Meanwhile, the long-term trend dating back four decades remains higher for IBM shares.

(Source: Barchart)

The chart shows the upward trajectory of the shares since 1980. However, as Mr. Buffett surmised, when he decided to sell his shares in the quest for superior returns, the company has not kept pace with the rest of the stock market in the United States over the long term.

Earnings met expectations

IBM has reached or beat analyst earnings estimates over the past four quarters.

(Source: Yahoo Finance)

As the chart shows, IBM’s earnings have consistently beat consensus EPS. In the third quarter of 2019, IBM delivered $2.68 per share. While the company beat on earnings, total revenues of $18.03 billion were a bit below the consensus expectations for $18.24 billion. Moreover, third-quarter revenues declined by 3.9% on a year-on-year basis.

Corporate tax reform has benefited IBM, and the company had been buying back its shares. In late 2018, the company said it planned to repurchase as much as $4 billion in stock, adding to about $1.4 billion remaining from a previous share buyback program. The company had said it would stop buying back stock in 2020 and 2021 to save cash for its acquisition of Red Hat, which has created synergies for the company.

A great dividend- IBM offers value

At just over $134 per share, IBM shares make up for some of the lack of upside trajectory with its above-market dividend. At 4.79%, the yield on IBM shares is above the market average of the Dow 30 stocks.

IBM is a company that offers value at its current share price. The P/E ratio is below the market’s average, and the dividend yield is higher. Therefore, at $134.21 per share on December 13, the risk-reward continues to favor the upside.

IBM shares were trading at $134.36 per share on Monday afternoon, up $0.15 (+0.11%). Year-to-date, IBM has gained 23.87%, versus a 29.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| IBM | Get Rating | Get Rating | Get Rating |